- United States

- /

- Communications

- /

- NasdaqGS:HLIT

How Investors May Respond To Harmonic (HLIT) Powering Telia’s Virtualized Broadband Upgrade With cOS Platform

Reviewed by Sasha Jovanovic

- Harmonic recently announced that Telia, Norway’s second-largest telecom operator, is upgrading its broadband network using Harmonic’s cOS virtualized broadband platform, including migration to DOCSIS 3.1 and deployment of automation, analytics and spectrum management tools.

- This deal highlights growing operator interest in virtualized, software-based broadband infrastructure that can cut operating costs, extend hardware lifecycles and support higher-speed services.

- Against this backdrop, we’ll explore how Telia’s move to Harmonic’s cOS platform could reinforce the company’s broadband upgrade and SaaS-focused investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Harmonic Investment Narrative Recap

To own Harmonic, you need to believe in the long-term shift toward virtualized, software-based broadband and video infrastructure and Harmonic’s ability to stay technologically relevant as this transition unfolds. The Telia cOS deployment fits that thesis and mildly supports the near term catalyst around operator upgrade cycles, but it does not materially change the key risk that large customers or operators could still delay or scale back spending.

Among recent announcements, the ongoing US$200 million share repurchase program stands out alongside the Telia win, as it directly affects per share exposure to any future broadband and SaaS growth Harmonic may achieve. Together, the Telia deployment and buybacks sit against a backdrop where Harmonic still faces pressure on margins and must keep investing in R&D to avoid technological obsolescence in a fast moving broadband market.

But investors also need to be aware that heavy reliance on a few large broadband customers could...

Read the full narrative on Harmonic (it's free!)

Harmonic's narrative projects $695.5 million revenue and $70.6 million earnings by 2028. This assumes revenue will decline by 0.3% per year and implies a modest earnings increase of about $2 million from $68.6 million today.

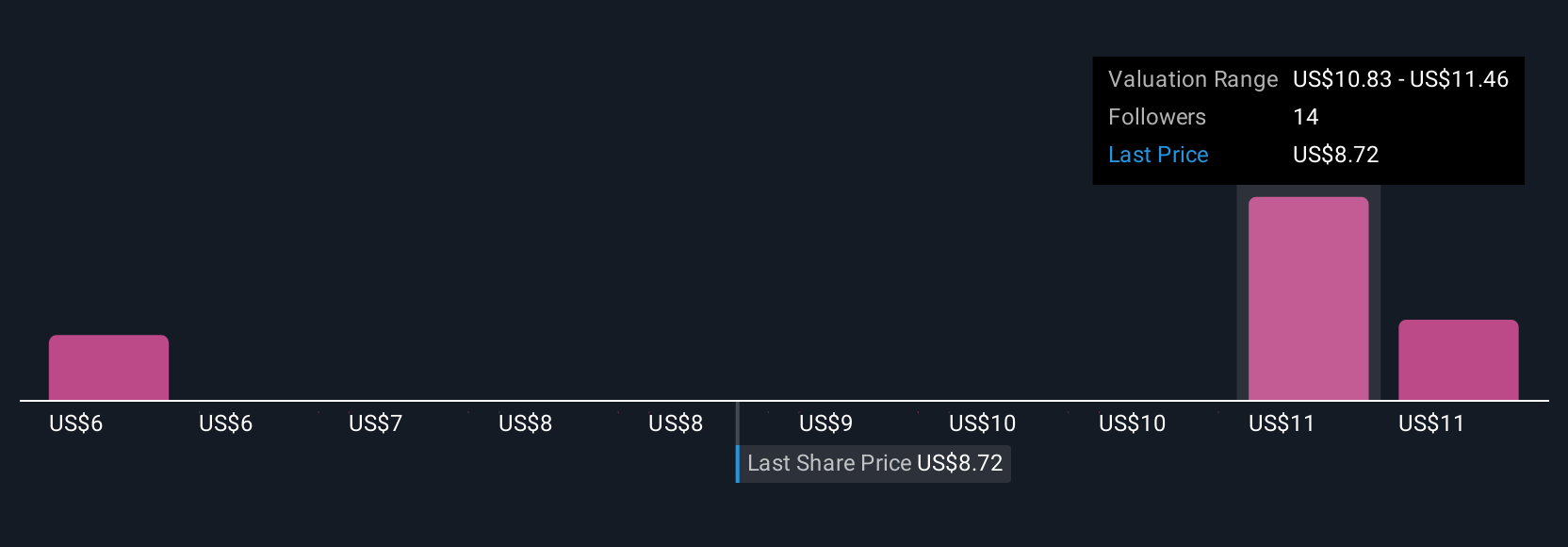

Uncover how Harmonic's forecasts yield a $11.79 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates span roughly US$11.79 to US$174.91 per share, underlining how far apart individual views can be. You can weigh those opinions against the Telia cOS win, which speaks to the broader virtualized broadband upgrade cycle that may influence Harmonic’s ability to convert its strong order book into future revenue growth.

Explore 3 other fair value estimates on Harmonic - why the stock might be worth just $11.79!

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

No Opportunity In Harmonic?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmonic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HLIT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026