- United States

- /

- Communications

- /

- NasdaqCM:GNSS

Revenues Tell The Story For Genasys Inc. (NASDAQ:GNSS) As Its Stock Soars 25%

The Genasys Inc. (NASDAQ:GNSS) share price has done very well over the last month, posting an excellent gain of 25%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 45% in the last twelve months.

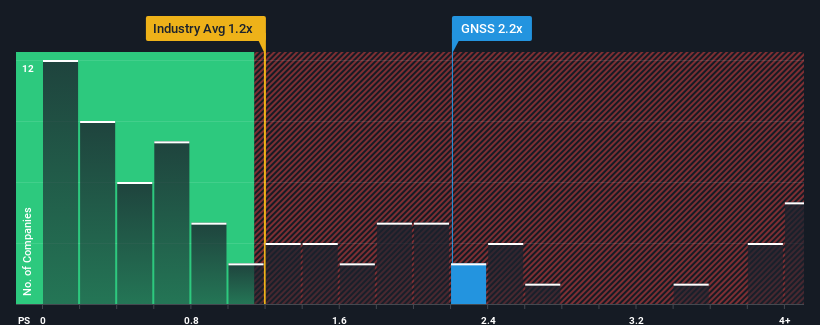

After such a large jump in price, when almost half of the companies in the United States' Communications industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Genasys as a stock probably not worth researching with its 2.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Genasys

How Genasys Has Been Performing

Genasys could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Genasys will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Genasys' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. As a result, revenue from three years ago have also fallen 4.1% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 48% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.2%, which would indicate the company is doing very well.

With this in consideration, we understand why Genasys' P/S is a cut above its industry peers. Right now, investors are willing to pay more for a stock that is shaping up to buck the trend of the broader industry going backwards.

What We Can Learn From Genasys' P/S?

Genasys' P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We can see that Genasys maintains its high P/S on the strength of its forecast growth potentially beating a struggling industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. We still remain cautious about the company's ability to keep swimming against the current of the broader industry turmoil. Assuming the company's outlook remains unchanged, the share price is likely to be supported by prospective buyers.

Plus, you should also learn about these 3 warning signs we've spotted with Genasys.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GNSS

Genasys

Engages in the designing, developing, and commercializing of critical communications hardware and software solutions to alert, inform, and protect people principally in Asia Pacific, North and South America, Europe, the Middle East, and Africa.

Low risk with limited growth.

Similar Companies

Market Insights

Community Narratives