- United States

- /

- Communications

- /

- NasdaqGS:GILT

A Look at Gilat Satellite Networks (NasdaqGS:GILT) Valuation Following Fresh U.S. Army SATCOM Terminal Orders

Reviewed by Kshitija Bhandaru

Gilat Satellite Networks (NasdaqGS:GILT) just announced that its subsidiary, Gilat DataPath, secured over $7 million in new orders from the U.S. Army for advanced SATCOM terminals. This move highlights continued demand for its defense-focused communications solutions.

See our latest analysis for Gilat Satellite Networks.

Momentum is clearly building for Gilat Satellite Networks. The new U.S. Army contracts are only the latest in a series of events, including an upcoming investor conference, that have drawn fresh attention to the stock. Gilat’s 1-month share price return of nearly 36% and a remarkable 1-year total shareholder return of 187% both hint at renewed growth optimism, as investors increasingly price in the company’s role in robust defense communications markets.

Given the interest in cutting-edge connectivity, you might want to see what other companies in aerospace and defense are gaining traction. See the full list for free.

With Gilat’s shares surging and recent wins fueling excitement, the real question is whether the stock’s sharp rally leaves room for further upside or if the market has already priced in the company’s future growth story.

Most Popular Narrative: 30.5% Overvalued

Despite last close at $14.36, the most widely followed narrative sets fair value for Gilat Satellite Networks at just $11.00, highlighting a notable gap between fundamentals and current momentum. With investor excitement running high, here is what underpins this cautious view.

Growing global investment in secure, mission-critical satellite connectivity, driven by increased geopolitical tensions, public infrastructure modernization, and digital inclusion initiatives, continues to expand Gilat's addressable market. This is evidenced by record new defense contracts and major government programs in regions such as Latin America and Europe. This is likely to support outsized revenue growth and enhance long-term earnings visibility.

The real driver behind this tough valuation? Ambitious forecasts for sales expansion, margin shifts, and a bold path to recurring revenue. If you want to find out which specific financial leaps and global contracts are fueling (or capping) the narrative’s fair value, now is your chance to see what makes this case tick.

Result: Fair Value of $11.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower than expected production ramp-ups and margin pressure from lower value contracts could quickly challenge current growth assumptions for Gilat’s stock.

Find out about the key risks to this Gilat Satellite Networks narrative.

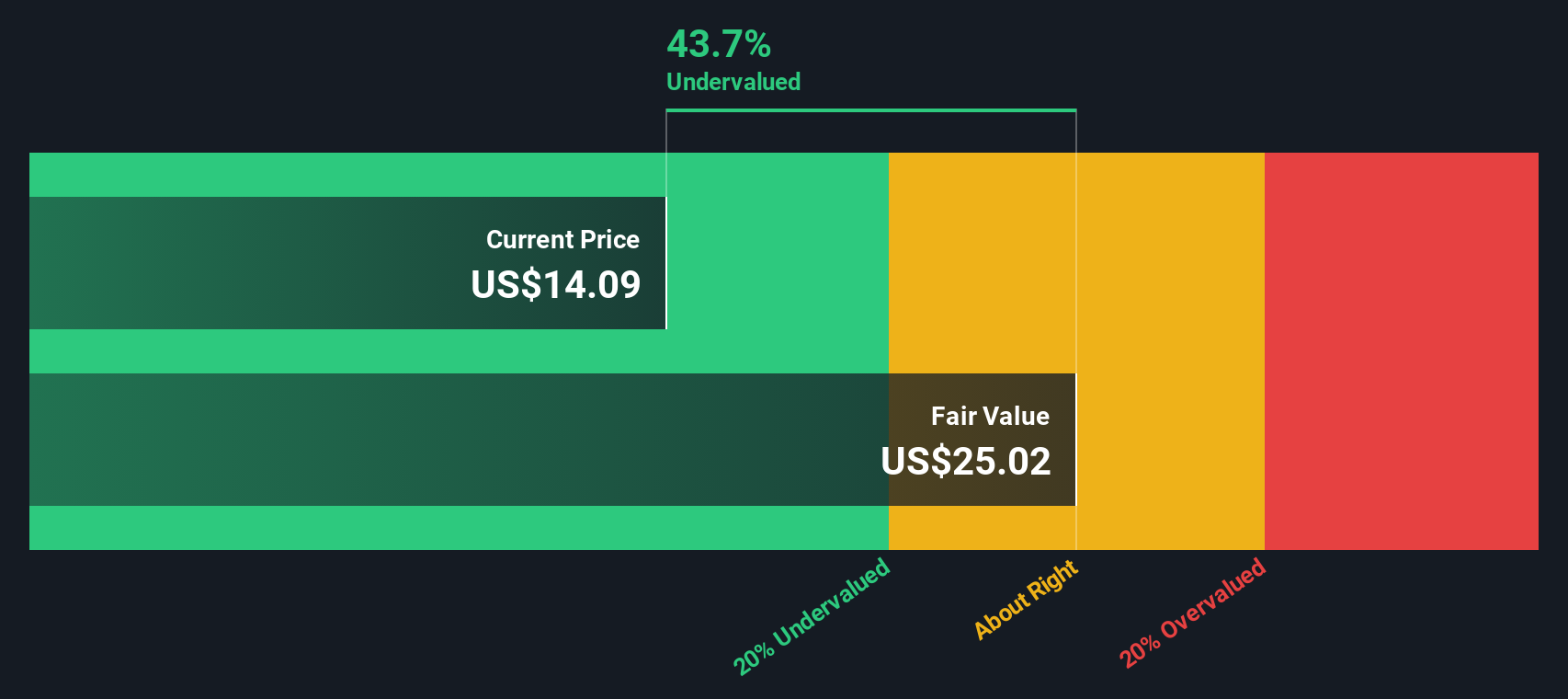

Another View: What the SWS DCF Model Reveals

While the popular narrative leans cautious, our SWS DCF model gives a far more optimistic read on Gilat Satellite Networks. It values the stock at $25.10 per share, which is 42.8% above the current price. This suggests a strong case for undervaluation. Could this be the growth window investors are looking for, or is the market right to be skeptical?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gilat Satellite Networks for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gilat Satellite Networks Narrative

If you see the story differently, or want to dig into the numbers on your own terms, you can craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Gilat Satellite Networks research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your next big opportunity. Use these powerful tools to find stocks with strong upside potential and diversify your portfolio with confident, high-conviction picks.

- Spot unique growth potential by checking out these 3573 penny stocks with strong financials with resilient fundamentals and remarkable earnings momentum.

- Boost your passive income strategy with these 19 dividend stocks with yields > 3% that consistently deliver yields above 3% and help lock in reliable returns.

- Stay ahead of the innovation curve by targeting these 32 healthcare AI stocks, where advanced technologies are transforming patient outcomes and profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILT

Gilat Satellite Networks

Provides satellite-based broadband communication solutions in Israel, the United States, Peru, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives