- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:FORD

Forward Industries (FORD): A Fresh Look at Valuation Following Recent Share Price Moves

Reviewed by Kshitija Bhandaru

Price-to-Book Ratio of -1635.3x: Is it justified?

Forward Industries currently trades with a price-to-book (P/B) ratio of -1635.3x. This stands in sharp contrast to the US Electronic industry average of 2.6x and the peer average of 2x. This negative and extremely high multiple signals a notable outlier compared to its industry.

The price-to-book ratio helps investors assess how the market is valuing the company's net assets. For technology and electronics companies, a negative P/B multiple often points to persistent unprofitability, negative equity, or a balance sheet under pressure. It indicates that, currently, Forward Industries' market value is far removed from its actual net assets.

This disconnect suggests the market is either pricing in ongoing losses or expecting little recovery in book value soon. The negative equity underlying this ratio also adds complexity to any straightforward valuation assessment.

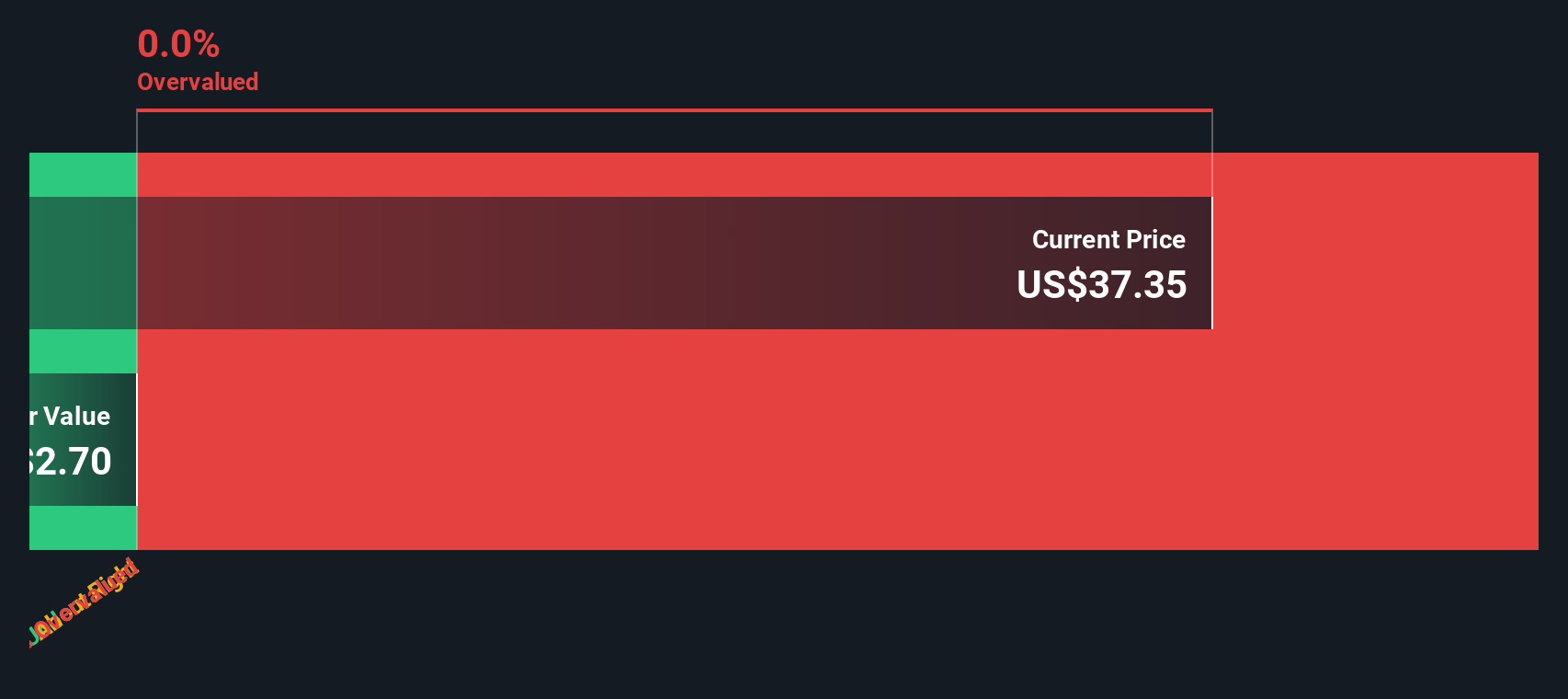

Result: Fair Value of $30.45 (ABOUT RIGHT)

See our latest analysis for Forward Industries.However, persistent net losses and negative equity could increase volatility or spark investor concern, quickly shifting the story in an unexpected direction.

Find out about the key risks to this Forward Industries narrative.Another View

While the price-to-book ratio paints one picture, looking at Forward Industries' value through our DCF model provides a different perspective. This approach leads to a similar conclusion and suggests little value gap is present. Could both methods be missing something important, or is the story just that straightforward?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Forward Industries Narrative

If this story does not quite match your perspective or you would rather follow the numbers your own way, you can easily build your own view in just a few minutes: Do it your way.

A great starting point for your Forward Industries research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot tomorrow’s market winners. Simply Wall Street’s tailored screeners are packed with opportunities you do not want to miss.

- Uncover undervalued gems trading below their potential by tapping into undervalued stocks based on cash flows for promising companies the market is overlooking.

- Supercharge your search for steady income and find businesses consistently rewarding with high payouts through the dividend stocks with yields > 3%.

- Get ahead of emerging trends in artificial intelligence by jumping into AI penny stocks to meet forward-thinking companies harnessing tomorrow’s biggest growth engine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FORD

Forward Industries

Designs, manufactures, sources, markets, and distributes carry and protective solutions.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives