- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

Flex (FLEX): Reassessing Valuation as Reliability Solutions Outperforms a Weaker Tech Sector

Reviewed by Simply Wall St

Flex’s segment gains stand out amid sector rotation

Flex (FLEX) is catching attention as its Reliability Solutions segment continues to grow in areas like Power and Health Solutions, even while investors rotate out of other tech names after weaker peer updates.

See our latest analysis for Flex.

That backdrop helps explain why short term share price returns have cooled slightly even as Flex still trades at $67.81 and boasts a powerful multi year total shareholder return. This suggests momentum has eased in the near term, but the long term trend remains firmly positive.

If Flex’s run has sharpened your appetite for durable growth stories, now could be a smart time to explore high growth tech and AI stocks for other potential compounders.

With shares up sharply over the past year and trading only modestly below analyst targets, investors now face a key question: Is Flex still mispriced relative to its earnings power, or is future growth already fully embedded in the stock?

Most Popular Narrative: 7.8% Undervalued

Flex’s most followed narrative pegs fair value modestly above the recent $67.81 close, framing a premium on its evolving earnings mix and data center positioning.

The company's deployment of AI enabled systems and advanced automation across its facilities is delivering meaningful productivity gains, which should support ongoing operating margin expansion and improve long term earnings potential.

Want to see what kind of earnings engine justifies that higher price tag? The narrative quietly bakes in rising margins, accelerating profits, and a richer future multiple.

Result: Fair Value of $73.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a handful of hyperscalers and structurally thin margins means that any customer loss or pricing pressure could quickly dent that upbeat outlook.

Find out about the key risks to this Flex narrative.

Another Way to Look at Value

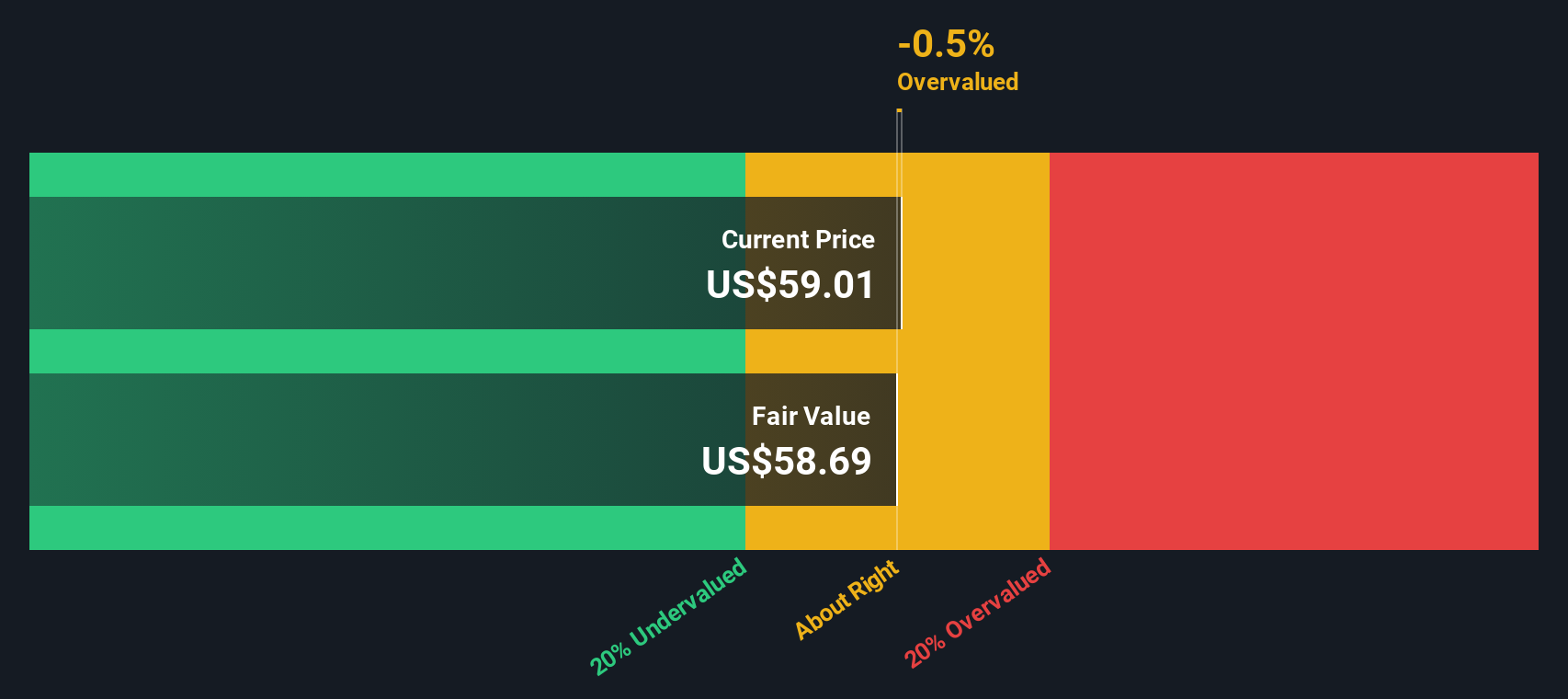

Our DCF model paints a cooler picture, with Flex’s $67.81 share price sitting slightly above an estimated fair value of $65.78, which implies the stock may be a touch overvalued. If the story really is that strong, how much upside is left for new buyers?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Flex for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Flex Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a custom view in minutes. Do it your way.

A great starting point for your Flex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one strong idea when you can quickly scan fresh opportunities across themes, sectors, and strategies tailored to how you like to invest.

- Pinpoint potential bargains by reviewing these 913 undervalued stocks based on cash flows that may offer strong upside based on solid cash flow fundamentals.

- Ride structural growth trends by scanning these 25 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your income stream by assessing these 13 dividend stocks with yields > 3% that can help you aim for more consistent returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)