- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:FLEX

Flex (FLEX): Exploring Valuation After Launching Scalable Data Center Cooling Solution for AI and HPC Growth

Flex (NasdaqGS:FLEX) just launched its Modular Rack-Level Cooling Distribution Unit through its JetCool division, aiming to help data centers efficiently scale for demanding AI and high-performance computing workloads. The vertical integration and flexible design could draw interest from operators who are tracking evolving industry trends.

See our latest analysis for Flex.

Flex’s big moves in advanced data center cooling have come at a time when market enthusiasm is gradually building. The company’s 1-year total shareholder return of 0.79% shows measured progress, and its 5-year figure of 5.55% points to slow, steady compounding for patient investors. With the Modular Rack-Level CDU launch sparking renewed industry attention, some see Flex’s recent momentum as a sign of potential growth ahead, especially as it continues to invest in next-gen infrastructure and vertical integration.

If Flex’s expansion into scalable AI-ready solutions has you interested in what else is gaining traction, consider discovering fast growing stocks with high insider ownership.

Flex’s recent launch puts the spotlight on its data center strategy and share price. With excitement building around AI infrastructure, investors are asking whether there is a genuine buying opportunity or if markets are already pricing in Flex’s growth potential.

Most Popular Narrative: Fairly Valued

Flex’s last close at $58.09 sits almost exactly at the most popular narrative’s fair value estimate of $57.86, setting the stage for a debate about precision pricing and future momentum.

The ongoing surge in demand for data center and AI infrastructure, requiring integrated power, cooling, and advanced IT hardware, positions Flex for sustained, outsized revenue growth, as evidenced by the 35% forecasted annual increase in its data center segment. This growth supports both topline expansion and higher portfolio margins.

Ready to discover the secret engine of this valuation? What if the true catalyst is not just data centers, but a transformation in revenue mix and projected margin boosts? Uncover the bold analyst expectations and see the numbers that underpin this razor-thin “fair value” call. There is more beneath the surface.

Result: Fair Value of $57.86 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Flex’s reliance on a handful of major customers and persistently slim operating margins could quickly undermine future growth expectations if conditions shift.

Find out about the key risks to this Flex narrative.

Another View: What Do Multiples Say?

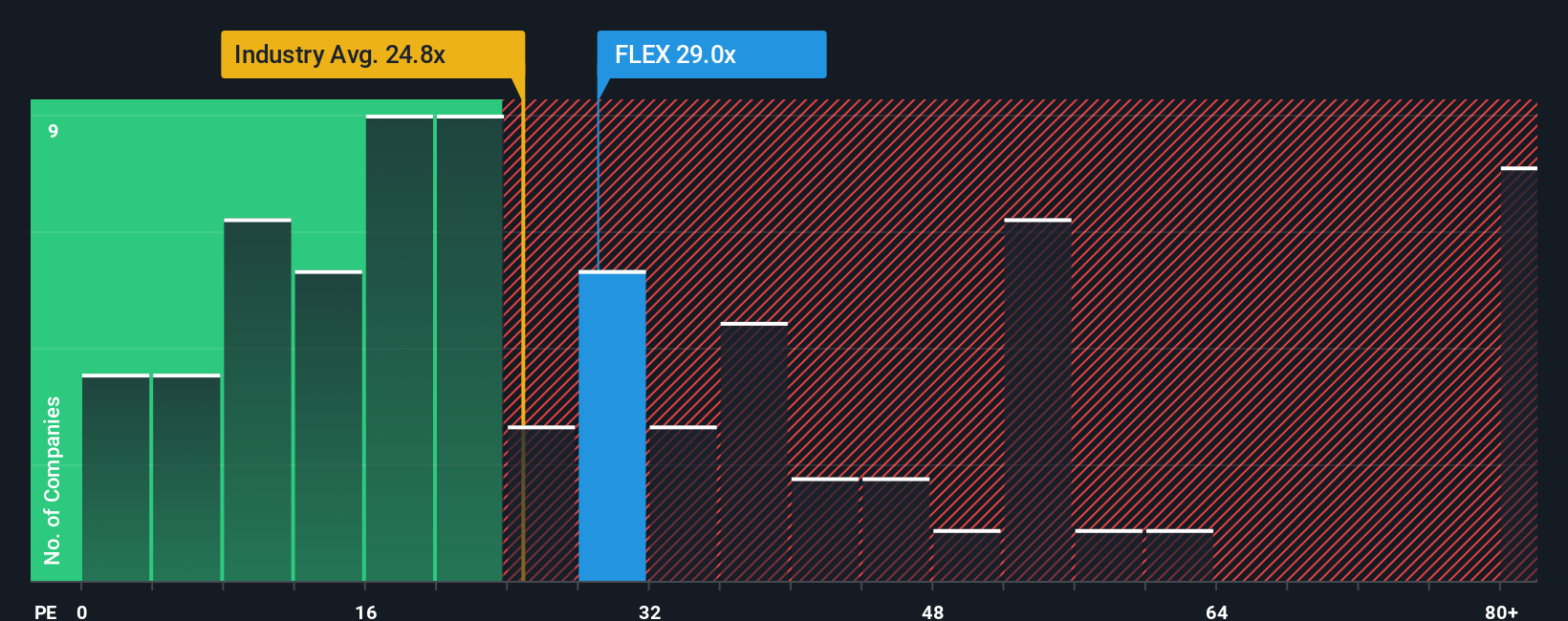

For a different angle, let’s consider how Flex’s earnings multiple compares to its industry and the broader market. With a P/E ratio of 24.5x, Flex trades just slightly above the US Electronic industry average of 24.3x, but well below its peer group average of 36x and the fair ratio of 32.1x. This gap could signal hidden opportunity or a warning sign. Which way will investors lean when sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flex Narrative

If you have your own perspective to add or want to dig deeper into the numbers, you can easily put together your own take in just a few minutes. Do it your way.

A great starting point for your Flex research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by keeping tabs on emerging opportunities. Don’t sit back while others uncover stocks that could reshape your strategy and boost your returns.

- Grow your portfolio with steady income by targeting these 19 dividend stocks with yields > 3%, which offers yields above 3 percent and robust financials.

- Join the tech evolution by seeking out these 24 AI penny stocks, which are at the forefront of artificial intelligence breakthroughs and rapid industry change.

- Stay ahead of the curve by tapping into these 78 cryptocurrency and blockchain stocks, helping to fuel crypto adoption and blockchain-driven innovation in today’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FLEX

Flex

Provides technology innovation, supply chain, and manufacturing solutions to data center, communications, enterprise, consumer, automotive, industrial, healthcare, industrial, and power industries.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Investment Case: Sotkamo Silver (SOSI)

The "AI Fear" Arbitrage Opportunity

From $5M to $2B: Why the 2024 Crash Was the Best Buying Opportunity in Consumer Stocks

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.