- United States

- /

- Communications

- /

- NasdaqCM:FKWL

Earnings Miss: Here's What Franklin Wireless Corp. (NASDAQ:FKWL) Analysts Are Forecasting For Next Year

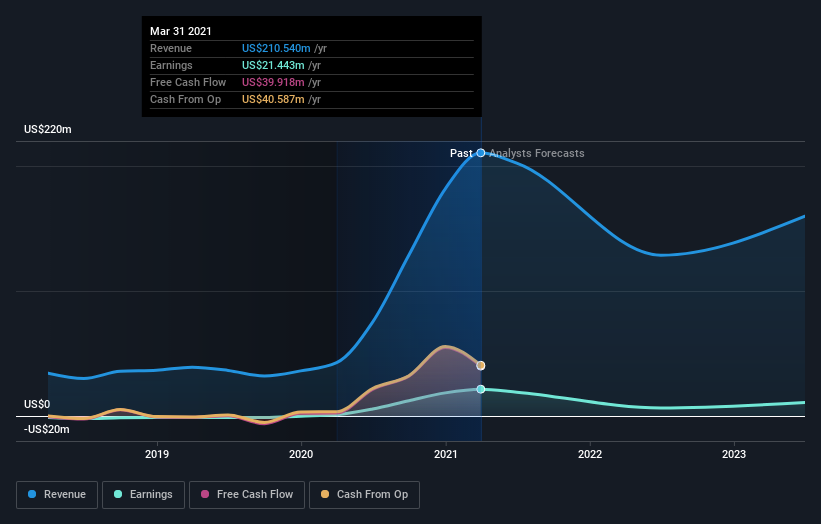

It's shaping up to be a tough period for Franklin Wireless Corp. (NASDAQ:FKWL), which a week ago released some disappointing third-quarter results that could have a notable impact on how the market views the stock. Earnings fell badly short of analyst estimates, with US$44m revenues missing by 13%, and statutory earnings per share (EPS) of US$0.33 falling short of forecasts by some -15%. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analyst has changed their mind on Franklin Wireless after the latest results.

See our latest analysis for Franklin Wireless

Taking into account the latest results, the current consensus, from the one analyst covering Franklin Wireless, is for revenues of US$128.6m in 2022, which would reflect a stressful 39% reduction in Franklin Wireless' sales over the past 12 months. Statutory earnings per share are expected to plummet 73% to US$0.53 in the same period. Before this earnings report, the analyst had been forecasting revenues of US$213.5m and earnings per share (EPS) of US$1.74 in 2022. It looks like sentiment has declined substantially in the aftermath of these results, with a pretty serious reduction to revenue estimates and a pretty serious reduction to earnings per share numbers as well.

The consensus price target fell 43% to US$16.00, with the weaker earnings outlook clearly leading valuation estimates.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Franklin Wireless' past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 33% by the end of 2022. This indicates a significant reduction from annual growth of 26% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 4.0% per year. It's pretty clear that Franklin Wireless' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The biggest concern is that the analyst reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Franklin Wireless. Unfortunately, they also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target fell measurably, with the analyst seemingly not reassured by the latest results, leading to a lower estimate of Franklin Wireless' future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on Franklin Wireless. Long-term earnings power is much more important than next year's profits. We have analyst estimates for Franklin Wireless going out as far as 2023, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 3 warning signs for Franklin Wireless (1 is significant!) that you should be aware of.

If you’re looking to trade Franklin Wireless, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:FKWL

Franklin Wireless

Provides integrated wireless solutions in North America and Asia.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.