- United States

- /

- Communications

- /

- NasdaqGS:FFIV

F5 (FFIV): Evaluating Valuation After Raised Revenue Guidance and Strong Cloud Demand

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

The most widely followed narrative views F5 as fairly valued at current levels, with the consensus price target only marginally above the recent share price. This outlook is based on expectations of sustained revenue and profit growth, but also recognizes the need for further evidence to justify a higher valuation.

Accelerated enterprise adoption of hybrid multi-cloud architectures and data center modernization is fueling durable demand for F5's application delivery and security solutions. This trend is positioning the company for sustained product and software revenue growth over the next several years.

Want to know what could push F5’s value even higher? The secret lies in aggressive growth forecasts for earnings and margins, plus a discounted cash flow benchmark that sets the bar for fair value. Are bold profit projections and future multiples the backbone of this narrative? Find out what specific financial expectations drive the consensus judgment on valuation.

Result: Fair Value of $327.18 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, heightened competition and slower adoption of F5’s software offerings could quickly change the story, which may put both future revenue and margin growth at risk.

Find out about the key risks to this F5 narrative.Another View: A Different Valuation Check

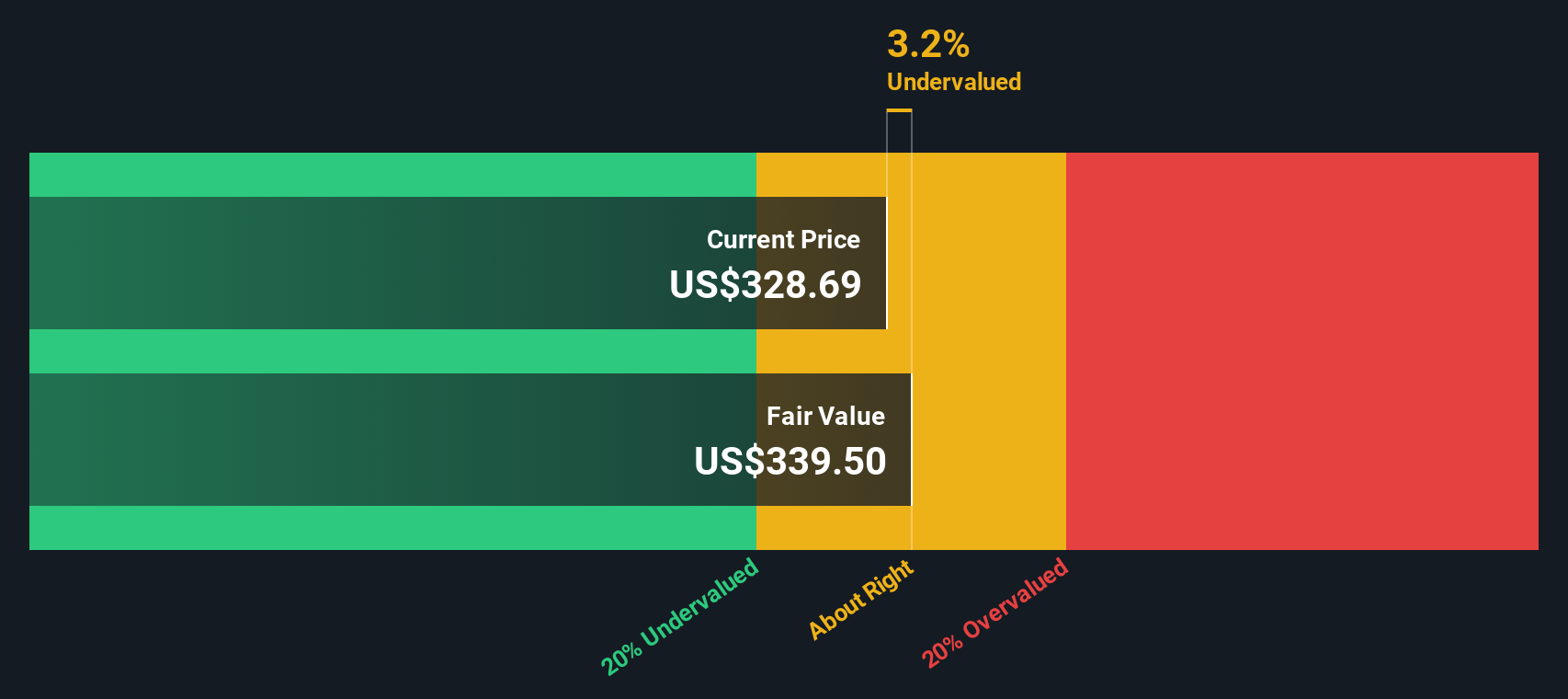

While consensus sees F5 as fairly valued, a look through the lens of our SWS DCF model offers a different perspective. This model suggests the shares might actually be trading below their intrinsic worth. Could the market be missing the longer-term upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own F5 Narrative

If you have a different outlook or want to dive into the details yourself, you can build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding F5.

Looking for More Investment Ideas?

Serious investors know that opportunities are not just limited to one standout stock. Do not let new possibilities slip by; use the right tools to seize your next big move right now.

- Uncover value by checking out companies flying under the radar with remarkable financial strength in our collection of penny stocks with strong financials.

- Tap into breakthroughs reshaping tomorrow’s healthcare by searching for leaders in artificial intelligence advancements across medical tech with healthcare AI stocks.

- Claim your edge by targeting businesses trading well below their potential, all through our selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIV

F5

Provides multicloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives