- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGM:FEIM

The Frequency Electronics (NASDAQ:FEIM) Share Price Has Gained 21% And Shareholders Are Hoping For More

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Frequency Electronics, Inc. (NASDAQ:FEIM) share price is up 21% in the last five years, that's less than the market return. Zooming in, the stock is up a respectable 18% in the last year.

Check out our latest analysis for Frequency Electronics

Frequency Electronics isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Frequency Electronics saw its revenue shrink by 6.4% per year. The stock is only up 4% for each year during the period. That's pretty decent given the top line decline, and lack of profits. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

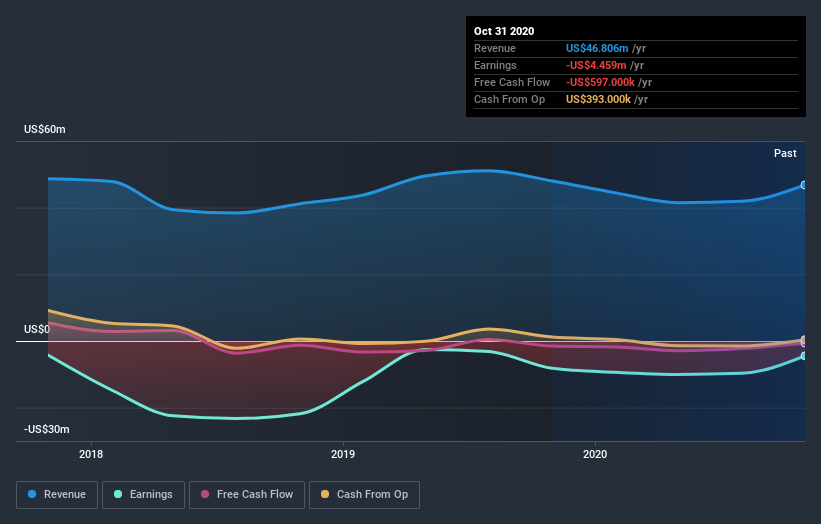

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Frequency Electronics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Frequency Electronics shareholders gained a total return of 18% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 4% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Frequency Electronics better, we need to consider many other factors. Even so, be aware that Frequency Electronics is showing 2 warning signs in our investment analysis , and 1 of those can't be ignored...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Frequency Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:FEIM

Frequency Electronics

Engages in the design, development, manufacture, marketing, and sale of precision time and frequency control products and components for microwave integrated circuit applications.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

13x Aussie Polymetal Silver/Zinc/Lead Project

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks