- United States

- /

- Communications

- /

- NasdaqGS:EXTR

Despite shrinking by US$206m in the past week, Extreme Networks (NASDAQ:EXTR) shareholders are still up 120% over 5 years

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. Long term Extreme Networks, Inc. (NASDAQ:EXTR) shareholders would be well aware of this, since the stock is up 120% in five years. But it's down 9.2% in the last week. But this could be related to the soft market, with stocks selling off around 2.1% in the last week.

Although Extreme Networks has shed US$206m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for Extreme Networks

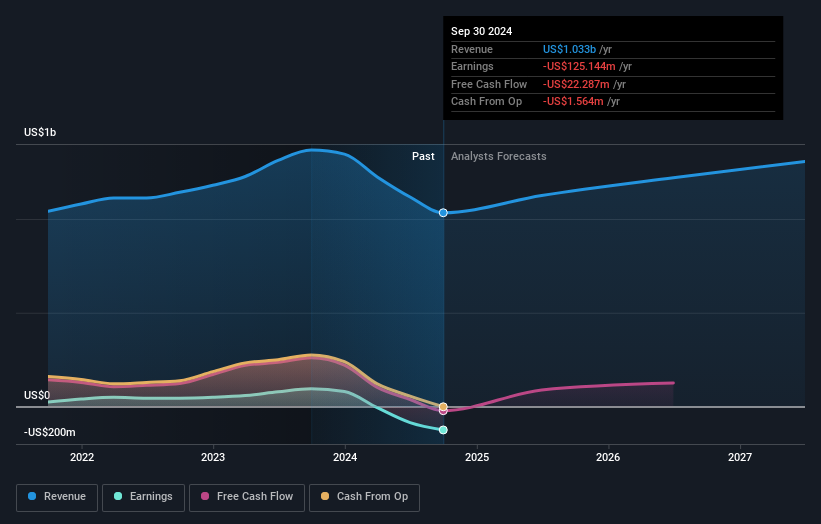

Because Extreme Networks made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, Extreme Networks can boast revenue growth at a rate of 5.8% per year. That's not a very high growth rate considering the bottom line. In comparison, the share price rise of 17% per year over the last half a decade is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. Some might suggest that the sentiment around the stock is rather positive.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Extreme Networks' financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 32% in the last year, Extreme Networks shareholders lost 7.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 17%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Extreme Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EXTR

Extreme Networks

Provides software-driven networking solutions worldwide.

Undervalued with limited growth.