- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

Evolv (EVLV) Is Up 8.7% After Strong Q2 Growth, Legal Resolutions, and Major Contract Wins

Reviewed by Simply Wall St

- Gates Ventures, LLC, a significant shareholder, recently sold 1,470,700 shares of Evolv Technologies Holdings after the company reported a 29% year-over-year revenue increase in Q2 driven by new customer wins and expanded deployments.

- Alongside strong earnings, Evolv Technologies Holdings resolved important legal matters and secured key contracts, leading analysts to express greater confidence in its strategic direction and growth opportunities.

- We'll explore how the successful resolution of legal issues and major contract wins could influence Evolv Technologies Holdings’ investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Evolv Technologies Holdings Investment Narrative Recap

To be a shareholder in Evolv Technologies Holdings, you need confidence in its ability to capture a larger share of the growing physical site security market, especially as public safety concerns drive demand for AI-based screening solutions. The recent sale of shares by a major investor after strong earnings and new contract wins has brought attention to near-term momentum, but it does not materially change the most significant catalyst (contract wins in key verticals) or the biggest risk (sustained unprofitability due to margin pressure and high operating expenses).

Among recent developments, the company's upgraded revenue guidance for 2025 stands out, forecasting a growth rate of 27% to 30% and improved operational efficiency. This announcement reinforces management's outlook for higher growth, though persistent losses highlight ongoing challenges balancing expansion with profitability targets.

Yet, despite these positive signals, investors should be aware that profitability pressures from lower gross margins and ongoing expenses continue to be relevant...

Read the full narrative on Evolv Technologies Holdings (it's free!)

Evolv Technologies Holdings is forecast to reach $208.0 million in revenue and $18.8 million in earnings by 2028. This outlook assumes 19.8% annual revenue growth and an earnings increase of $107.2 million from current earnings of -$88.4 million.

Uncover how Evolv Technologies Holdings' forecasts yield a $9.50 fair value, a 8% upside to its current price.

Exploring Other Perspectives

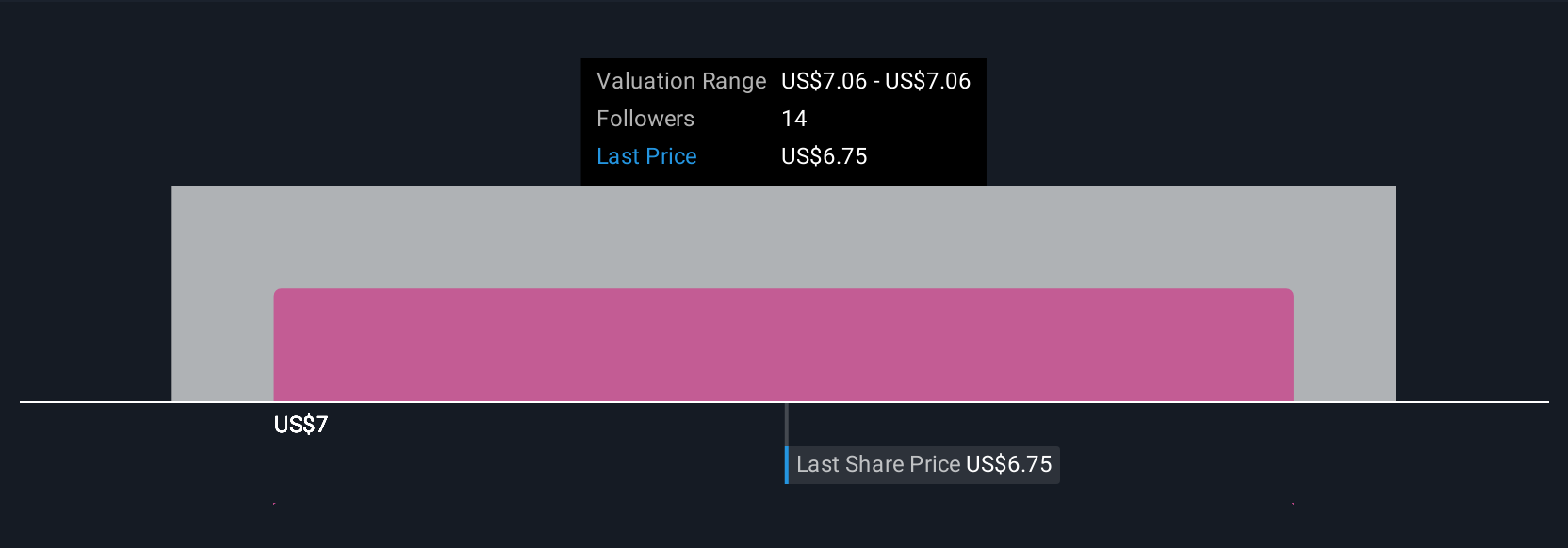

Simply Wall St Community members have shared 1 fair value estimate for Evolv at US$9.50, showing a unified outlook among private investors. However, with the company's revenue growth reliant on securing and expanding contracts, your own view may differ as you weigh these factors for Evolv's future.

Explore another fair value estimate on Evolv Technologies Holdings - why the stock might be worth as much as 8% more than the current price!

Build Your Own Evolv Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolv Technologies Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Evolv Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolv Technologies Holdings' overall financial health at a glance.

No Opportunity In Evolv Technologies Holdings?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives