- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:EVLV

After Leaping 29% Evolv Technologies Holdings, Inc. (NASDAQ:EVLV) Shares Are Not Flying Under The Radar

The Evolv Technologies Holdings, Inc. (NASDAQ:EVLV) share price has done very well over the last month, posting an excellent gain of 29%. Looking back a bit further, it's encouraging to see the stock is up 83% in the last year.

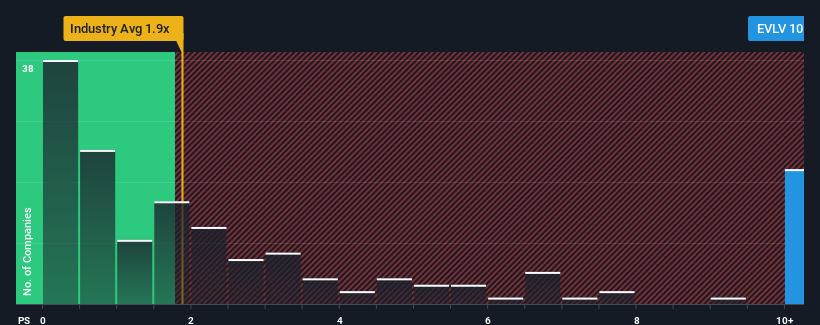

Since its price has surged higher, you could be forgiven for thinking Evolv Technologies Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 10.3x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Evolv Technologies Holdings

What Does Evolv Technologies Holdings' P/S Mean For Shareholders?

Evolv Technologies Holdings certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. The P/S ratio is probably high because investors think the company will continue to navigate the broader industry headwinds better than most. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Evolv Technologies Holdings.Is There Enough Revenue Growth Forecasted For Evolv Technologies Holdings?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Evolv Technologies Holdings' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 94% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 44% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 18% per year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Evolv Technologies Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Evolv Technologies Holdings' P/S Mean For Investors?

Evolv Technologies Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Evolv Technologies Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Evolv Technologies Holdings has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Evolv Technologies Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Evolv Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EVLV

Evolv Technologies Holdings

Provides artificial intelligence (AI)-based weapons detection for security screening in the United States and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion