- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:IZEA

US Penny Stocks To Watch In December 2024

Reviewed by Simply Wall St

As the Federal Reserve's policy meeting on interest rates looms, stock futures have slipped slightly, reflecting investor caution amidst a backdrop of mixed performances in major indices. For those willing to explore beyond well-known companies, penny stocks—typically smaller or newer firms—offer intriguing opportunities that remain relevant despite their seemingly outdated label. This article will spotlight three such stocks that present potential growth prospects with notable financial stability, providing an interesting avenue for investors seeking value in less conventional areas of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Inter & Co (NasdaqGS:INTR) | $4.42 | $2.03B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $128.29M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.874625 | $6.32M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.87 | $89.78M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.23 | $8.25M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.50 | $48.84M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $0.875 | $13.39M | ★★★★★☆ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8366 | $75.59M | ★★★★★☆ |

Click here to see the full list of 716 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Electro-Sensors (NasdaqCM:ELSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Electro-Sensors, Inc. manufactures and sells industrial production monitoring and process control systems, with a market cap of $15.84 million.

Operations: The company generates revenue of $9.29 million from its production monitoring segment.

Market Cap: $15.84M

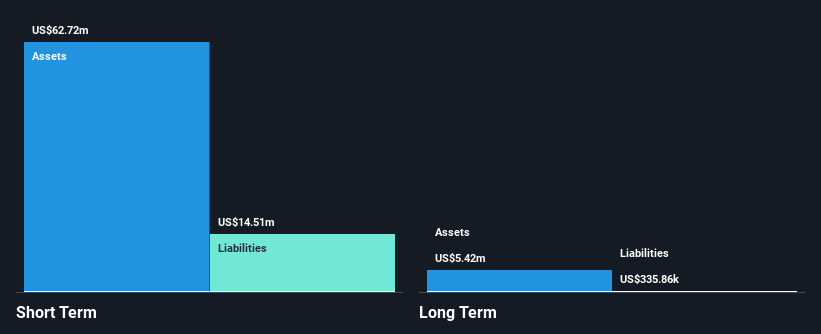

Electro-Sensors, Inc. recently reported third-quarter sales of US$2.51 million, up from US$2.06 million the previous year, with net income rising to US$0.238 million from US$0.008 million. The company is debt-free and has robust short-term assets of US$13.8 million against liabilities of just US$859,000, indicating strong financial health for a penny stock. Earnings have grown by 25.4% over the past year and show high-quality characteristics despite a low return on equity at 3.1%. The seasoned board adds stability, though management tenure details are unclear.

- Click here to discover the nuances of Electro-Sensors with our detailed analytical financial health report.

- Evaluate Electro-Sensors' historical performance by accessing our past performance report.

IZEA Worldwide (NasdaqCM:IZEA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IZEA Worldwide, Inc. provides software and professional services that connect brands with content creators across North America, the Asia Pacific, and internationally, with a market cap of $43.60 million.

Operations: The company's revenue is derived from two main segments: SaaS Services, generating $0.82 million, and Managed Services, contributing $32.95 million.

Market Cap: $43.6M

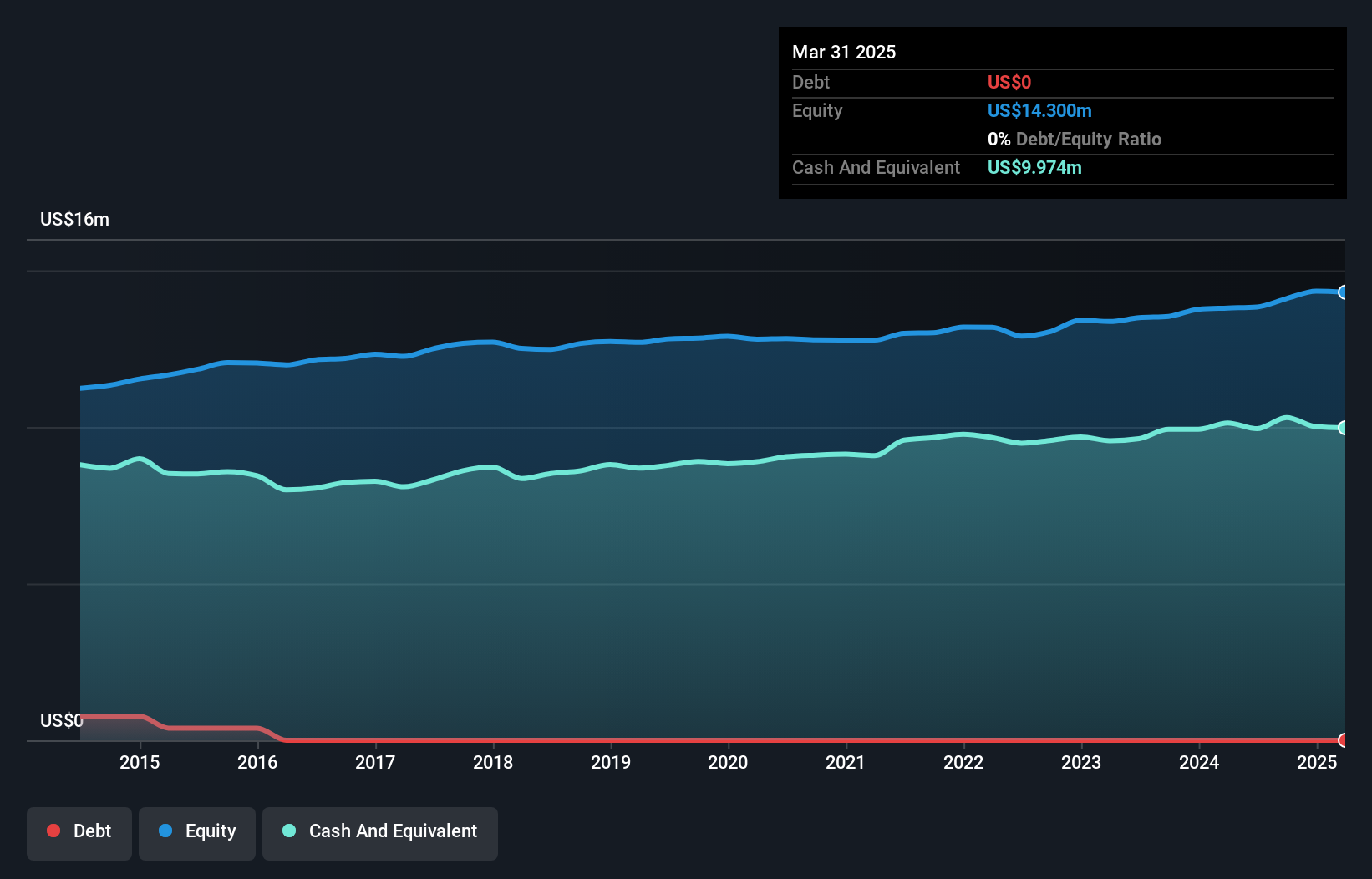

IZEA Worldwide, Inc. is navigating the penny stock landscape with a market cap of US$43.60 million and revenue primarily from Managed Services at US$32.95 million, contrasting its smaller SaaS segment. Despite being unprofitable with a negative return on equity, IZEA has managed to reduce losses over five years and maintains a solid cash runway exceeding three years without debt concerns. Recent strategic moves include seeking acquisitions and executing share buybacks worth up to US$9.94 million, indicating confidence in its growth prospects despite reporting increased net losses due to goodwill impairments this past quarter.

- Navigate through the intricacies of IZEA Worldwide with our comprehensive balance sheet health report here.

- Understand IZEA Worldwide's earnings outlook by examining our growth report.

MOGU (NYSE:MOGU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MOGU Inc. operates an online fashion and lifestyle platform in the People's Republic of China, with a market cap of $18.13 million.

Operations: The company's revenue comes entirely from its Domestic Business segment, which generated CN¥138.90 million.

Market Cap: $18.13M

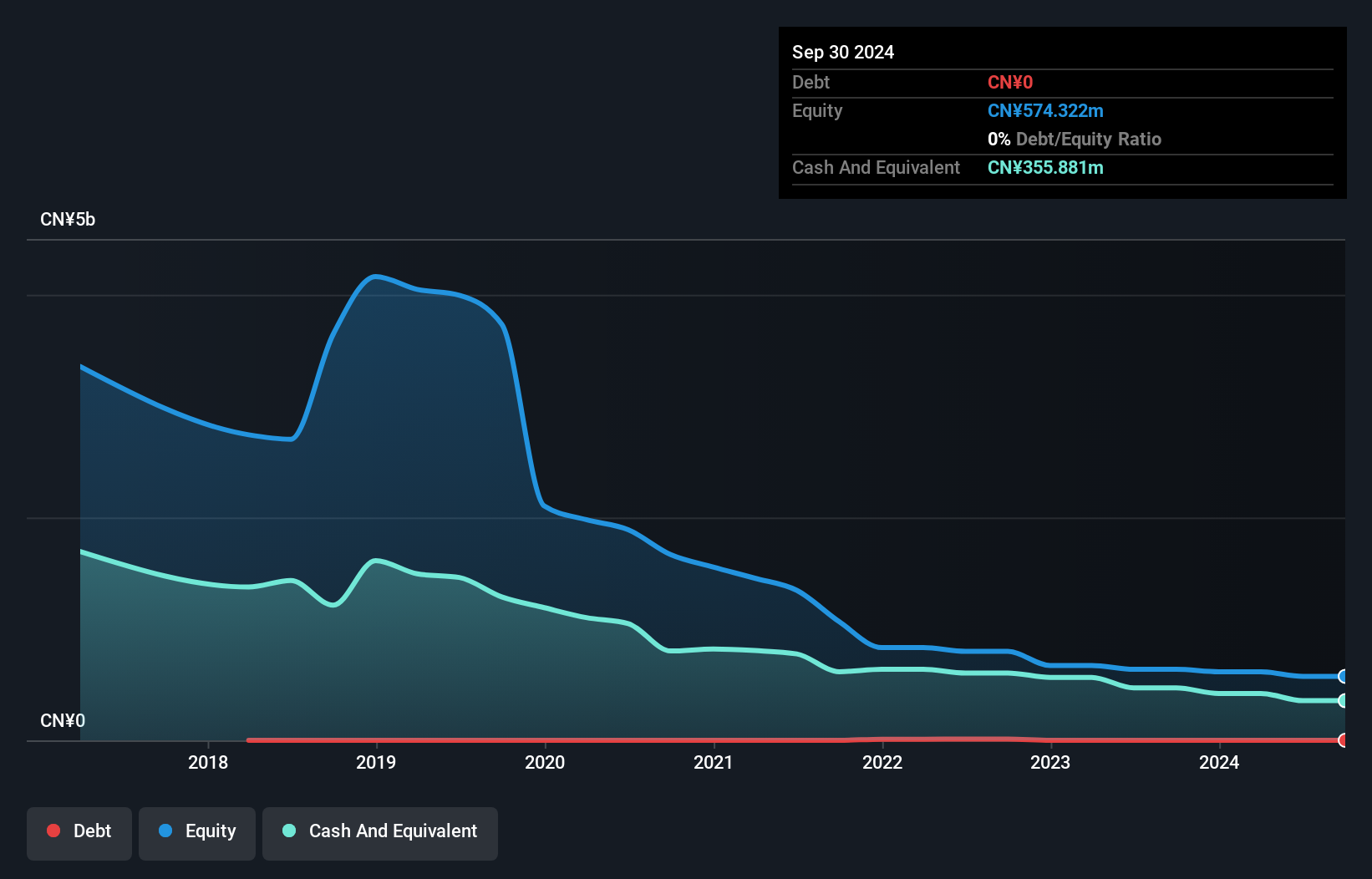

MOGU Inc., with a market cap of $18.13 million, operates in the online fashion sector and faces challenges typical of penny stocks. The company is unprofitable but has shown a 55.7% annual reduction in losses over five years, indicating some operational improvements. Despite reporting a net loss of CN¥35.41 million for the recent half-year, revenue increased to CN¥83.3 million from CN¥61.85 million year-on-year, suggesting some growth momentum. MOGU benefits from an experienced board and maintains sufficient cash runway for over three years without debt concerns, though its stock remains highly volatile with significant weekly fluctuations.

- Get an in-depth perspective on MOGU's performance by reading our balance sheet health report here.

- Examine MOGU's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Jump into our full catalog of 716 US Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IZEA

IZEA Worldwide

Provides software and professional services to connect brands and content creators in North America, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives