- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:DAKT

Daktronics (DAKT) Is Up 23.1% After Return to Profit and Share Buybacks – What's Changed?

Reviewed by Simply Wall St

- Daktronics, Inc. recently reported first quarter 2026 earnings, posting sales of US$218.97 million and a return to profitability with net income of US$16.47 million, after a net loss in the same period the previous year.

- This marked improvement in financial performance coincided with the completion of a significant share repurchase program and a new shelf registration filing aimed at supporting its employee stock ownership plan.

- With Daktronics swinging back to profit, we'll explore how this operational turnaround impacts its longer-term growth outlook and investment narrative.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Daktronics Investment Narrative Recap

Investors in Daktronics need to believe in the long-term adoption of digital displays across industries such as sports, transportation, and education, which could create consistent demand for the company's solutions. The sharp swing back to profitability in the latest quarter buoys confidence around execution and balance sheet health, but it does not materially reduce the biggest risk: the company’s reliance on cyclical project-based revenues, which remain unpredictable in the short term.

Of the recent announcements, the completion of Daktronics’ share repurchase program stands out. While buybacks can signal management’s confidence and support shareholder value, they are less directly tied to driving core business catalysts such as expanding order backlogs or reducing exposure to price competition in displays.

In contrast, it’s important for investors to be aware that the unpredictability tied to project-based revenue and cash flows can still result in sharp quarterly swings...

Read the full narrative on Daktronics (it's free!)

Daktronics' narrative projects $931.8 million revenue and $120.0 million earnings by 2028. This requires 7.2% yearly revenue growth and an earnings increase of $130.1 million from current earnings of $-10.1 million.

Uncover how Daktronics' forecasts yield a $23.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

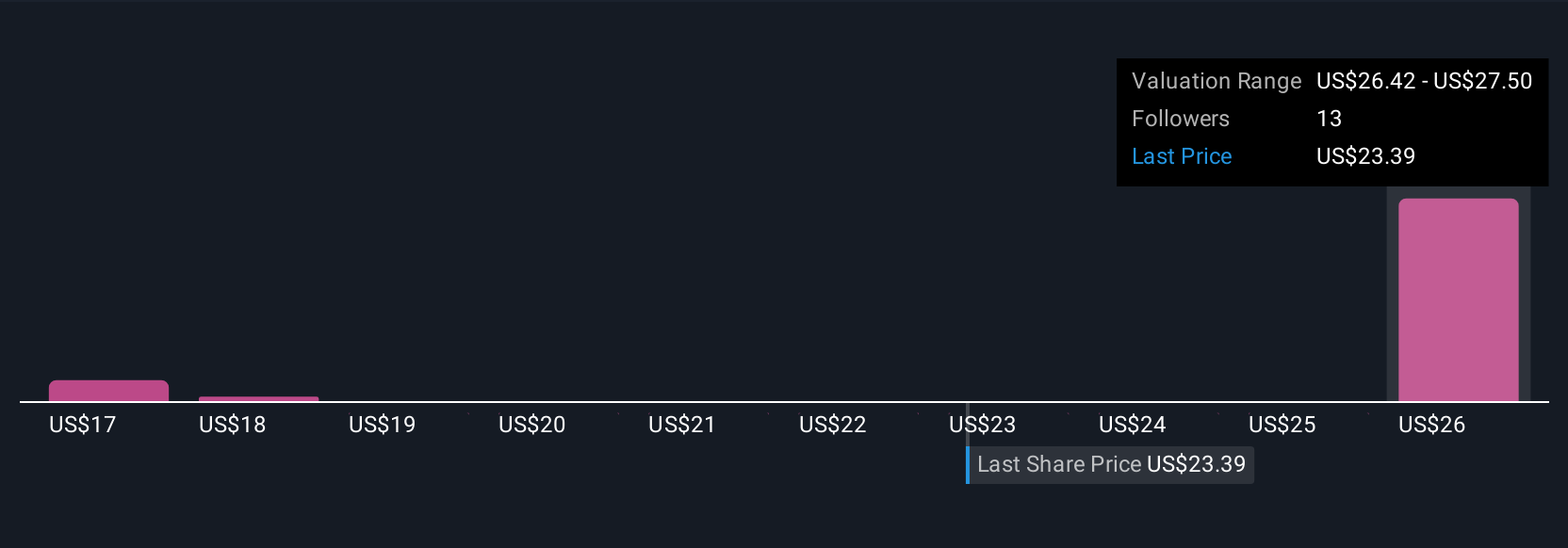

Simply Wall St Community members estimate fair values for Daktronics ranging from US$8.29 to US$23 across four independent views. Despite this variety, the largest risk for future performance remains the variability and lumpiness of project-driven revenues, inviting you to consider the wide spectrum of opinions on what could drive the company next.

Explore 4 other fair value estimates on Daktronics - why the stock might be worth as much as 10% more than the current price!

Build Your Own Daktronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Daktronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daktronics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DAKT

Daktronics

Designs, manufactures, and sells electronic scoreboards, programmable display systems, and large screen video displays for sporting, commercial, and transportation applications in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives