- United States

- /

- Communications

- /

- NasdaqGS:CSCO

Cisco Systems (CSCO): Evaluating the Valuation After a Steady Share Price Climb

Let’s talk about Cisco Systems (CSCO) and why it’s back in the spotlight. With no splashy M&A deals or game-changing new product launches triggering the move, investors may still be watching closely as shares shift, wondering if there’s a deeper story underneath or just the usual market shuffle. Sometimes a stock’s subtle move can be as revealing as the loudest headlines, especially for those considering their next step.

Looking back at the past year, Cisco has quietly put up a strong showing with a one-year total return over 41% and a 13% gain since January, outpacing many peers. The past three months saw momentum ticking up, hinting at renewed market interest after a slower stretch last month. Against the backdrop of steady revenue and net income growth, these price swings have kept investors tuned in for signs of what might come next.

So after this steady climb, is Cisco now trading at a compelling entry point, or has the market fully priced in the company’s growth story?

Most Popular Narrative: 11.8% Undervalued

According to the prevailing narrative, Cisco Systems is currently viewed as undervalued relative to its fair value, with analysts projecting notable upside based on key business catalysts and financial drivers.

The rapid acceleration in AI infrastructure investment, highlighted by record AI infrastructure orders from webscale/cloud customers (doubling targets to $2B in FY25) and continued strength in order pipeline, positions Cisco to benefit from surging demand for high-performance, AI-optimized networking hardware. This is expected to drive both revenue and margin expansion as next-generation networks scale globally.

Curious what’s behind this double-digit discount to fair value? This narrative hinges on an ambitious growth transformation and bold profit margin projections. There is one variable you might not expect driving analysts’ confidence. Want to glimpse which forward-looking figures form the backbone of this bullish view? Find out what makes this price target so compelling.

Result: Fair Value of $75.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges like slowing cloud spending or tough price competition could quickly undermine this bullish case. This serves as a reminder to investors that risks remain.

Find out about the key risks to this Cisco Systems narrative.Another View: SWS DCF Model

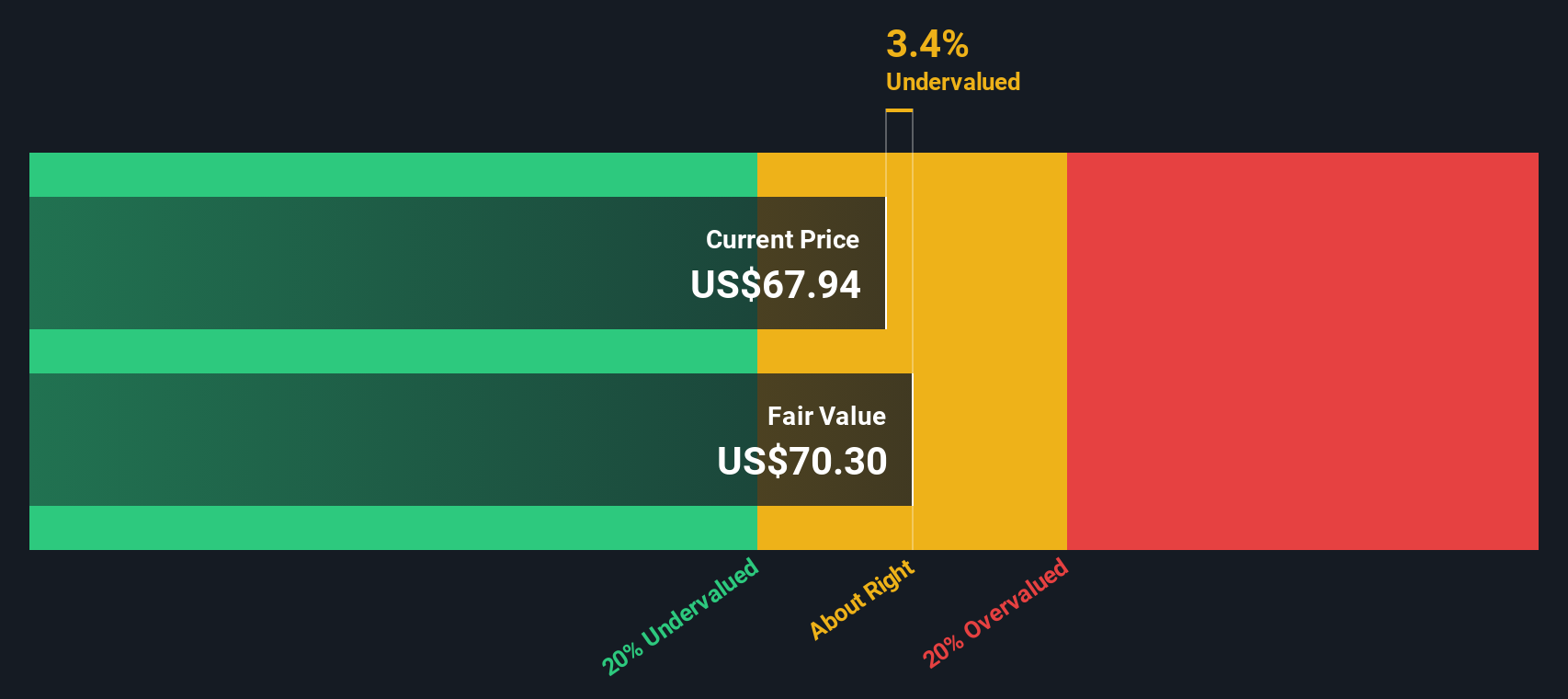

Taking a second look using our SWS DCF model, Cisco also appears to be trading below its estimated fair value. This alternative method supports the first view. However, does the DCF tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cisco Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cisco Systems Narrative

If you’re not convinced or want to dig deeper, take control and build your own perspective using the data. Crafting your narrative takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cisco Systems.

Looking for more investment ideas?

Smart investors never settle for the obvious. Make your next move count by scouting untapped opportunities that can reshape your portfolio and keep you ahead of the curve.

- Zero in on stocks with extra income potential by checking out companies offering steady payouts through dividend stocks with yields > 3%.

- Jump into tomorrow’s growth stories early by reviewing trailblazers innovating with artificial intelligence via AI penny stocks.

- Accelerate your search for hidden gems trading under their true worth using our powerful tools to find undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:CSCO

Cisco Systems

Designs, develops, and sells technologies that help to power, secure, and draw insights from the internet in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.