- United States

- /

- Tech Hardware

- /

- NasdaqGS:CRSR

Corsair Gaming's (NASDAQ:CRSR) Short Squeeze Looks Unlikely at the Moment

After a prolonged decline, Corsair Gaming, Inc. (NASDAQ: CRSR) finally found support around the critical level of US$20. Interestingly, insider selling dried up as the price declined. However, the stock remains heavily shorted.

Check out our latest analysis for Corsair Gaming

An Orderly Decline with High Short Interest

After a huge rally upon the public trading debut in 2020, Corsair Gaming has lost 35% of its value in 2021. Between the supply chain constraints and chip shortages, negative catalysts did not crash the stock – they sent it spiraling downwards in an orderly manner.

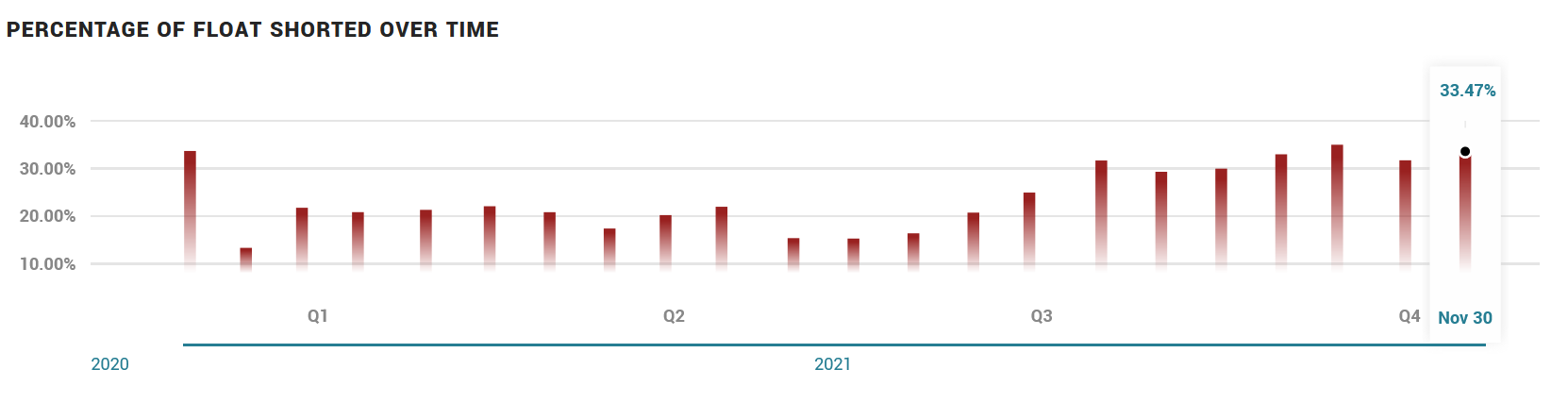

The negative sentiment resulted in growing short interest, evident from the following graph.

Currently, it is sitting at the highest at 33.47% of the float, with 9.7 days to cover. While not outrageous, these are high numbers. Given the nature of Corsair business, whose target audience falls within the population of short squeeze speculators, it is natural to wonder if this stock could be next.

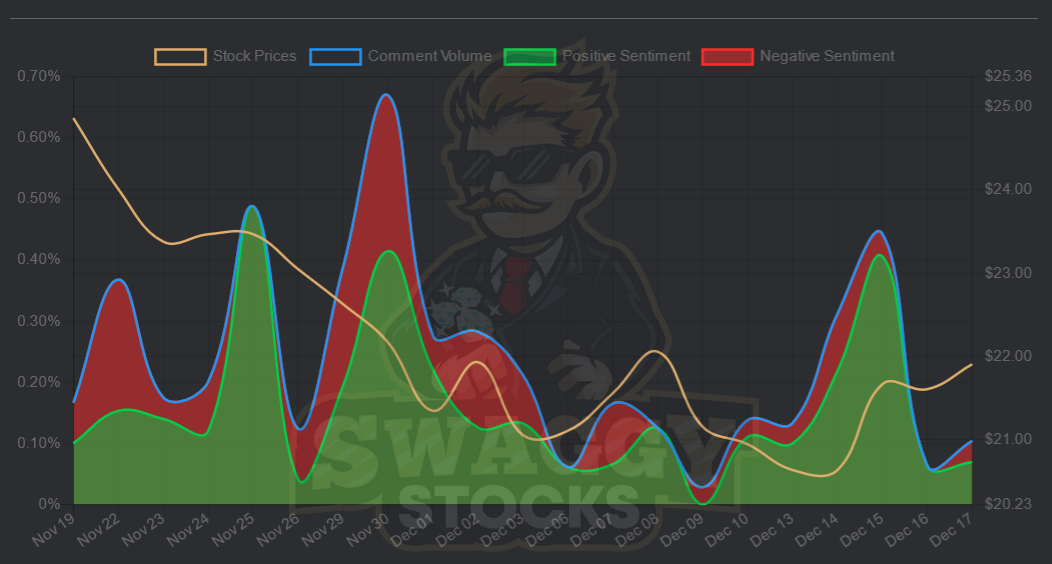

However, sentiment analysis of WallStreetBets is showing it to be unlikely, as the comment volume is too low.

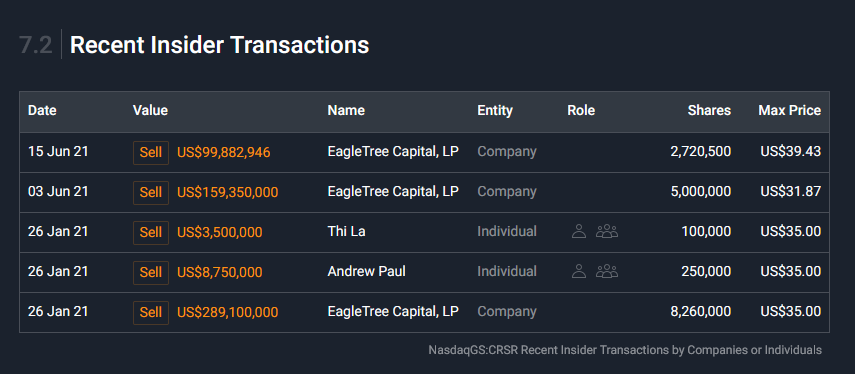

Insider Selling Halts

Looking at the recent insider transactions, we can see that there have been no sales since the price declined. This is a positive sign, showing that the insiders refuse to sell at these prices.

What is Corsair Gaming worth?

Despite the decline, the stock's ratio of 17.34x is currently above the industry average of 11.88x, meaning that it is trading at a higher price than its peers. In addition to this, it seems like Corsair Gaming's share price is relatively stable, which could mean two things: firstly, it may take the share price a while to fall back down to an attractive buying range, and secondly, there may be fewer chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the wider market, given its low beta.

What does the future of Corsair Gaming look like?

Investors looking for growth in their portfolio may want to consider a company's prospects before buying its shares. Although value investors would argue that it's the intrinsic value relative to the price that matters the most, a more compelling investment thesis would be high growth potential at a low price.

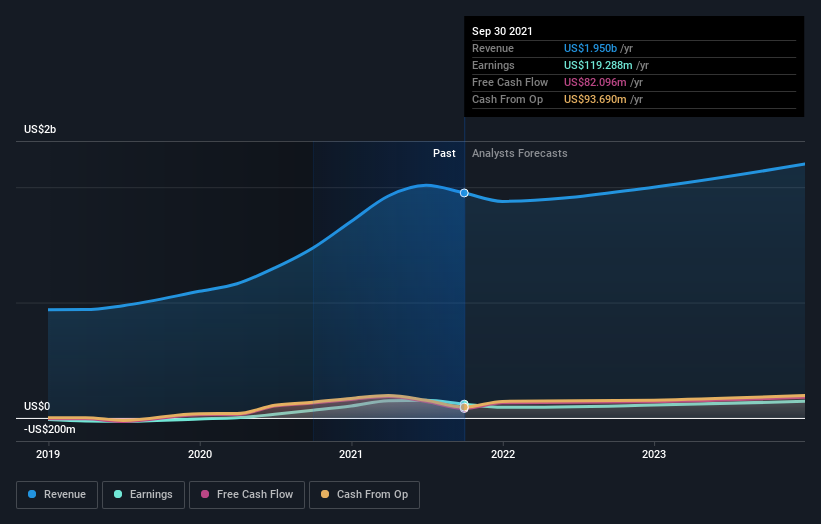

With profit expected to grow by 72% over the next couple of years, the future seems bright for Corsair Gaming. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What this means for you:

Are you a shareholder? Although CRSR is trading at a multiple higher than the industry average, the growth forecasts are much higher as well. Furthermore, it seems that the insiders are dissatisfied with the current valuation, refusing to sell, which can be a positive sign. Before you make this decision, please look at whether its fundamentals have changed.

Are you a potential investor? If you've been keeping an eye on CRSR for a while, you have likely observed that it held above the critical level of US$20. This is a positive sign but purely technical in nature. However, if you are speculating purely for the short-squeeze purposes it seems that the odds of that happening anytime soon are not very high.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. While conducting our analysis, we found that Corsair Gaming has 2 warning signs, and it would be unwise to ignore them.

If you are no longer interested in Corsair Gaming, you can use our free platform to see our list of over 50 other stocks with high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:CRSR

Corsair Gaming

Designs and sells gaming and streaming peripherals, components, and systems in Europe, the Middle East, North Africa, North America, Latin America, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026