- United States

- /

- Interactive Media and Services

- /

- NYSE:YALA

Undiscovered Gems in the United States to Explore This February 2025

Reviewed by Simply Wall St

The United States market has shown robust performance, with a 1.2% increase over the last week and a remarkable 21% rise over the past year, while earnings are forecast to grow by 15% annually. In this thriving environment, identifying stocks that offer unique potential and align with these growth trends can be key to uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. offers wireless transport solutions for cellular operators and other wireless service providers across various regions, including North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America, with a market cap of $430.21 million.

Operations: Ceragon Networks generates revenue primarily from its role as a global innovator and leading solutions provider of wireless transport, amounting to $377.62 million. The company's market cap stands at approximately $430.21 million.

Ceragon Networks, a smaller player in the telecommunications sector, has seen notable financial improvements recently. Its net income for Q4 2024 was US$3.61 million, a turnaround from a US$1.2 million loss the previous year, with sales rising to US$106.93 million from US$90.36 million. The company is trading at 90% below its estimated fair value and boasts strong interest coverage of 140 times EBIT over interest payments, suggesting robust financial health despite recent share price volatility. As Ceragon expands into India and leverages millimeter-wave technology, it appears well-positioned for future growth opportunities amidst competitive challenges.

Biglari Holdings (NYSE:BH.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Biglari Holdings Inc. is a diversified holding company that, through its subsidiaries, primarily operates and franchises restaurants in the United States, with a market cap of $715.84 million.

Operations: Biglari Holdings generates revenue through various segments, with Restaurant Operations - Steak n Shake contributing $241.60 million and Insurance Operations - First Guard adding $37.65 million. The company also earns from Oil and Gas Operations, including Southern Oil at $14.74 million and Abraxas Petroleum at $22.96 million, along with other restaurant and insurance activities.

Biglari Holdings, a smaller player in the market, is showing promising signs with its earnings growing by 151% over the past year, outpacing the Hospitality industry's growth of 15%. The company's debt situation appears manageable as it holds more cash than total debt and has reduced its debt to equity ratio from 30% to just 1.5% over five years. Furthermore, Biglari's earnings quality is impacted by a one-off gain of US$39.8M recently. With a price-to-earnings ratio of 14x below the US market average and well-covered interest payments at 6.8x EBIT, it seems positioned for potential value appreciation.

- Click here to discover the nuances of Biglari Holdings with our detailed analytical health report.

Examine Biglari Holdings' past performance report to understand how it has performed in the past.

Yalla Group (NYSE:YALA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yalla Group Limited operates a social networking and gaming platform primarily in the Middle East and North Africa region, with a market cap of $664.07 million.

Operations: Yalla Group generates revenue primarily from its social networking and entertainment platform, which brought in $329.77 million. The company's financial performance is influenced by its cost structure, impacting the net profit margin.

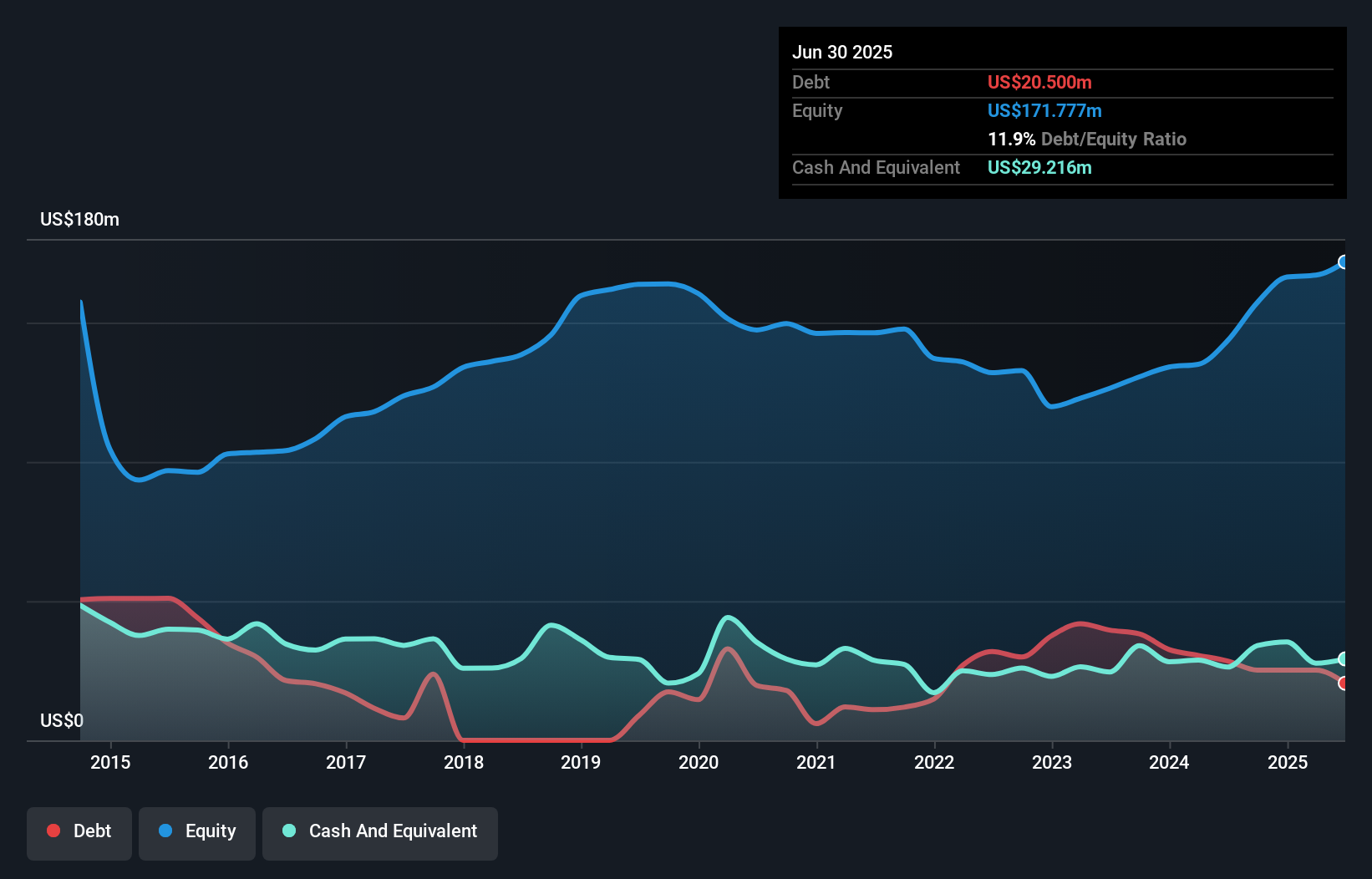

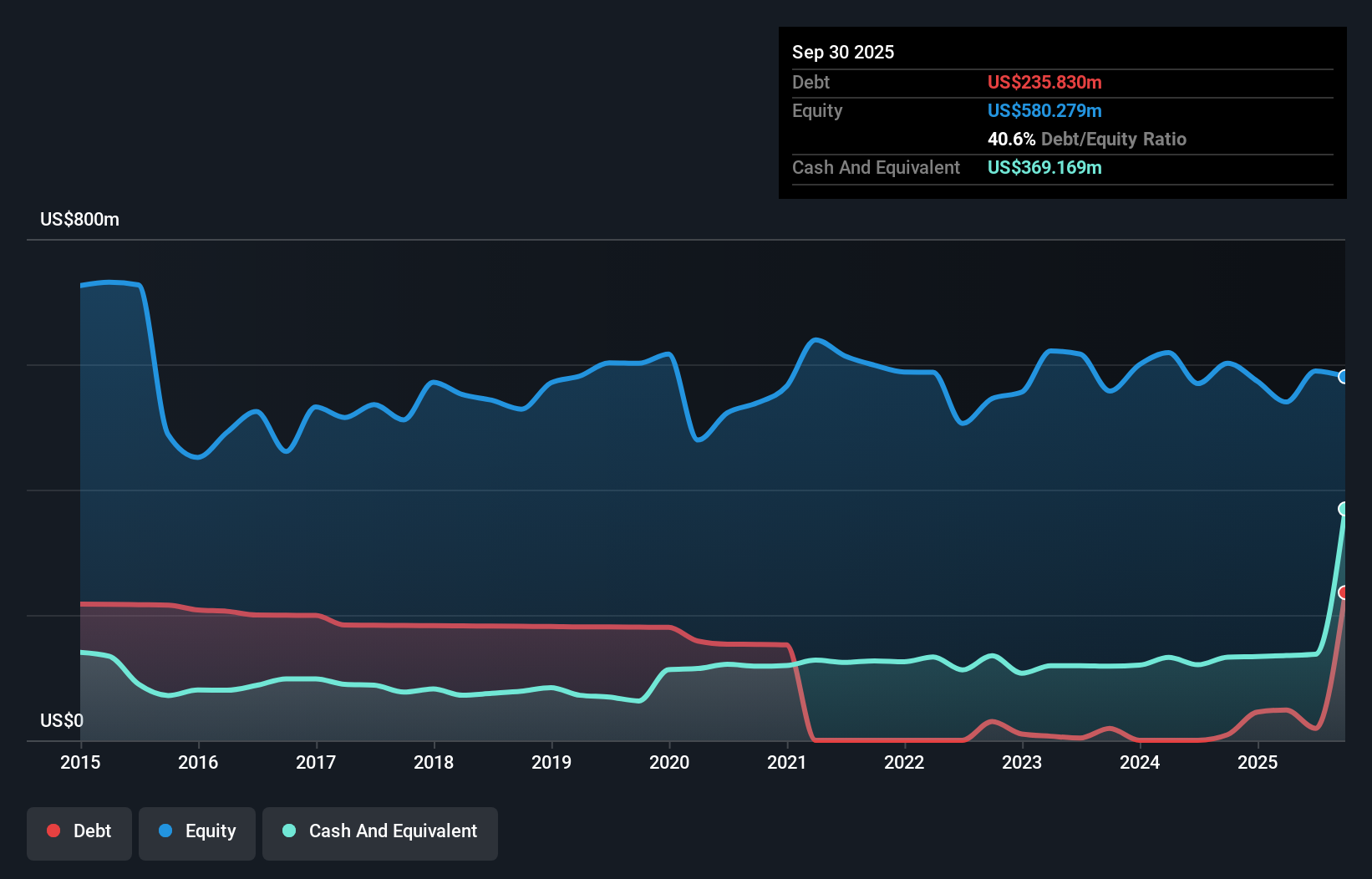

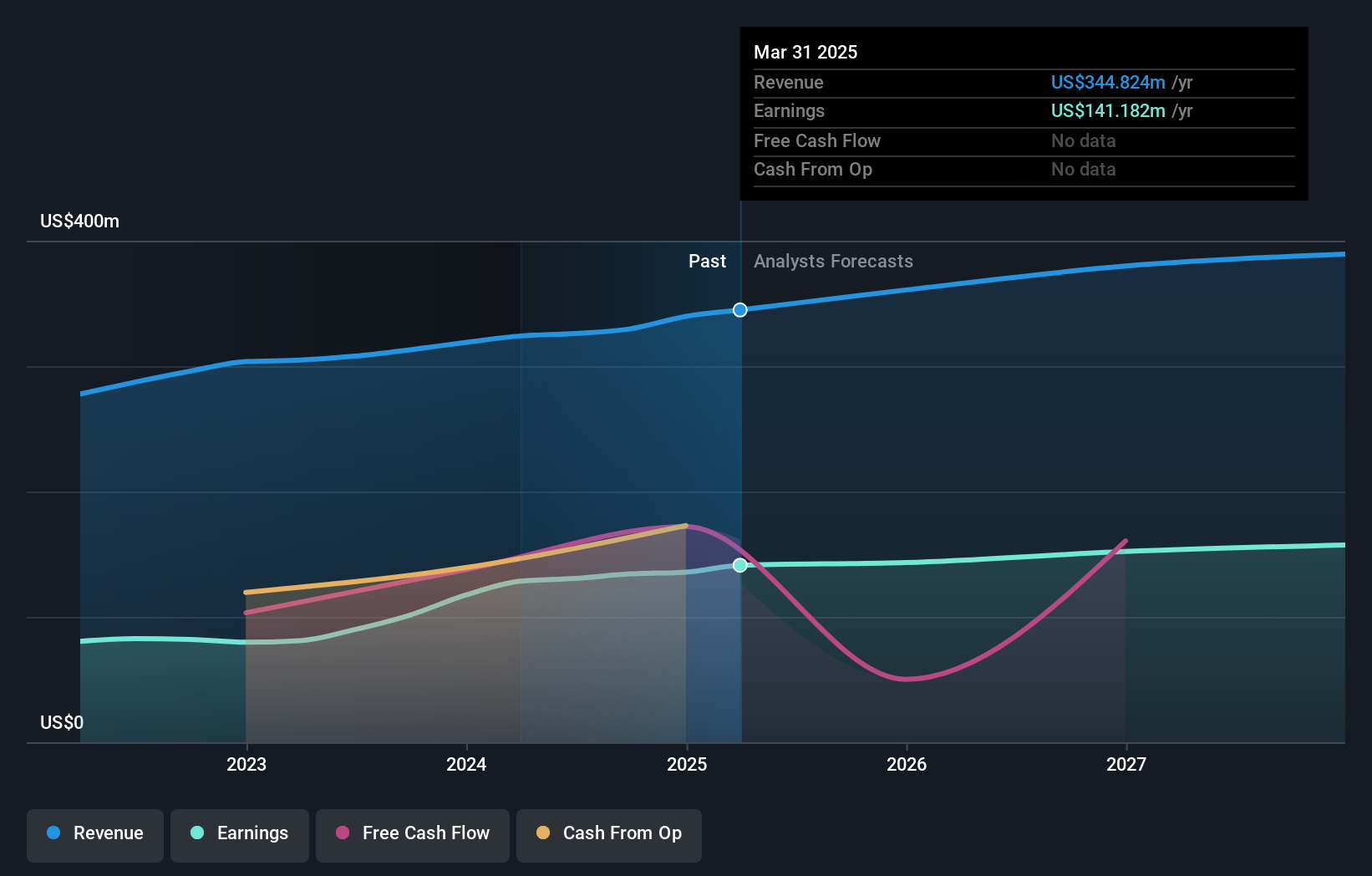

Yalla Group, a nimble player in the interactive media space, is debt-free and has shown robust earnings growth of 32.3% over the past year, outpacing its industry peers. Trading at 82.9% below estimated fair value suggests attractive valuation prospects. Recent earnings reports highlight a net income increase to US$39.85 million for Q3 2024 from US$36.23 million the previous year, with sales rising to US$88.92 million from US$85.19 million year-over-year for the same period. Despite these gains, rising costs and new tax laws in UAE could pressure profit margins as they expand into MENA's gaming sector, targeting revenue growth through localized game offerings while navigating potential market expansion risks beyond their core areas.

Turning Ideas Into Actions

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 278 more companies for you to explore.Click here to unveil our expertly curated list of 281 US Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YALA

Yalla Group

Operates a social networking and gaming platform in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives