- United States

- /

- Communications

- /

- NasdaqGS:CRNT

Ceragon Networks (NasdaqGS:CRNT) Reports Strong Q4 Earnings Despite 10% Price Dip

Reviewed by Simply Wall St

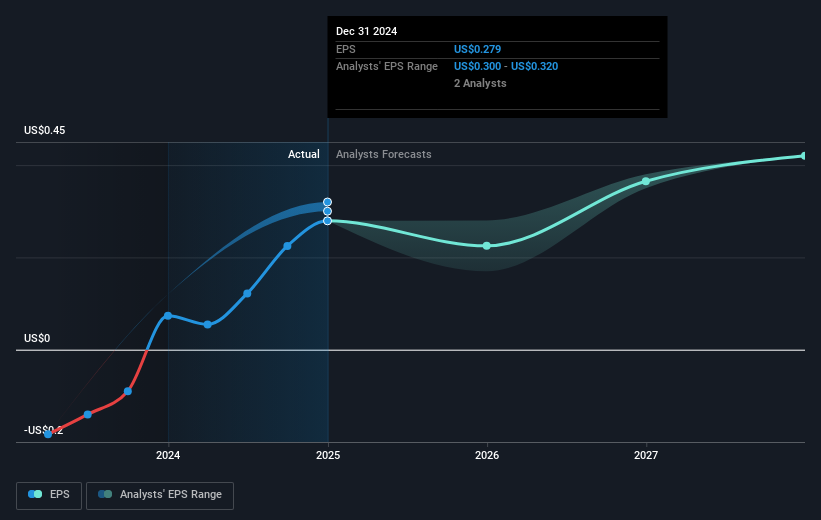

Ceragon Networks (NasdaqGS:CRNT) recently launched innovative new products at the Mobile World Congress, including the IP-100E and IP-50GP, showcasing cutting-edge networking solutions. Despite these advancements, the company saw a 10% decline in its share price over the last week. An important context here is the broader market environment, which was turbulent, with the NASDAQ experiencing a 3.6% decline. Ceragon reported solid earnings for Q4 2024, with significant improvements in sales and net income, suggesting optimism about its financial health amidst global and regional challenges. Nevertheless, investor caution may persist due to broader economic uncertainties, such as President Trump's tariff announcements, which have already created ripple effects across technology and semiconductor stocks like Nvidia and Broadcom. The mixed reactions in tech sectors, coupled with concentrated business dependencies and global 5G rollout challenges, could have influenced the share price trajectory for CRNT during this period.

Click to explore a detailed breakdown of our findings on Ceragon Networks.

The last five years have seen Ceragon Networks deliver a total shareholder return of 70.29%. Despite recent share price challenges, this performance highlights the company's ability to grow its earnings consistently, with a very large increase over the past year, significantly outpacing the broader Communications industry. Driving this growth were substantial revenue increases, bolstered by major product launches such as the IP-100E and IP-50GP, and a record-setting order from an ISP in 2024. This growth underscores the potential impact of its product innovation strategy on its financial health.

The company's recent earnings reports have shown strong revenue and profit growth, with fourth-quarter 2024 revenue reaching US$106.93 million. However, shareholder returns lagged both the US Communications industry, which saw a 34.1% return over the past year, and the US market's 16.7% return during the same period. Continued focus on product innovation and addressing market risks like the 5G rollout challenges will be crucial for maintaining and enhancing long-term performance.

- Learn how Ceragon Networks' intrinsic value compares to its market price with our detailed valuation report.

- Assess the downside scenarios for Ceragon Networks with our risk evaluation.

- Is Ceragon Networks part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNT

Ceragon Networks

Provides wireless transport solutions for cellular operators and other wireless service providers in North America, Europe, Africa, the Asia Pacific, the Middle East, India, and Latin America.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026