- United States

- /

- Auto Components

- /

- NYSE:QS

Ceragon Networks And 2 Other US Penny Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market experiences a mix of gains and losses, with indices like the Nasdaq and S&P 500 showing positive momentum, investors are keenly observing opportunities that arise from smaller-cap stocks. Penny stocks, often associated with smaller or newer companies, offer a unique blend of affordability and growth potential. In this article, we explore several penny stocks that stand out for their financial strength and potential to deliver significant returns amidst current market dynamics.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.827 | $5.56M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $143.12M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.56 | $133.43M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $90.58M | ★★★★☆☆ |

| Better Choice (NYSEAM:BTTR) | $1.63 | $3.19M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.22 | $526.12M | ★★★★★★ |

| Puma Biotechnology (NasdaqGS:PBYI) | $2.74 | $134.5M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.76 | $2.31B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8799 | $75.22M | ★★★★★☆ |

Click here to see the full list of 744 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ceragon Networks (NasdaqGS:CRNT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ceragon Networks Ltd. provides wireless transport solutions for cellular operators and other wireless service providers across various regions, with a market cap of $267.92 million.

Operations: Ceragon Networks Ltd. does not report specific revenue segments.

Market Cap: $267.92M

Ceragon Networks has shown significant financial improvement, becoming profitable this year with net income growing substantially. Recent earnings for the third quarter revealed sales of US$102.67 million and a net income of US$12.22 million, indicating robust growth compared to the previous year. The company maintains strong liquidity, with short-term assets exceeding both short- and long-term liabilities, while its debt is well-covered by operating cash flow. Despite an increased debt-to-equity ratio over five years, Ceragon's management and board are experienced, contributing to its stable weekly volatility and high-quality earnings profile.

- Get an in-depth perspective on Ceragon Networks' performance by reading our balance sheet health report here.

- Learn about Ceragon Networks' future growth trajectory here.

Dingdong (Cayman) (NYSE:DDL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market capitalization of $904.05 million.

Operations: The company's revenue is derived from its online retail operations, totaling CN¥22.15 billion.

Market Cap: $904.05M

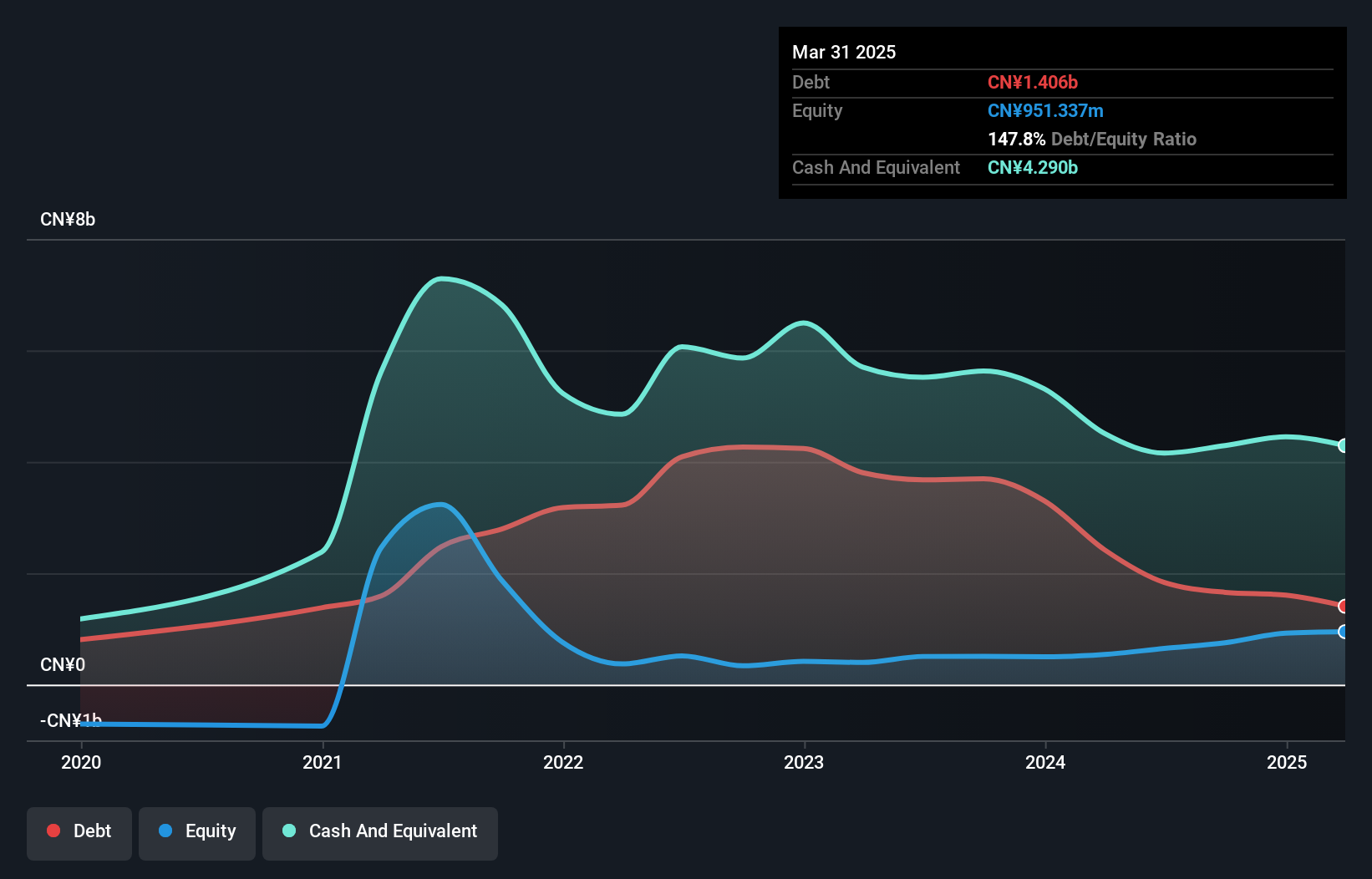

Dingdong (Cayman) Limited has shown a marked transition to profitability, reporting third-quarter revenue of CN¥6.54 billion and net income of CN¥133.41 million, a significant increase from the previous year. The company is raising financial guidance for 2024, anticipating GAAP profits for the fourth quarter and full year. With more cash than total debt and operating cash flow covering its debt well, Dingdong's financial health appears solid despite high share price volatility. The management team is experienced, with strategic changes aimed at enhancing operational efficiency and aligning resources with stakeholder interests.

- Navigate through the intricacies of Dingdong (Cayman) with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Dingdong (Cayman)'s future.

QuantumScape (NYSE:QS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: QuantumScape Corporation is a research and development stage company specializing in the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications, with a market cap of approximately $2.42 billion.

Operations: QuantumScape Corporation does not currently report any revenue segments, as it is focused on the research and development of solid-state lithium-metal batteries.

Market Cap: $2.42B

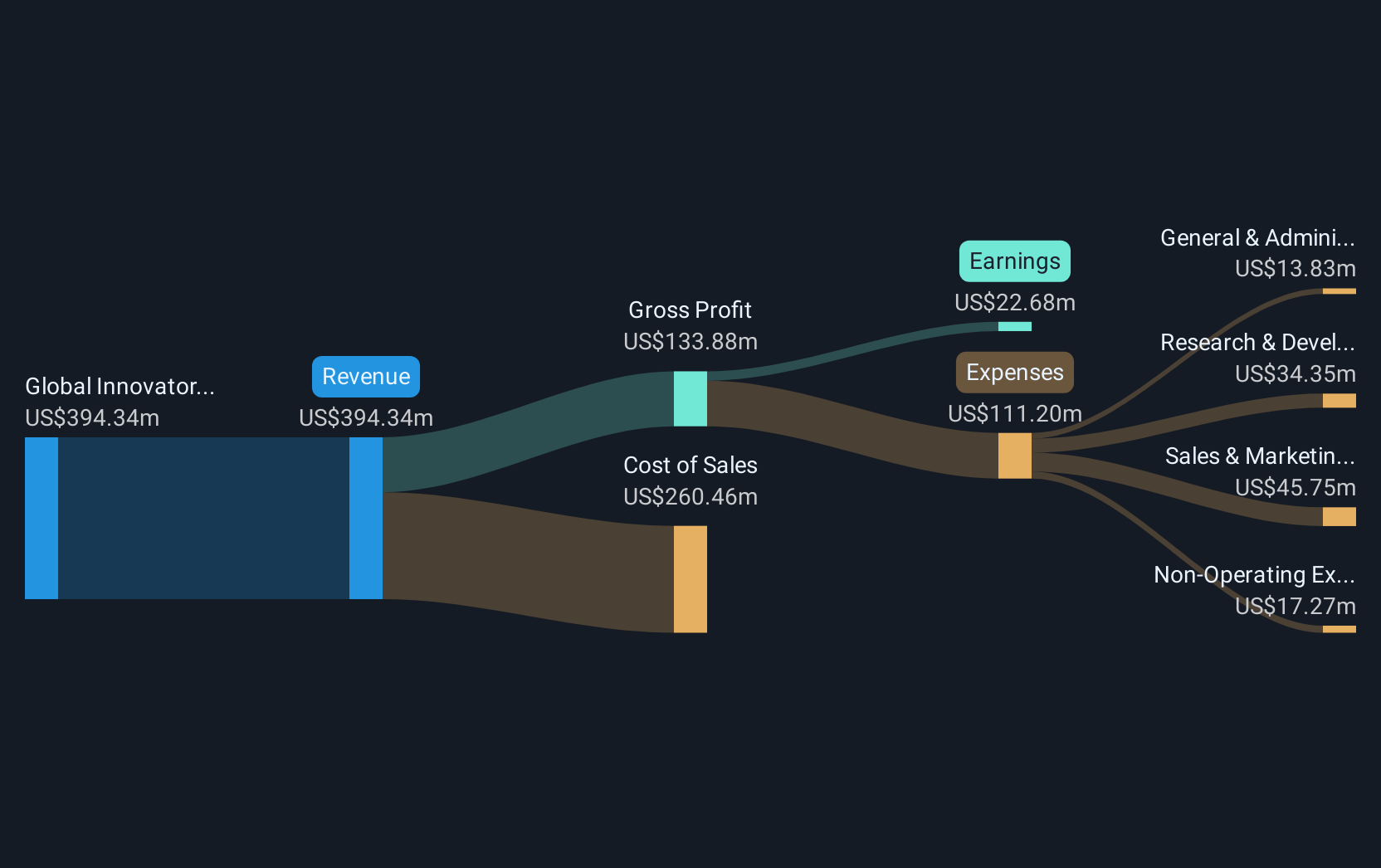

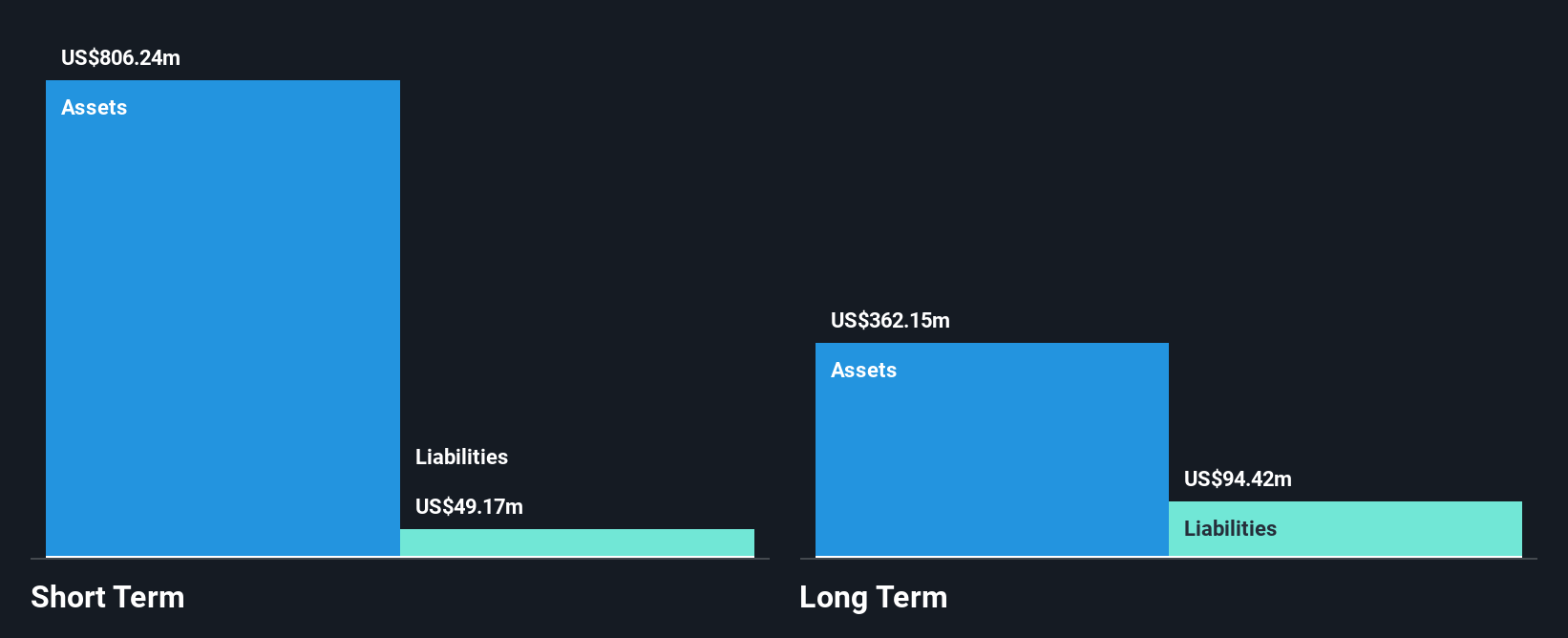

QuantumScape Corporation is a pre-revenue company focused on developing solid-state lithium-metal batteries, with short-term assets of US$853.7 million covering both its short- and long-term liabilities. Despite being debt-free, the company remains unprofitable with a negative return on equity of -42.91% and has seen shareholder dilution over the past year. Recent board changes include appointing Dennis Segers as Chairman, effective January 2025, following Jagdeep Singh's retirement. The company reported a net loss of US$119.57 million for Q3 2024, slightly higher than the previous year's loss but maintains sufficient cash runway for future operations.

- Dive into the specifics of QuantumScape here with our thorough balance sheet health report.

- Gain insights into QuantumScape's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Click through to start exploring the rest of the 741 US Penny Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QuantumScape might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QS

QuantumScape

Focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications in the United States.

Excellent balance sheet low.

Similar Companies

Market Insights

Community Narratives