- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:CPTN

After Leaping 28% Cepton, Inc. (NASDAQ:CPTN) Shares Are Not Flying Under The Radar

Cepton, Inc. (NASDAQ:CPTN) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

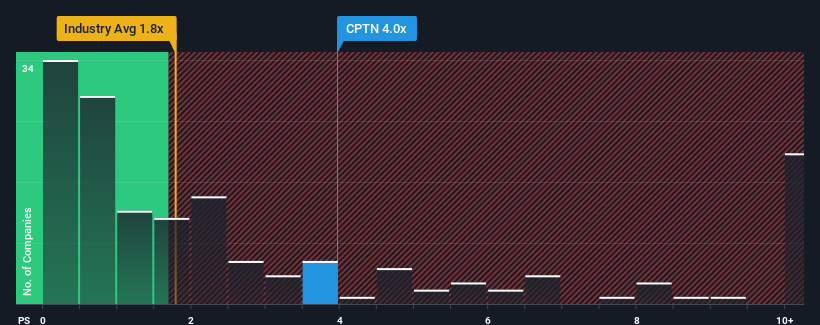

After such a large jump in price, you could be forgiven for thinking Cepton is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4x, considering almost half the companies in the United States' Electronic industry have P/S ratios below 1.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cepton

How Cepton Has Been Performing

Cepton certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cepton.How Is Cepton's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Cepton's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 76% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 159% per annum as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 9.1% per annum growth forecast for the broader industry.

With this in mind, it's not hard to understand why Cepton's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Cepton's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Cepton maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electronic industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Cepton you should be aware of.

If you're unsure about the strength of Cepton's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CPTN

Cepton

Provides lidar-based solutions for automotive, smart cities, smart spaces, and smart industrial applications in the United States, Japan, China, and internationally.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives