- United States

- /

- Communications

- /

- NasdaqGS:COMM

How Investors May Respond To CommScope Holding Company (COMM) Launching Its FAST Track Fiber Training Hub

Reviewed by Sasha Jovanovic

- CommScope recently opened its Fiber Architecture Solutions Technology (FAST) Track facility in Catawba, NC, a fully operational fiber-to-the-home network that functions as both a live testing environment and a training center for service providers.

- By giving customers hands-on access to real-world fiber architectures and CommScope experts, FAST Track aims to turn complex broadband technology into practical deployment know-how that could deepen customer relationships and support product adoption.

- Next, we’ll examine how this new real-world fiber training and innovation hub might influence CommScope’s existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

CommScope Holding Company Investment Narrative Recap

To own CommScope, you need to believe that a smaller, focused company can still convert broadband and enterprise network upgrades into durable earnings, despite higher cyclicality after the CCS sale. The FAST Track fiber facility is directionally positive for strengthening ANS customer ties, but it does not materially change the near term dependence on large cable operator spending and the timing of DOCSIS related projects, which remain the key catalyst and risk.

This FAST Track opening sits alongside recent RUCKUS launches such as the Wi Fi 7 and AI powered MDU Suite, which speak to CommScope’s effort to align with customers modernizing broadband and wireless networks. Together, these initiatives could influence how investors weigh the near term project driven volatility of ANS against the potential for higher margin, software enriched revenue in RUCKUS over time.

Yet, behind the promise of faster broadband and smarter Wi Fi, investors should also be aware of...

Read the full narrative on CommScope Holding Company (it's free!)

CommScope Holding Company's narrative projects $6.7 billion revenue and $139.1 million earnings by 2028. This requires 12.3% yearly revenue growth and about a $48.8 million earnings increase from $90.3 million today.

Uncover how CommScope Holding Company's forecasts yield a $22.67 fair value, a 18% upside to its current price.

Exploring Other Perspectives

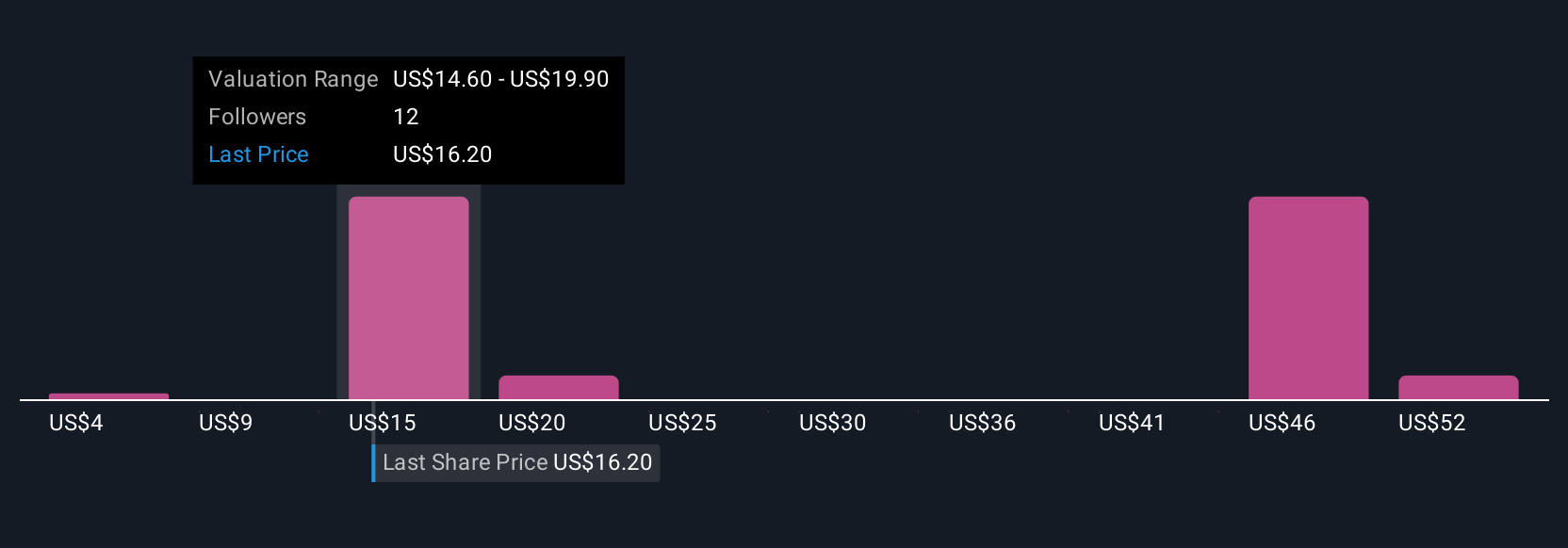

Six fair value estimates from the Simply Wall St Community span roughly US$13.90 to US$53.30 per share, reflecting very different expectations. Against this wide range, the reliance on a few major cable operators and uncertain DOCSIS 4.0 upgrade timing may meaningfully shape how you think about CommScope’s future performance and invites you to compare several perspectives before forming your own view.

Explore 6 other fair value estimates on CommScope Holding Company - why the stock might be worth 27% less than the current price!

Build Your Own CommScope Holding Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CommScope Holding Company research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CommScope Holding Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CommScope Holding Company's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026