- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CNXN

A Closer Look at Connection’s (CNXN) Valuation Following Fifth Consecutive Quarter of Net Sales Growth

Reviewed by Kshitija Bhandaru

PC Connection (CNXN) just delivered its fifth straight quarter of year-over-year net sales growth, supported by strong customer spending on data center refreshes and upgrades related to the Windows 11 rollout. This trend is drawing attention, especially as other sector players report mixed results.

See our latest analysis for PC Connection.

PC Connection’s upbeat sales streak sets it apart from peers, but the market reaction has been cautious. The current share price sits at $60.71 with a 1-day share price return of 1.74%. However, cautious sentiment has weighed on performance, resulting in an 11.72% year-to-date share price decline and a one-year total shareholder return loss of 17.32%. For long-term holders, the story is more positive, as shown by a 3-year total shareholder return of 37.03% and a 5-year total shareholder return of 41.83%. This suggests underlying resilience and potential if the recent business momentum continues.

If you’re curious which other tech stocks are benefitting from digital transformation trends, now is the perfect time to widen your search and discover See the full list for free.

But with shares still below analyst targets and healthy top and bottom line growth, does the current valuation represent a missed opportunity? Or is the market already anticipating further gains from PC Connection’s accelerating business?

Most Popular Narrative: 20.1% Undervalued

According to the widely followed investment narrative, PC Connection’s fair value stands noticeably higher than its latest closing price of $60.71. This gap between current price and fair value has investors eyeing the underlying growth drivers closely.

Ongoing shift in customer demand from commodity hardware toward integrated IT solutions and managed services, alongside PC Connection's investment in technical capabilities, enhances customer retention and supports a transition to higher-margin, recurring revenue streams. This is likely to improve net margins over time.

Want to know the secret sauce behind this bullish valuation? Analysts are making bold assumptions about a profit margin turnaround and higher recurring sales, but there is more beneath the surface. Curious which future growth levers push this fair value up? Dive in and see the specific forecasts driving these high expectations.

Result: Fair Value of $76.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as declining gross margins or continued dependence on hardware sales could disrupt PC Connection’s growth path and challenge the bullish outlook.

Find out about the key risks to this PC Connection narrative.

Another View: What Do the Earnings Ratios Suggest?

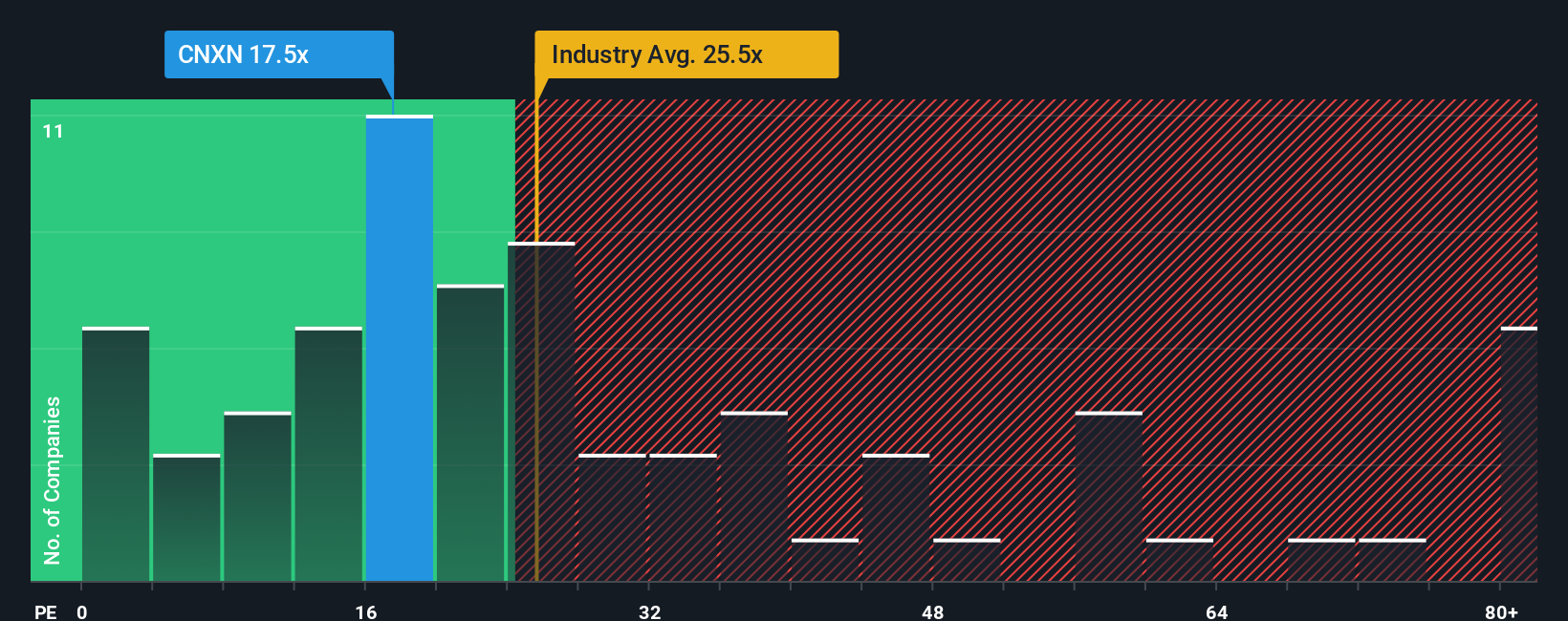

Looking through the lens of earnings-based valuation, PC Connection trades at a ratio of 17.9, nearly identical to the average of its closest peers at 17.8. However, this is well below the broader US Electronic industry average of 25 and also lower than the fair ratio of 22.5. While this could suggest there is some cushion for upside as the market’s perception changes, it also indicates that sentiment may be cautious for a reason. Does this pricing signal an opportunity or a warning for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PC Connection Narrative

If you see things differently or want to dig into the details on your own, you can easily craft your own story and analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding PC Connection.

Looking for More Investment Ideas? Don’t Miss Out

If you want to get ahead, now is the time to broaden your portfolio with untapped market opportunities and forward-thinking stocks picked by data-driven criteria.

- Unlock new income streams and steady payouts by targeting these 19 dividend stocks with yields > 3% with yields above 3% for income-focused portfolios.

- Catalyze your growth strategy by tapping into these 26 AI penny stocks powering breakthroughs in machine learning, automation, and digital enterprise solutions.

- Catch tomorrow’s tech trailblazers early by hunting for value among these 3572 penny stocks with strong financials that combine financial strength and rapid market potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CNXN

PC Connection

Provides various information technology (IT) solutions worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives