- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

US Market's Undiscovered Gems And 2 Other Promising Stocks To Explore

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.9% and over the past 12 months, it is up by 14%, with earnings forecasted to grow by 15% annually. In this vibrant environment, identifying stocks that are not only stable but also have potential for growth can be key to uncovering undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

We'll examine a selection from our screener results.

American Coastal Insurance (ACIC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Coastal Insurance Corporation operates in the United States, focusing on commercial and personal property and casualty insurance, with a market cap of $516.90 million.

Operations: ACIC generates revenue primarily from its commercial lines business, which contributes $302.26 million. The company's net profit margin reflects its profitability dynamics in the competitive insurance sector.

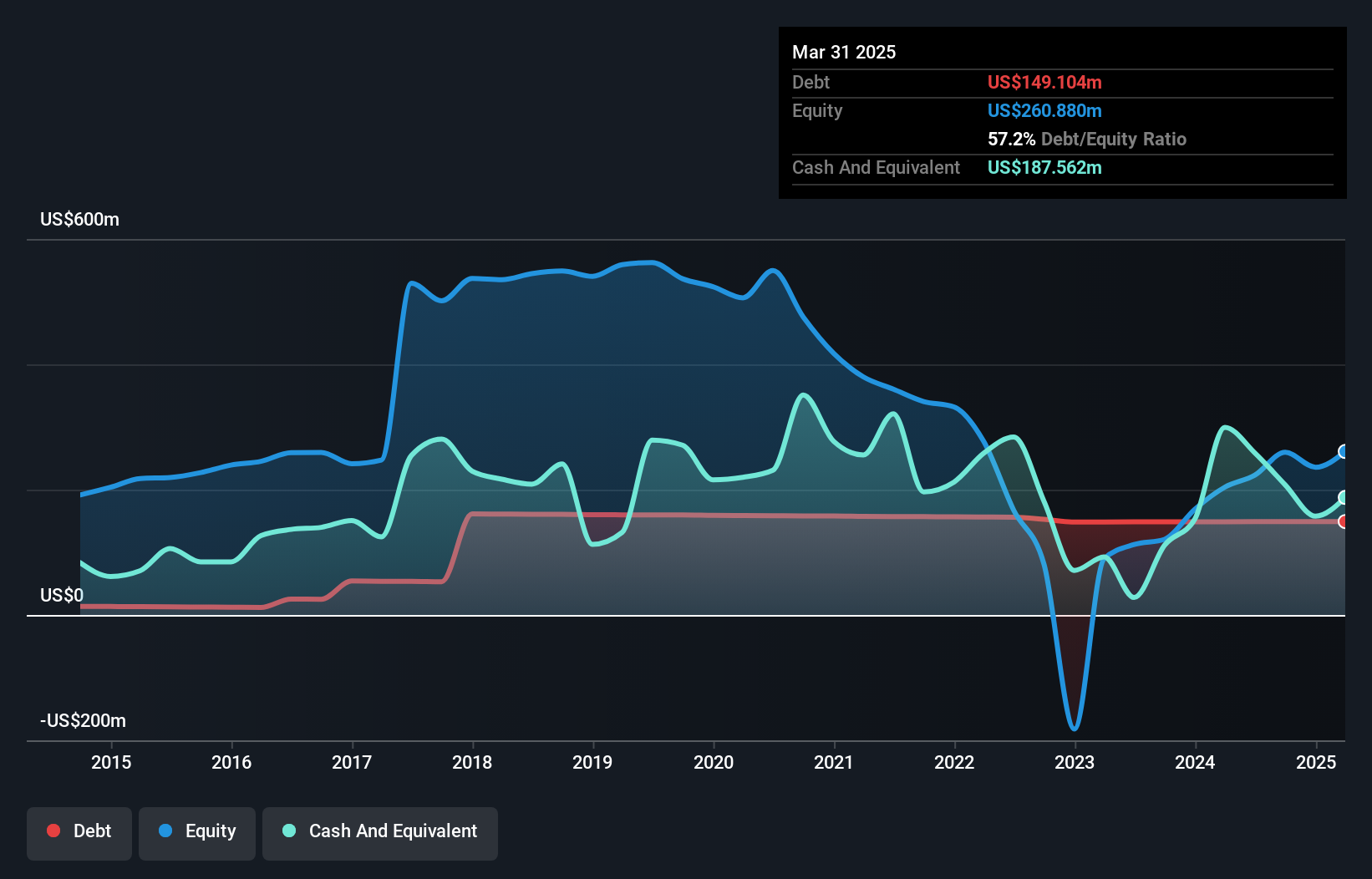

American Coastal Insurance, a smaller player in the insurance sector, has been gaining traction with its strategic moves like the launch of an apartment program and catastrophe bonds. The firm is trading at 74% below its estimated fair value, indicating potential for investors. Despite a rise in debt-to-equity ratio from 31.3% to 57.2% over five years, interest payments are well covered by EBIT at 8.9x coverage. However, recent insider selling and negative earnings growth of -6.5% compared to the industry average of 7%, alongside reliance on Florida's market regulations and natural disaster exposure present significant risks to consider.

National Energy Services Reunited (NESR)

Simply Wall St Value Rating: ★★★★★★

Overview: National Energy Services Reunited Corp. offers oilfield services in the Middle East and North Africa region, with a market capitalization of $569.07 million.

Operations: NESR generates revenue primarily from its Production Services and Drilling and Evaluation Services, with the former contributing $871.66 million and the latter $436.30 million. The company has a market capitalization of approximately $569.07 million.

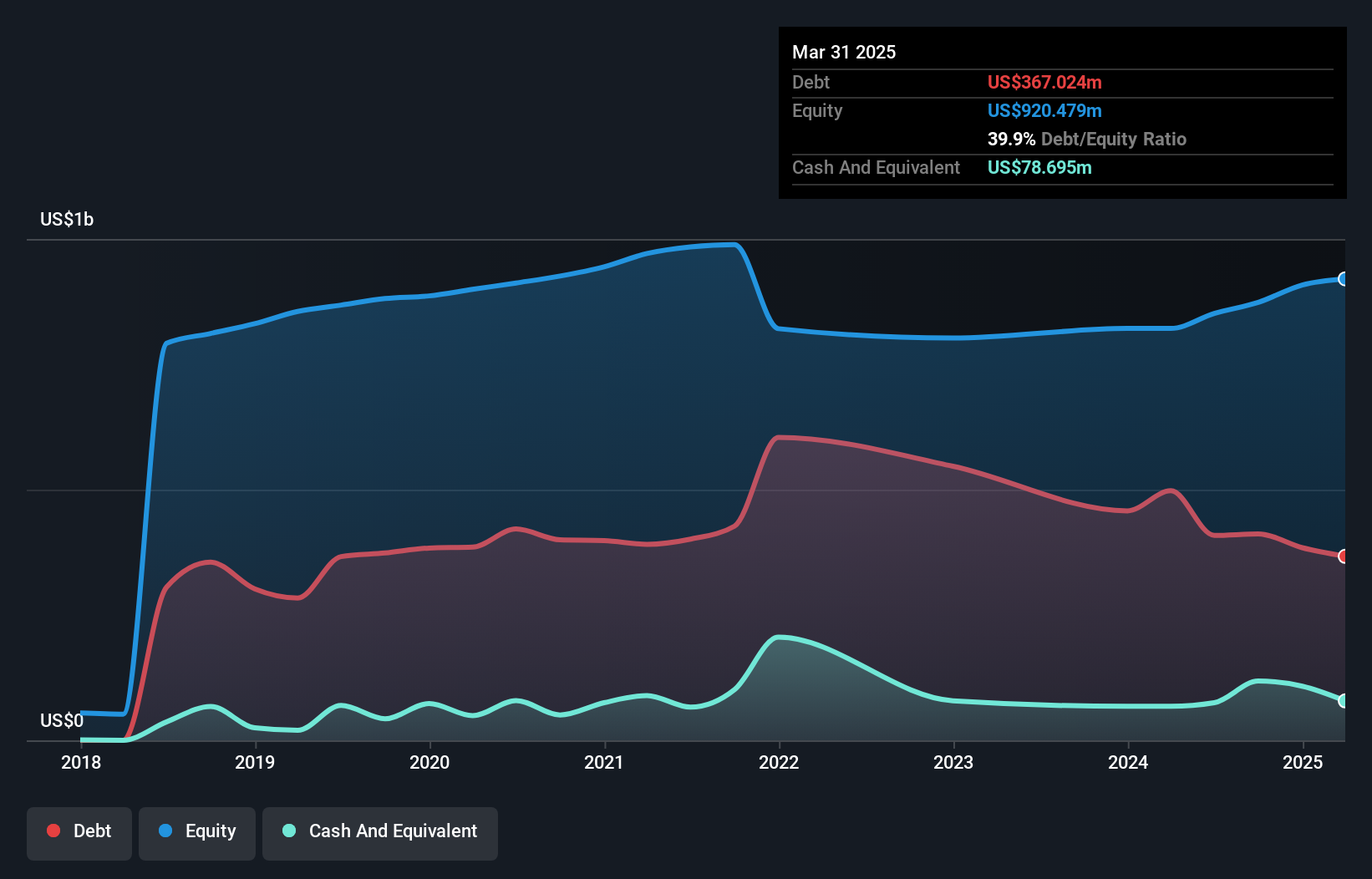

National Energy Services Reunited (NESR) is carving out a strong position within the energy sector, with its strategic expansion into Middle Eastern markets like Saudi Arabia and the UAE. The company's debt management appears robust, with a net debt to equity ratio of 31.3%, reflecting satisfactory financial health. NESR's earnings have surged by 209.8% over the past year, significantly outpacing industry growth of 9.6%. With levered free cash flow reaching US$137 million recently and interest payments well-covered at 3.6 times by EBIT, NESR seems poised for continued profitability despite potential geopolitical risks in its operating regions.

Climb Global Solutions (CLMB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Climb Global Solutions, Inc. is a value-added IT distribution and solutions company operating in the United States, Canada, Europe, and the United Kingdom with a market cap of $467.45 million.

Operations: Climb Global Solutions generates revenue primarily from its Distribution segment, which accounts for $487.28 million, while the Solutions segment contributes $23.95 million.

Climb Global Solutions, a rising player in the tech sector, is making waves with its impressive 67.2% earnings growth over the past year, outpacing the broader electronic industry. Despite a slight increase in debt-to-equity ratio to 0.6%, it maintains more cash than total debt, ensuring financial stability. The company's strategic focus on M&A and vendor relationships aims to enhance market presence while a new ERP system could boost efficiency and profitability. However, significant insider selling recently raises questions about potential internal concerns. Notably, Climb was added to the Russell 2000 Dynamic Index in June 2025, reflecting growing recognition of its market potential.

Next Steps

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 278 more companies for you to explore.Click here to unveil our expertly curated list of 281 US Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives