- United States

- /

- Communications

- /

- NasdaqGM:CLFD

Shareholders Will Probably Not Have Any Issues With Clearfield, Inc.'s (NASDAQ:CLFD) CEO Compensation

Key Insights

- Clearfield's Annual General Meeting to take place on 22nd of February

- Salary of US$425.0k is part of CEO Cheri Beranek's total remuneration

- The overall pay is 33% below the industry average

- Clearfield's three-year loss to shareholders was 10% while its EPS grew by 6.1% over the past three years

Shareholders may be wondering what CEO Cheri Beranek plans to do to improve the less than great performance at Clearfield, Inc. (NASDAQ:CLFD) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 22nd of February. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Clearfield

How Does Total Compensation For Cheri Beranek Compare With Other Companies In The Industry?

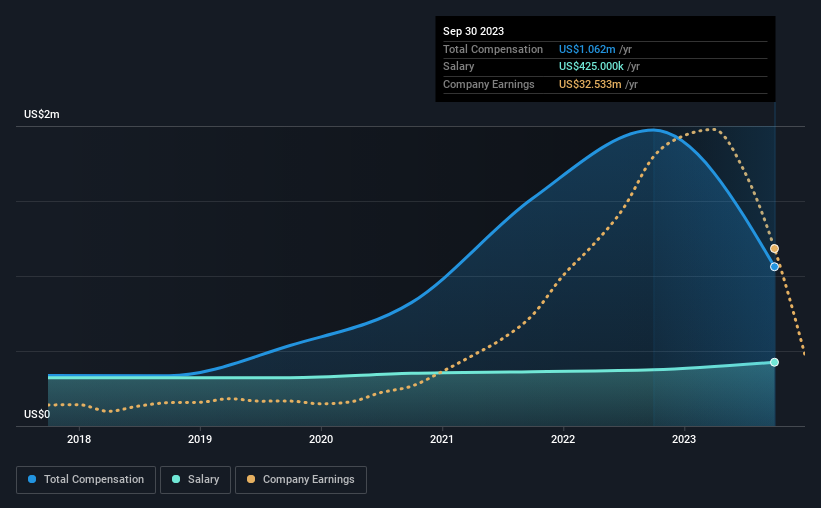

Our data indicates that Clearfield, Inc. has a market capitalization of US$454m, and total annual CEO compensation was reported as US$1.1m for the year to September 2023. We note that's a decrease of 46% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$425k.

On examining similar-sized companies in the American Communications industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.6m. Accordingly, Clearfield pays its CEO under the industry median. Moreover, Cheri Beranek also holds US$14m worth of Clearfield stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Speaking on an industry level, nearly 18% of total compensation represents salary, while the remainder of 82% is other remuneration. Clearfield is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Clearfield, Inc.'s Growth Numbers

Clearfield, Inc.'s earnings per share (EPS) grew 6.1% per year over the last three years. In the last year, its revenue is down 29%.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Clearfield, Inc. Been A Good Investment?

With a three year total loss of 10% for the shareholders, Clearfield, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

It may not be surprising to some that the recent weak performance in the share price may be driven in part by rather flat EPS growth. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board and assess if the board's plan is likely to improve company performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Clearfield (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CLFD

Clearfield

Designs, manufactures, and distributes fiber management, protection, and delivery products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Inotiv NAMs Test Center

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.