- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Should Cognex’s (CGNX) Analyst Upgrade and Earnings Outlook Prompt a Fresh Look from Investors?

Reviewed by Sasha Jovanovic

- In late September 2025, Cognex Corporation was upgraded to a Zacks Rank #2 (Buy) following a steady increase in analysts’ earnings estimates over the past three months.

- This upgrade highlights renewed confidence in Cognex’s underlying business and improved earnings outlook, signaling increased interest from market participants.

- To understand how analyst optimism and revised earnings forecasts may influence Cognex’s long-term outlook, we will assess the impact on its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Cognex Investment Narrative Recap

Cognex stock appeals to those who see value in long-term growth driven by industrial automation, AI-powered vision technologies, and expanding end-market demand. The recent upgrade to a Zacks Rank #2 (Buy) underscores near-term momentum, thanks to raised earnings estimates, but the persistent risk remains: sustaining gross margin strength in the face of hardware commoditization and tightening competition, especially in price-sensitive regions, has not materially changed and is still the biggest concern for the business right now.

Among recent announcements, Cognex’s July 2025 quarterly results reflected both rising sales and earnings, validating analyst optimism behind the improved short-term outlook and suggesting operational progress despite sector headwinds. This earnings growth is being closely watched as a primary catalyst supporting analyst upgrades and influencing investor sentiment heading into upcoming quarters.

However, while earnings momentum is encouraging, keep in mind that any shift in competitive pricing power, particularly in key Asian markets, is something every investor should be aware of...

Read the full narrative on Cognex (it's free!)

Cognex's outlook anticipates $1.2 billion in revenue and $241.2 million in earnings by 2028. This is based on an annual revenue growth rate of 10.2% and represents a $119.1 million earnings increase from current earnings of $122.1 million.

Uncover how Cognex's forecasts yield a $47.21 fair value, in line with its current price.

Exploring Other Perspectives

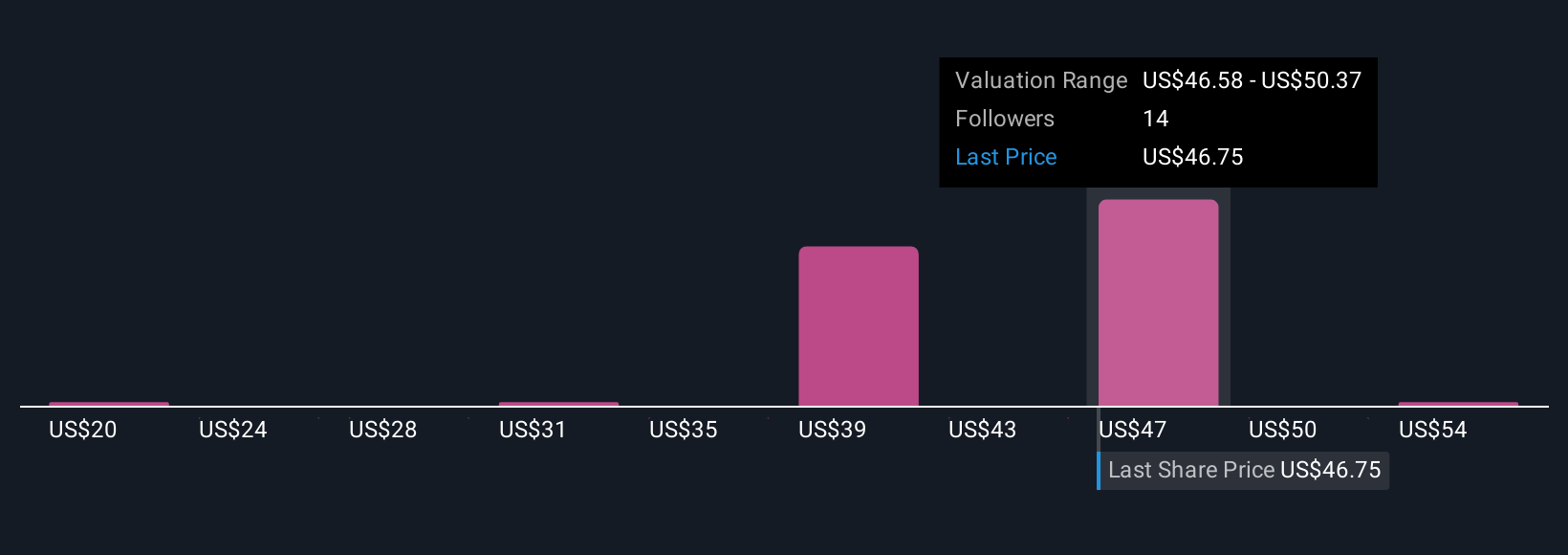

Five fair value estimates from the Simply Wall St Community cluster between US$20 and US$57.97, with both cautious and bullish projections represented. Amidst this wide spectrum, many are watching whether Cognex’s gains in AI-driven vision solutions will be enough to offset threats to its premium pricing and margin stability.

Explore 5 other fair value estimates on Cognex - why the stock might be worth as much as 25% more than the current price!

Build Your Own Cognex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognex research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cognex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognex's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives