- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

Shareholders Will Likely Find Cognex Corporation's (NASDAQ:CGNX) CEO Compensation Acceptable

The performance at Cognex Corporation (NASDAQ:CGNX) has been rather lacklustre of late and shareholders may be wondering what CEO Rob Willett is planning to do about this. At the next AGM coming up on 05 May 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Cognex

How Does Total Compensation For Rob Willett Compare With Other Companies In The Industry?

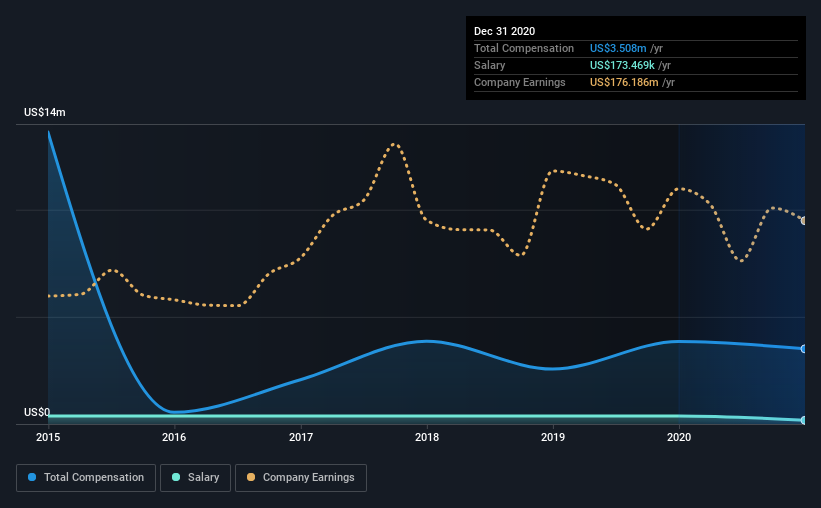

At the time of writing, our data shows that Cognex Corporation has a market capitalization of US$16b, and reported total annual CEO compensation of US$3.5m for the year to December 2020. That's a notable decrease of 8.9% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$173k.

On comparing similar companies in the industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$11m. Accordingly, Cognex pays its CEO under the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$173k | US$376k | 5% |

| Other | US$3.3m | US$3.5m | 95% |

| Total Compensation | US$3.5m | US$3.8m | 100% |

On an industry level, roughly 29% of total compensation represents salary and 71% is other remuneration. A high-salary is usually a no-brainer when it comes to attracting the best executives, but Cognex paid Rob Willett a nominal salary to the CEO over the past 12 months, instead focusing on non-salary compensation. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Cognex Corporation's Growth Numbers

Earnings per share at Cognex Corporation are much the same as they were three years ago, albeit slightly lower. It achieved revenue growth of 12% over the last year.

The lack of EPS growth is certainly uninspiring. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Cognex Corporation Been A Good Investment?

Boasting a total shareholder return of 103% over three years, Cognex Corporation has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Cognex prefers rewarding its CEO through non-salary benefits. While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us wonder if these strong returns can continue. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Cognex that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Cognex, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives