- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

New Leadership at CDW (CDW): Mukesh Kumar Joins as Chief Services and Solutions Officer

Reviewed by Simply Wall St

CDW (CDW) recently announced that Mukesh Kumar will join as Chief Services and Solutions Officer, potentially reinforcing its market position. Over the last quarter, the company experienced a 5% price increase. During this period, key developments included CDW's new partnerships with Asato Corporation for AI-powered solutions and with Smartsheet for work management platforms, which could bolster its tech capabilities. Furthermore, CDW's addition to the Russell 1000 Dynamic Index likely increased its market visibility. Despite broader market volatility, such developments possibly anchored CDW's positive quarterly performance.

You should learn about the 1 weakness we've spotted with CDW.

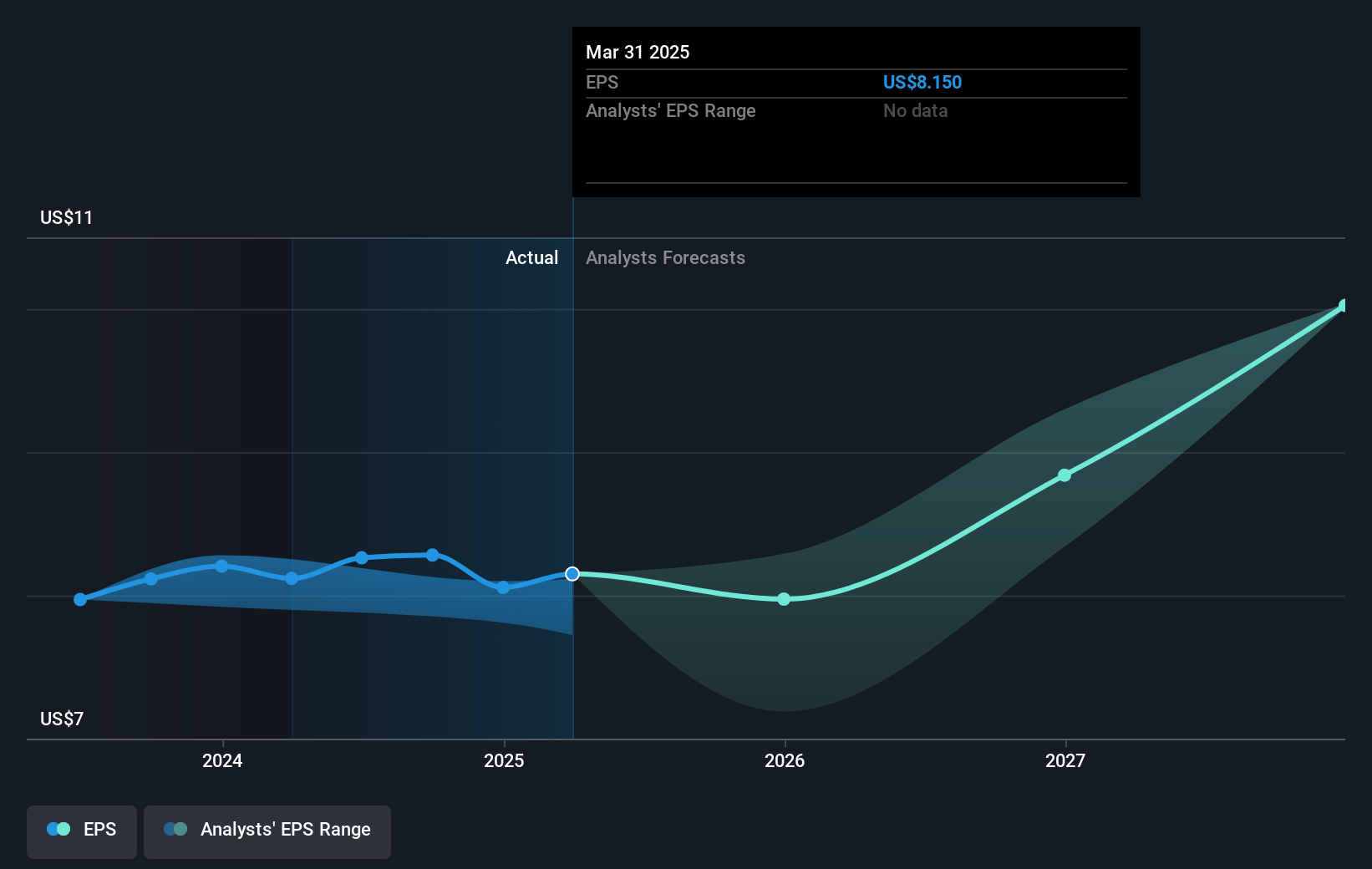

The recent appointment of Mukesh Kumar as the new Chief Services and Solutions Officer at CDW and the company's strategic partnerships could solidify its market presence. This development aligns with CDW's focus on expanding its capabilities in cloud, cybersecurity, and AI, areas poised for growth. Despite recent favorable share price movements, the broader economic uncertainties such as tariffs and government spending changes still present risks to revenue and earnings forecasts. In addition, the strategic acquisitions and share repurchase initiatives highlight a concentrated effort to elevate earnings per share and reduce the number of shares outstanding, aligning with the anticipated growth trajectory.

Over the longer term, CDW's total shareholder return, including dividends, amounted to 61% over the past five years. However, in the last year, CDW underperformed relative to the US market, which returned 15.7%, and the US Electronic industry, which increased by 30.5%. With a current share price of US$174.38 and an analyst price target of US$213.0, there's a perceived upside potential of approximately 21%. The company's growth vector in high-margin sectors like healthcare, coupled with investments in cloud and AI solutions, may bolster future revenue streams, although competition and economic factors could influence the realization of these forecasts.

Take a closer look at CDW's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives