- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CDW

CDW (NasdaqGS:CDW) Reports Q1 Earnings Growth; Declares US$0.63 Quarterly Dividend

Reviewed by Simply Wall St

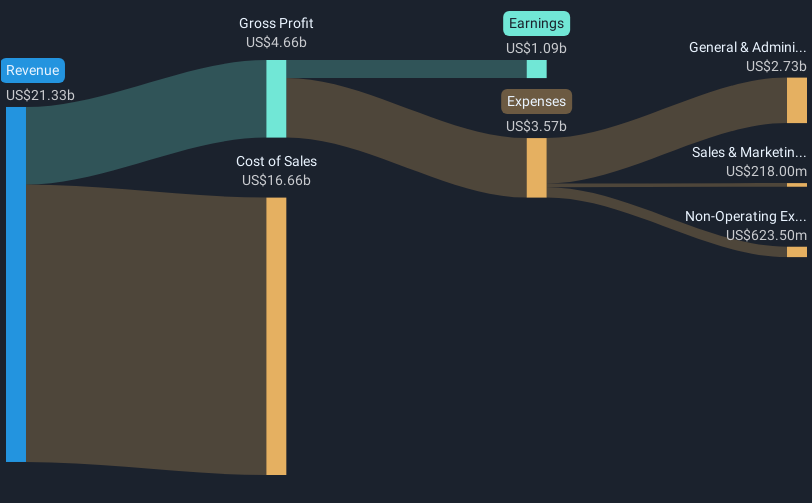

CDW (NasdaqGS:CDW) experienced a 13% increase in its share price over the last month, possibly influenced by its robust first-quarter earnings report. The company reported a rise in sales to USD 5,199 million and net income to USD 225 million. Additionally, the quarterly dividend announcement of USD 0.625 per share might have further bolstered investor confidence. This upward movement occurred amidst a mixed market backdrop, where the Nasdaq Composite saw slight declines, influenced by investor anticipation of Federal Reserve decisions and ongoing trade discussions between the U.S. and China. CDW's performance appears aligned with wider corporate earnings' trends, with optimistic earnings outlooks supporting its price trajectory.

We've discovered 1 weakness for CDW that you should be aware of before investing here.

The recent surge in CDW's share price, alongside its robust first-quarter earnings and dividend announcement, could positively influence its strategic initiatives. The company's focus on cloud, AI, and healthcare solutions is poised to augment future customer offerings and revenue streams. Despite macroeconomic challenges, CDW's investments may elevate earnings outlooks, enhancing investor sentiment and potentially driving further share price appreciation.

Over five years, CDW's total shareholder return, including dividends, reached 70.38%, suggesting solid long-term growth for investors. However, in the past year, CDW underperformed both the US market and the Electronic industry, which recorded returns of 8.2% and 7.1%, respectively.

Looking forward, the impact of CDW's developments on revenue and earnings forecasts could be significant, as analysts expect revenue growth driven by increases in profit margins and strategic investments. Nonetheless, market headwinds remain a concern. With CDW's current share price at US$159.96, the analyst consensus price target of US$207.43 suggests a potential upside. This points to possible market confidence in CDW's strategic direction and growth prospects moving into 2028.

Jump into the full analysis health report here for a deeper understanding of CDW.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDW

CDW

Provides information technology (IT) solutions in the United States, the United Kingdom, and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives