- United States

- /

- Tech Hardware

- /

- NasdaqCM:BOXL

Investors Holding Back On Boxlight Corporation (NASDAQ:BOXL)

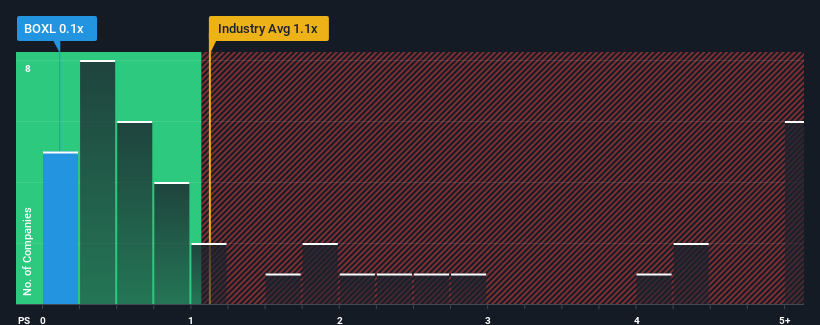

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Boxlight Corporation (NASDAQ:BOXL) is a stock worth checking out, seeing as almost half of all the Tech companies in the United States have P/S ratios greater than 1.1x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Boxlight

What Does Boxlight's P/S Mean For Shareholders?

Recent times haven't been great for Boxlight as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Boxlight.How Is Boxlight's Revenue Growth Trending?

In order to justify its P/S ratio, Boxlight would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.2%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Turning to the outlook, the next year should generate growth of 6.1% as estimated by the three analysts watching the company. With the industry predicted to deliver 4.6% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Boxlight's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Boxlight's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It looks to us like the P/S figures for Boxlight remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Boxlight you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Boxlight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BOXL

Boxlight

Designs, produces, and distributes interactive technology solutions for the education, health, corporate, military, and government sectors in the Americas, Europe, the Middle East, Africa, and internationally.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives