- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:BELF.A

Do Bel Fuse's (NASDAQ:BELF.A) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Bel Fuse (NASDAQ:BELF.A). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Bel Fuse

Bel Fuse's Improving Profits

In the last three years Bel Fuse's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, Bel Fuse's EPS soared from US$3.73 to US$5.93, over the last year. That's a commendable gain of 59%.

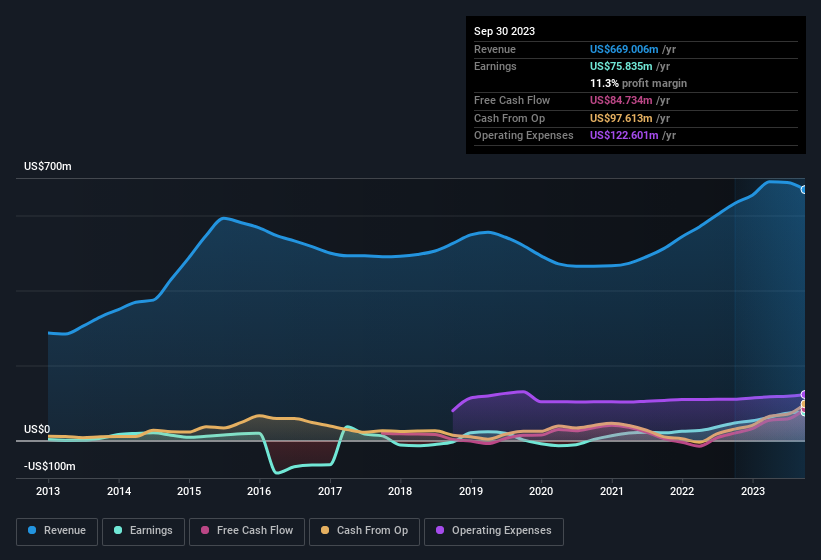

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Bel Fuse shareholders is that EBIT margins have grown from 9.5% to 14% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Bel Fuse's future EPS 100% free.

Are Bel Fuse Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's pleasing to note that insiders spent US$1.8m buying Bel Fuse shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the company insider, Christopher Bennett, who made the biggest single acquisition, paying US$1.0m for shares at about US$31.95 each.

On top of the insider buying, it's good to see that Bel Fuse insiders have a valuable investment in the business. Indeed, they hold US$41m worth of its stock. This considerable investment should help drive long-term value in the business. Those holdings account for over 6.3% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Bel Fuse's CEO, Daniel Bernstein, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between US$400m and US$1.6b, like Bel Fuse, the median CEO pay is around US$3.7m.

The CEO of Bel Fuse only received US$825k in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Bel Fuse To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Bel Fuse's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 1 warning sign for Bel Fuse that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Bel Fuse, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bel Fuse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BELF.A

Bel Fuse

Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion