- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:AVT

Assessing Avnet (AVT) Valuation After Earnings Beat and Upgraded Guidance

Reviewed by Simply Wall St

Avnet (AVT) just delivered quarterly results that beat revenue expectations and came with guidance above estimates, yet the stock slipped, creating an interesting setup for investors watching both fundamentals and sentiment.

See our latest analysis for Avnet.

Over the past few months, Avnet’s share price has swung from post earnings disappointment to a recent 7 day share price return of 4.4 percent. Its 5 year total shareholder return of 75.45 percent shows that, despite the latest 1 year total shareholder return of negative 8.33 percent and a 90 day share price return of negative 7.9 percent, the long term momentum has still been positive.

If Avnet’s mix of resilient earnings and shifting sentiment has your attention, this could be a good moment to explore high growth tech and AI stocks as potential next wave beneficiaries.

With earnings surprising to the upside, guidance nudging higher and the share price still lagging its five year performance, is Avnet quietly undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 7% Undervalued

With Avnet last closing at $49.31 against a narrative fair value of $53, the valuation case leans positive and rests on several specific growth levers.

With improving book-to-bill ratios, a stabilizing inventory environment, and a strong commitment to operational efficiency (cost control and optimized capital allocation), Avnet is set to translate industry tailwinds into higher earnings and cash flow, supporting future shareholder returns through buybacks/dividends and potential multiple expansion.

Curious how steady but unspectacular revenue growth can still support ambitious earnings, margin upgrades and a lower future earnings multiple than the industry uses today? The narrative lays out a precise roadmap for that math. Want to see which moving parts really carry the fair value story and how sensitive it is to each one? Read on to unpack the full set of projections behind this price tag.

Result: Fair Value of $53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on EMEA demand recovering and Asian growth not permanently diluting margins; otherwise, earnings and valuation could undershoot the narrative.

Find out about the key risks to this Avnet narrative.

Another Angle on Valuation

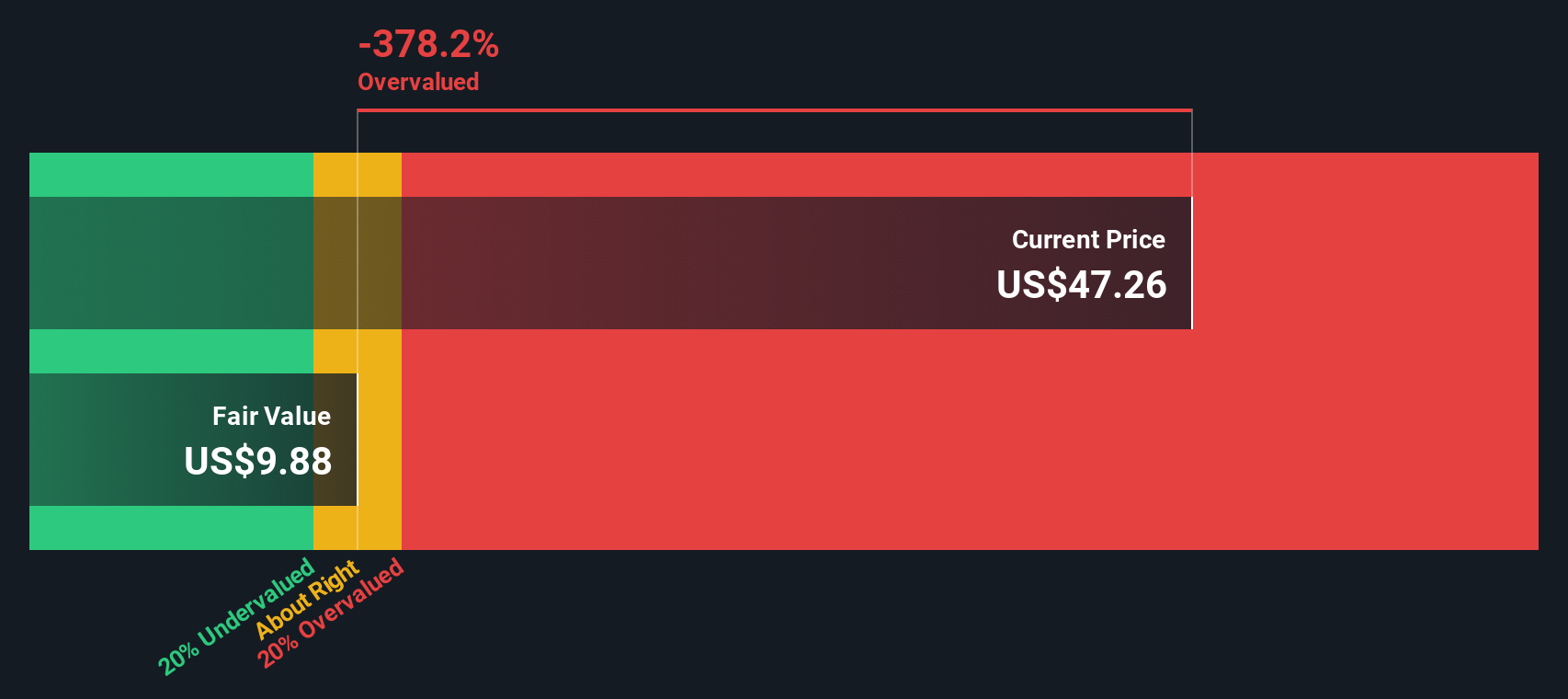

While the narrative fair value pins Avnet at around $53, our SWS DCF model paints a much harsher picture, with a fair value closer to $9.94. This implies the shares are materially overvalued and leaves far less margin of safety than the story driven case suggests.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avnet for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avnet Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A great starting point for your Avnet research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you move on, secure your edge by using the Simply Wall Street Screener to uncover fresh, data driven opportunities that most investors are still overlooking.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 920 undervalued stocks based on cash flows and position yourself ahead of sentiment shifts.

- Ride structural growth trends by zeroing in on innovative businesses harnessing machine learning and automation across healthcare, finance, and more with these 25 AI penny stocks.

- Strengthen your income stream by focusing on reliable payers offering attractive yields and resilient cash generation, starting with these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVT

Avnet

Distributes electronic component technology in the Americas, Europe, the Middle East, Africa, and Asia/Pacific.

Established dividend payer with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026