- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:AIRG

What Does The Future Hold For Airgain, Inc. (NASDAQ:AIRG)? These Analysts Have Been Cutting Their Estimates

The latest analyst coverage could presage a bad day for Airgain, Inc. (NASDAQ:AIRG), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

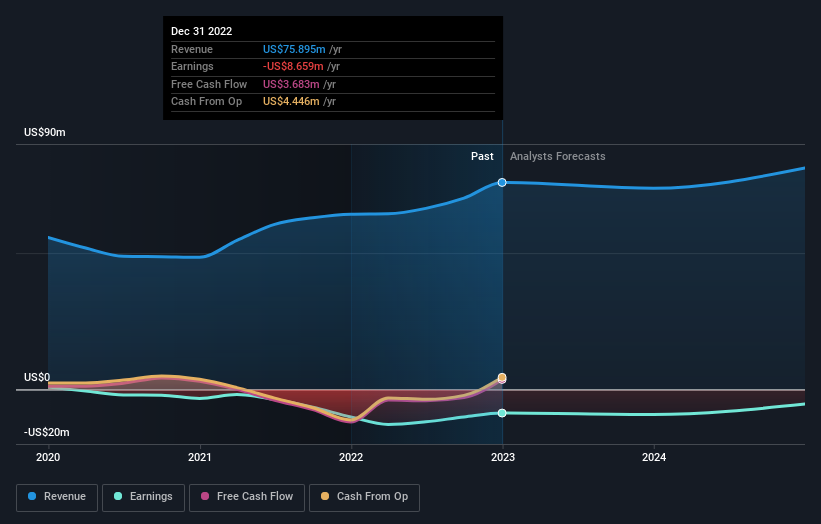

Following the latest downgrade, the four analysts covering Airgain provided consensus estimates of US$74m revenue in 2023, which would reflect a small 2.8% decline on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$87m in 2023. It looks like forecasts have become a fair bit less optimistic on Airgain, given the measurable cut to revenue estimates.

See our latest analysis for Airgain

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 2.8% by the end of 2023. This indicates a significant reduction from annual growth of 5.1% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 4.9% per year. It's pretty clear that Airgain's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Airgain this year. They're also anticipating slower revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Airgain after today.

Of course, there's always more to the story. At least one of Airgain's four analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AIRG

Airgain

Provides wireless connectivity solutions that offers embedded components, external antennas, and integrated systems worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)