- United States

- /

- Biotech

- /

- NasdaqGM:AUPH

Exploring Three High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.7% and is up 13% over the last 12 months, with earnings forecasted to grow by 15% annually. In this environment of robust growth, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability in an ever-evolving landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.64% | 66.60% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Legend Biotech | 26.68% | 57.96% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.69% | 60.42% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

ADMA Biologics (ADMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ADMA Biologics, Inc. is a biopharmaceutical company that develops, manufactures, and markets specialty plasma-derived biologics for treating immune deficiencies and infectious diseases globally, with a market cap of approximately $4.20 billion.

Operations: ADMA focuses on developing and marketing plasma-derived biologics, primarily generating revenue from its Biomanufacturing segment, which accounts for $449.41 million, while its Plasma Collection Centers contribute $9.83 million.

ADMA Biologics, having recently become profitable, exhibits a promising trajectory with its earnings expected to surge by 21.6% annually. This growth outpaces the broader US market's forecast of 14.7%. The firm's commitment to innovation is underscored by a recent FDA approval for a production process that boosts yields by 20%, significantly enhancing operational efficiency. Moreover, ADMA has initiated a robust share repurchase program valued at $500 million, reflecting confidence in its financial health and future prospects. These strategic moves, coupled with revenue projections rising to over $625 million by 2026, position ADMA well within the biotech sector's competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of ADMA Biologics.

Evaluate ADMA Biologics' historical performance by accessing our past performance report.

Aurinia Pharmaceuticals (AUPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aurinia Pharmaceuticals Inc. is a biopharmaceutical company focused on providing therapies for autoimmune diseases with significant unmet needs and has a market cap of $1.08 billion.

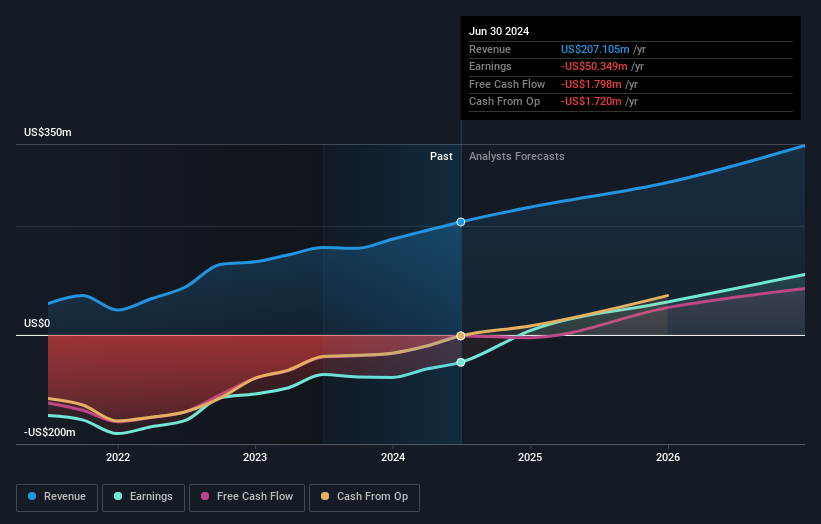

Operations: Aurinia Pharmaceuticals generates revenue primarily through the research, development, and commercialization of therapeutic drugs, amounting to $247.30 million.

Aurinia Pharmaceuticals has recently demonstrated a robust growth trajectory, with revenue forecasted to grow at 12.2% annually, outpacing the US market's average of 8.8%. This growth is complemented by an impressive expected annual earnings increase of 25.8%, signaling strong operational efficiency and market confidence. The company's strategic focus on R&D is evident from its significant investment, which has facilitated innovative treatments in lupus nephritis—highlighted by recent successful clinical results that are poised to enhance patient outcomes and potentially alter therapeutic standards in the industry. Furthermore, Aurinia's proactive approach to capital management is underscored by its recent share repurchases totaling $108.28 million, reinforcing its commitment to shareholder value amidst expanding market presence.

- Navigate through the intricacies of Aurinia Pharmaceuticals with our comprehensive health report here.

Learn about Aurinia Pharmaceuticals' historical performance.

ADTRAN Holdings (ADTN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ADTRAN Holdings, Inc. is a company that offers networking and communications platforms, software, systems, and services across the United States, Germany, the United Kingdom, and internationally with a market capitalization of approximately $711.86 million.

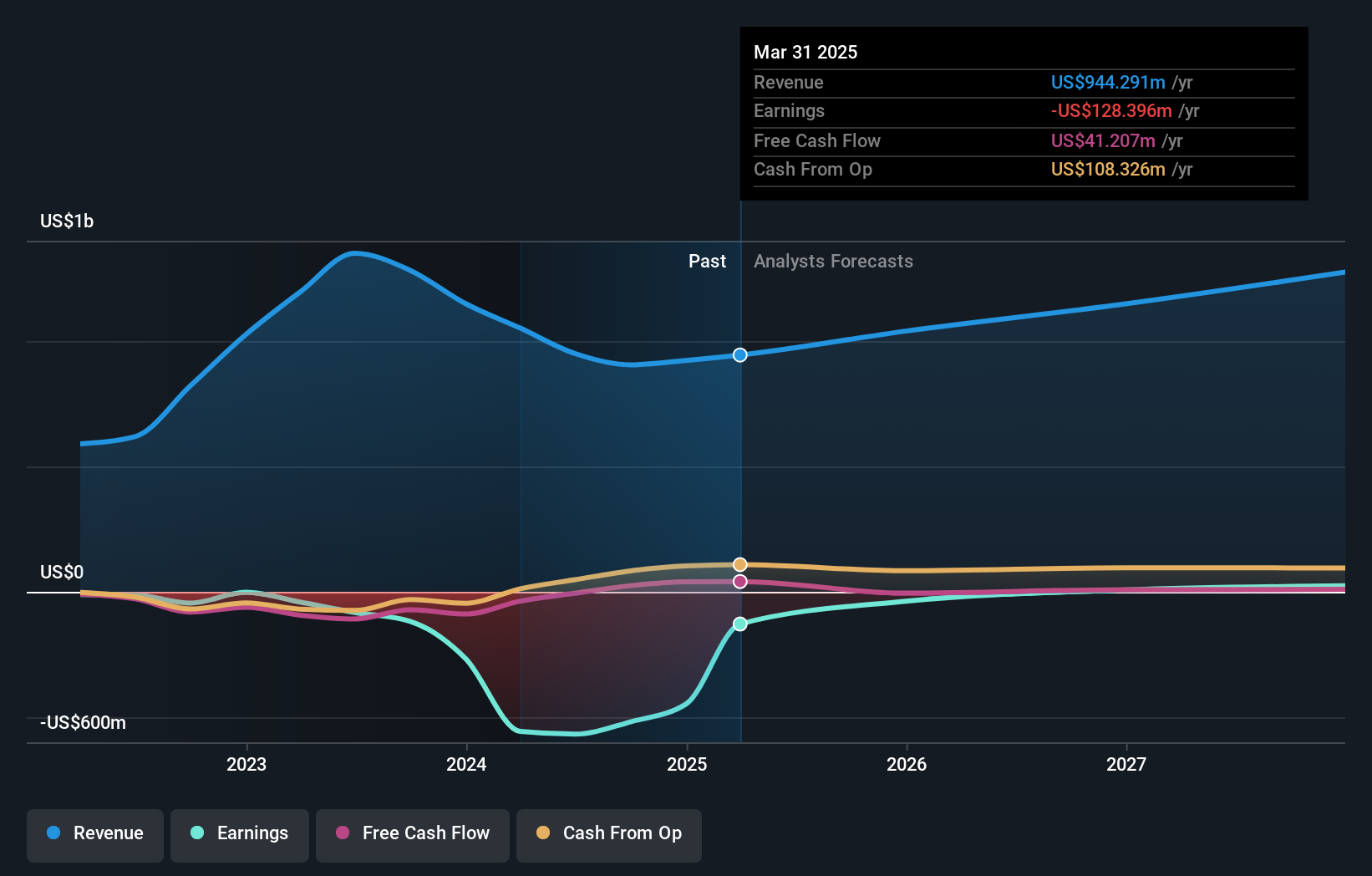

Operations: ADTRAN Holdings generates revenue primarily through its Network Solutions segment, contributing $759.91 million, and its Services & Support segment, which adds $184.38 million.

ADTRAN Holdings is distinguishing itself in the high-growth tech landscape, particularly through its recent deployment of FSP 3000 open optical transport technology. This innovation not only enhances data center interconnect capabilities for Cegeka but also integrates advanced security features like ConnectGuard™ optical-layer encryption and real-time fiber monitoring, ensuring high-capacity and reliable data transport. Furthermore, ADTRAN's strategic focus on R&D is evidenced by its significant annual investment in this area, aligning with industry trends towards more secure and scalable network solutions. With a revenue growth rate of 10.8% per year outpacing the US market average of 8.8%, and an impressive forecasted earnings growth of 107.3% annually, ADTRAN is well-positioned to capitalize on increasing demands for sophisticated networking solutions in various sectors including telecom and defense.

- Click here to discover the nuances of ADTRAN Holdings with our detailed analytical health report.

Gain insights into ADTRAN Holdings' past trends and performance with our Past report.

Key Takeaways

- Discover the full array of 226 US High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:AUPH

Aurinia Pharmaceuticals

A biopharmaceutical company that engages in delivering therapies to people living with autoimmune diseases with high unmet medical needs.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives