- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Assessing Apple (AAPL) Valuation As Long Term Returns Outpace Recent Share Price Weakness

Reviewed by Simply Wall St

Apple (AAPL) continues to attract close attention from investors as its recent share performance, financial scale, and profitability metrics are reassessed, with a particular focus on how current returns compare with its longer term track record.

See our latest analysis for Apple.

Recent trading has cooled slightly, with a 1 day share price return of a 1.38% decline and a 30 day share price return of a 4.13% decline. Apple’s 1 year total shareholder return of 10.84% compares with a 5 year total shareholder return of 113.16%, indicating that long term performance has been stronger than recent weakness at the current share price of $267.26.

If Apple’s recent moves have you reassessing your tech exposure, it could be a good time to widen the lens and check out high growth tech and AI stocks for more ideas.

With Apple delivering annual revenue of about US$416.2b and net income of roughly US$112.0b, yet trading at US$267.26 with mixed recent returns, is there still an opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 6.7% Undervalued

With Apple’s fair value estimate around US$287 versus the last close at US$267.26, the most followed narrative sees some upside still on the table.

The Fair Value Estimate has risen slightly to approximately $287 from about $282, reflecting modestly higher long term expectations.

The Revenue Growth assumption has increased modestly to around 7.23% from about 7.02%, signaling a slightly stronger top line outlook.

Curious what sits behind that higher fair value? Revenue projections, margin assumptions, and a rich future P/E all have to pull in the same direction. Want the full picture?

Result: Fair Value of $287 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view still leans on assumptions that could be tested by tighter App Store rules or supply chain disruptions that put pressure on Apple’s margins and earnings power.

Find out about the key risks to this Apple narrative.

Another Angle On Value

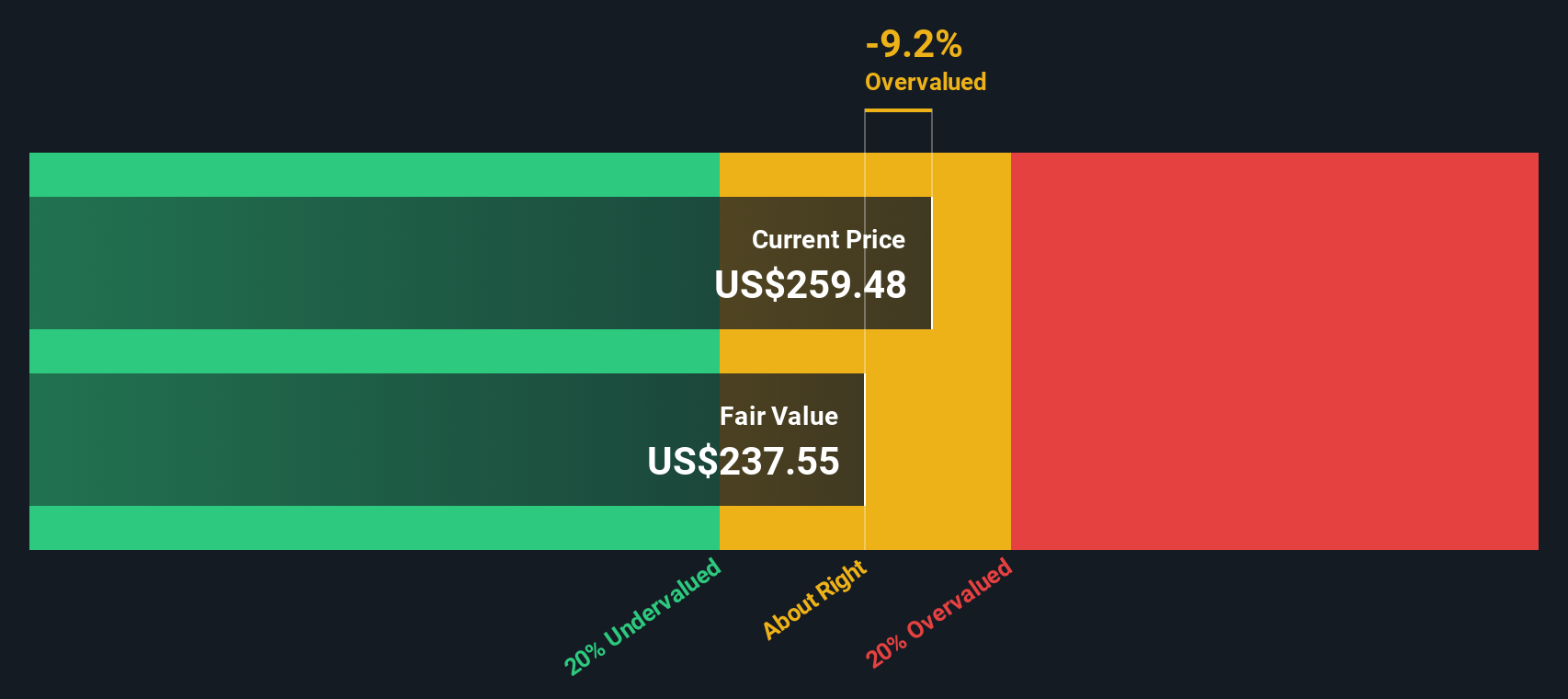

That 6.7% undervalued narrative sits awkwardly beside Simply Wall St’s own DCF output, which points to a fair value of about US$225.50 versus the current US$267.26. On that view Apple screens as overvalued. Which set of assumptions feels closer to how you see the next few years playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Apple for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Apple Narrative

If parts of this story do not quite fit how you see Apple, or you simply prefer to test the inputs yourself, you can build a fresh view in just a few minutes. To begin, use Do it your way.

A great starting point for your Apple research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Apple, you risk missing opportunities that could fit your goals even better, so consider widening your net and pressure testing your next move.

- Spot potential bargains by scanning these 878 undervalued stocks based on cash flows that currently look inexpensive relative to their cash flow profiles and earnings power.

- Explore the next wave of automation by checking out these 25 AI penny stocks harnessing artificial intelligence across software, hardware, and data rich services.

- Identify potential income ideas by reviewing these 14 dividend stocks with yields > 3% offering yields above 3% that may complement a growth focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Nike (NKE): When Brand Power Meets a Faster Fashion Cycle

Microsoft Stock: AI Momentum Is Strong — But Rising Capex Tests Investor Patience

UnitedHealth Stock: Why Scale, Data, and Integration Still Matter in U.S. Healthcare

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).