- United States

- /

- Tech Hardware

- /

- NasdaqGS:AAPL

Apple Inc. (NASDAQ:AAPL) Just Released Its Second-Quarter Results And Analysts Are Updating Their Estimates

Last week, you might have seen that Apple Inc. (NASDAQ:AAPL) released its second-quarter result to the market. The early response was not positive, with shares down 5.4% to US$199 in the past week. Apple reported in line with analyst predictions, delivering revenues of US$95b and statutory earnings per share of US$1.65, suggesting the business is executing well and in line with its plan. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

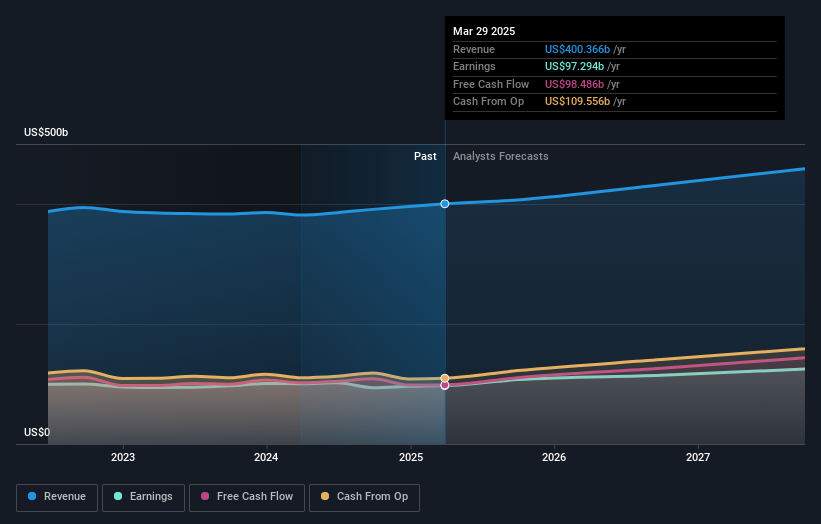

Taking into account the latest results, Apple's 42 analysts currently expect revenues in 2025 to be US$406.9b, approximately in line with the last 12 months. Per-share earnings are expected to swell 10% to US$7.18. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$407.4b and earnings per share (EPS) of US$7.25 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

See our latest analysis for Apple

The analysts reconfirmed their price target of US$232, showing that the business is executing well and in line with expectations. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Apple, with the most bullish analyst valuing it at US$300 and the most bearish at US$171 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Apple shareholders.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Apple's revenue growth is expected to slow, with the forecast 3.3% annualised growth rate until the end of 2025 being well below the historical 6.6% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 5.6% annually. Factoring in the forecast slowdown in growth, it seems obvious that Apple is also expected to grow slower than other industry participants.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for Apple going out to 2027, and you can see them free on our platform here.

It is also worth noting that we have found 1 warning sign for Apple that you need to take into consideration.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AAPL

Apple

Designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Inotiv NAMs Test Center

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion