- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Applied Optoelectronics, Inc.'s (NASDAQ:AAOI) Stock Retreats 33% But Revenues Haven't Escaped The Attention Of Investors

Applied Optoelectronics, Inc. (NASDAQ:AAOI) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. Nonetheless, the last 30 days have barely left a scratch on the stock's annual performance, which is up a whopping 473%.

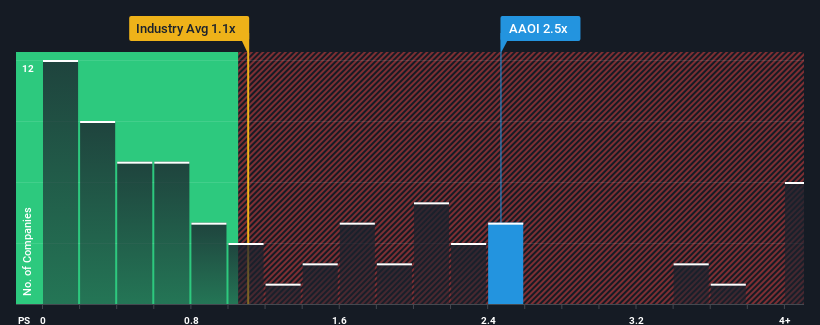

Although its price has dipped substantially, you could still be forgiven for thinking Applied Optoelectronics is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.5x, considering almost half the companies in the United States' Communications industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Applied Optoelectronics

What Does Applied Optoelectronics' P/S Mean For Shareholders?

Applied Optoelectronics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Applied Optoelectronics will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Applied Optoelectronics' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.3%. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.2% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 32%. That would be an excellent outcome when the industry is expected to decline by 0.4%.

With this in consideration, we understand why Applied Optoelectronics' P/S is a cut above its industry peers. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Bottom Line On Applied Optoelectronics' P/S

There's still some elevation in Applied Optoelectronics' P/S, even if the same can't be said for its share price recently. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we anticipated, our review of Applied Optoelectronics' analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. At this stage investors feel the potential for a deterioration in revenue is remote enough to justify paying a premium in the form of a high P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

Having said that, be aware Applied Optoelectronics is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026