- United States

- /

- Communications

- /

- NasdaqGM:AAOI

Applied Optoelectronics, Inc.'s (NASDAQ:AAOI) 25% Cheaper Price Remains In Tune With Revenues

To the annoyance of some shareholders, Applied Optoelectronics, Inc. (NASDAQ:AAOI) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

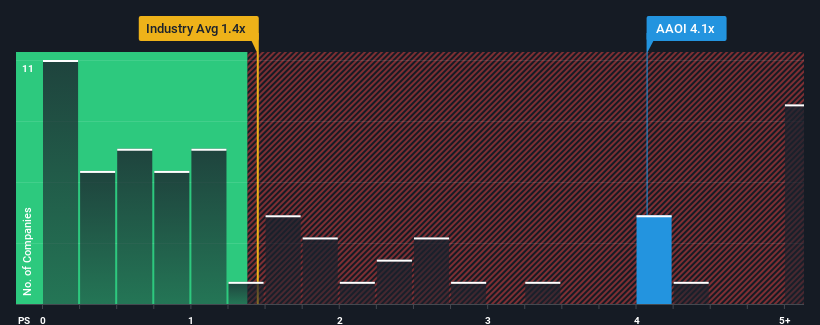

Even after such a large drop in price, you could still be forgiven for thinking Applied Optoelectronics is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.1x, considering almost half the companies in the United States' Communications industry have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Applied Optoelectronics

How Applied Optoelectronics Has Been Performing

With revenue growth that's superior to most other companies of late, Applied Optoelectronics has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Applied Optoelectronics will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Applied Optoelectronics?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Applied Optoelectronics' to be considered reasonable.

Retrospectively, the last year delivered a decent 15% gain to the company's revenues. The latest three year period has also seen a 18% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 112% as estimated by the five analysts watching the company. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Applied Optoelectronics' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Applied Optoelectronics' P/S?

Applied Optoelectronics' shares may have suffered, but its P/S remains high. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Applied Optoelectronics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Applied Optoelectronics you should be aware of, and 1 of them is concerning.

If you're unsure about the strength of Applied Optoelectronics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AAOI

Applied Optoelectronics

Designs, manufactures, and sells fiber-optic networking products in the United States, Taiwan, and China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026