- United States

- /

- Software

- /

- NYSEAM:BMNR

Why Is BitMine Immersion Technologies (BMNR) Amassing So Much Ethereum for Its Corporate Treasury?

Reviewed by Simply Wall St

- BitMine Immersion Technologies has continued its aggressive Ethereum accumulation, purchasing an additional US$200 million in ETH and bringing its total holdings past 2.1 million ETH, reaffirming its position as the largest corporate Ethereum holder.

- This move is part of a broader effort to control a significant portion of Ethereum’s circulating supply, highlighting BitMine’s commitment to a crypto treasury-led business model.

- We'll explore how BitMine Immersion Technologies’ pursuit of a leading Ethereum treasury position shapes its broader investment story.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Bitmine Immersion Technologies' Investment Narrative?

For those considering BitMine Immersion Technologies, the investment story has hinged on its bold Ethereum accumulation strategy and sizable share repurchase plans. The most recent US$200 million ETH purchase signals even greater conviction in using Ethereum as the core asset of BitMine's business model. This event appears to have reignited short-term investor enthusiasm, judging by the significant price rally and heightened options activity. The immediate catalyst remains BitMine’s ability to continue scaling its crypto treasury and secure a leadership role in altcoin-backed corporate treasuries. However, with such aggressive positioning, risks tied to Ethereum price swings, speculative trading, and shareholder dilution have become even more pronounced. While recent executive and board additions bring additional market and operational experience, the company's extended stretch of losses, high valuation multiples, and volatility mean any adverse move in Ethereum could now have a bigger impact on both balance sheet strength and sentiment. Investors should closely monitor how BitMine manages these amplified risks alongside its ambitions.

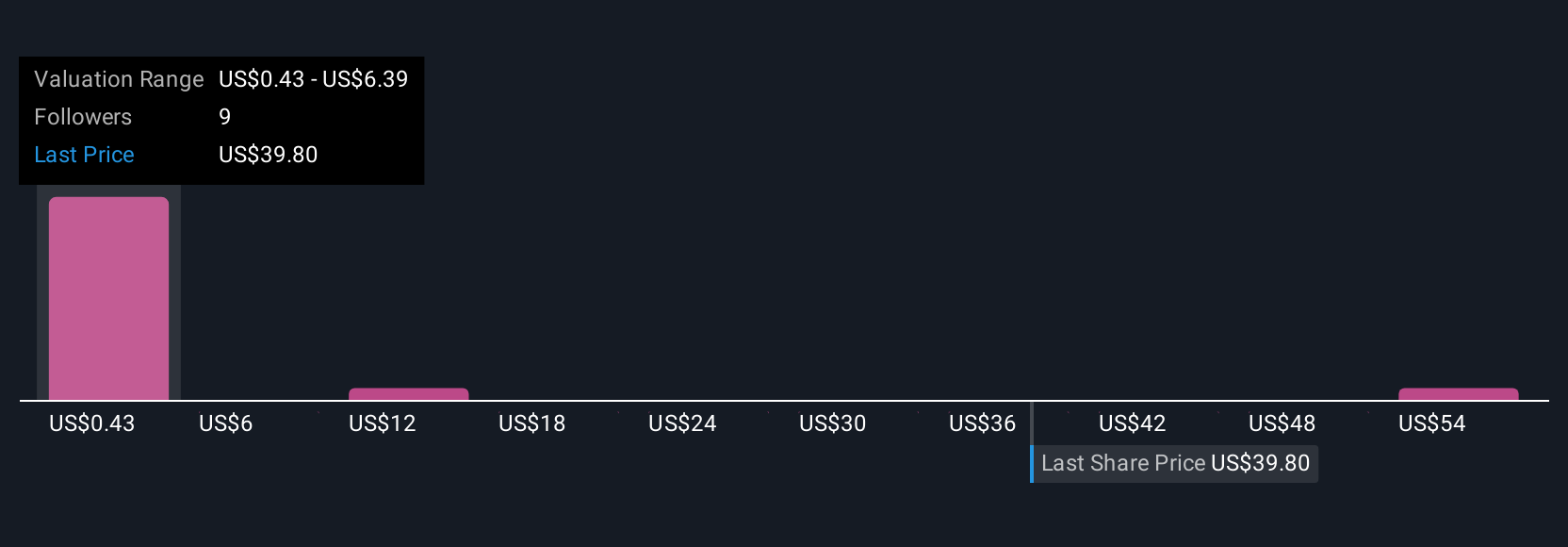

But with volatility in both crypto assets and the share price, risk can quickly shift. Bitmine Immersion Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 15 other fair value estimates on Bitmine Immersion Technologies - why the stock might be worth less than half the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026