- United States

- /

- Software

- /

- NYSEAM:BMNR

How a $2 Billion Stock Offering at Bitmine Immersion Technologies (BMNR) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, Bitmine Immersion Technologies filed a shelf registration to potentially issue a wide range of securities and separately announced a US$2 billion at-the-market common stock offering.

- This approach signals a flexible, robust drive to raise significant capital that could reshape the company’s resources and future initiatives.

- We'll explore what the move to secure up to US$2 billion in new equity capital means for Bitmine Immersion Technologies' investment thesis.

What Is Bitmine Immersion Technologies' Investment Narrative?

For anyone considering Bitmine Immersion Technologies, the core belief centers on management’s ability to use large-scale capital infusions to turn ongoing investments into future returns, even as the company remains unprofitable. The latest shelf registration and the at-the-market US$2 billion equity program provide flexibility and fuel for Bitmine’s ambitions, potentially bolstering near-term growth initiatives or funding expansion, yet, at the same time, this scale of fundraising introduces fresh risks of significant shareholder dilution. The company’s persistent losses, high volatility, previous share dilution, and high price-to-book valuation all shape the near-term catalysts and risk profile, and the recent announcement sharply magnifies both the stakes and the potential rewards for shareholders. Investors should expect increased attention on Bitmine’s capital deployment strategy since successful execution could improve financial stability but failure may intensify existing concerns regarding profitability and value.

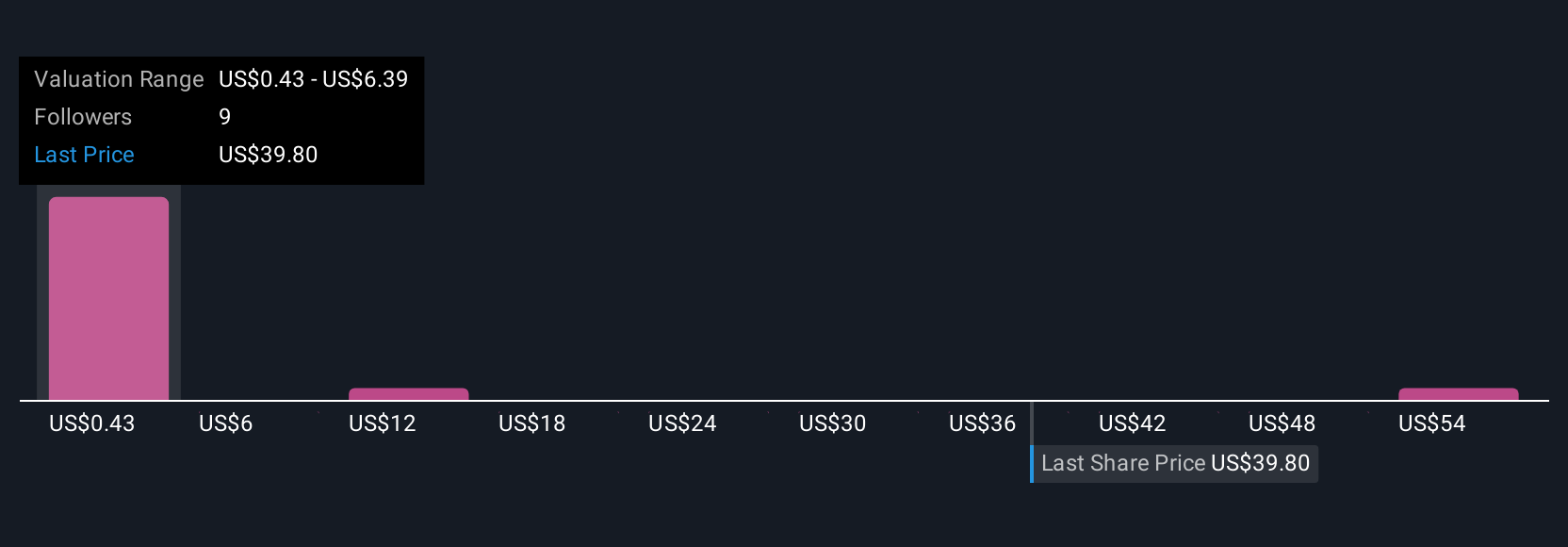

But with shareholder dilution on the horizon, the implications demand serious attention. Bitmine Immersion Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitmine Immersion Technologies' overall financial health at a glance.

No Opportunity In Bitmine Immersion Technologies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Adequate balance sheet low.

Market Insights

Community Narratives