- United States

- /

- Software

- /

- NYSEAM:BMNR

Bitmine Immersion Technologies (BMNR): Evaluating Valuation After Recent 8% Share Price Jump

Reviewed by Simply Wall St

Bitmine Immersion Technologies (BMNR) has drawn attention this week following a nearly 8% gain in its stock price. The stock is bouncing back from recent declines, and investors are now considering whether this shift signals a potential turnaround for the company.

See our latest analysis for Bitmine Immersion Technologies.

Bitmine Immersion Technologies’ recent jump comes after a tough month that saw a 23% drop in share price, part of a broader 32% decline over the past 90 days. Still, with a year-to-date share price return of nearly 475% and an outstanding 570% total shareholder return for the past year, momentum remains impressive even as the pace of gains appears to be cooling from earlier highs.

If shifting trends in fast-moving stocks like BMNR interest you, now is an ideal moment to broaden your search and see what you find in the fast growing stocks with high insider ownership.

The company’s volatile swings raise a crucial question for investors: Is Bitmine Immersion Technologies now undervalued given its recent pullback, or is the market already anticipating strong future growth, leaving little room for upside?

Price-to-Book Ratio of 3980.4x: Is it justified?

Bitmine Immersion Technologies carries a sky-high price-to-book ratio of 3980.4x compared to a last close price of $40.23, suggesting significant overvaluation relative to both industry peers and its own fundamentals.

The price-to-book ratio compares a company’s market capitalization to its net assets on the balance sheet. This metric offers a quick snapshot of how much investors are paying for each dollar of book value. For software companies, elevated ratios can sometimes be explained by strong growth prospects or intangible assets, but such an extreme figure demands extra scrutiny.

Bitmine’s price-to-book valuation is much higher than the US software industry average of just 3.7x, as well as the peer average of 16.6x. This disparity highlights an aggressive premium being placed on the stock, which may be difficult to justify given its current unprofitability and lack of near-term forecasts for profit growth. There is no data available for what its fair ratio should be, so the premium may be exposed to a sharp correction if the market reassesses company prospects.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 3980.4x (OVERVALUED)

However, rapid revenue growth may not offset Bitmine’s ongoing losses or justify such a high premium if profitability remains elusive in the near term.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

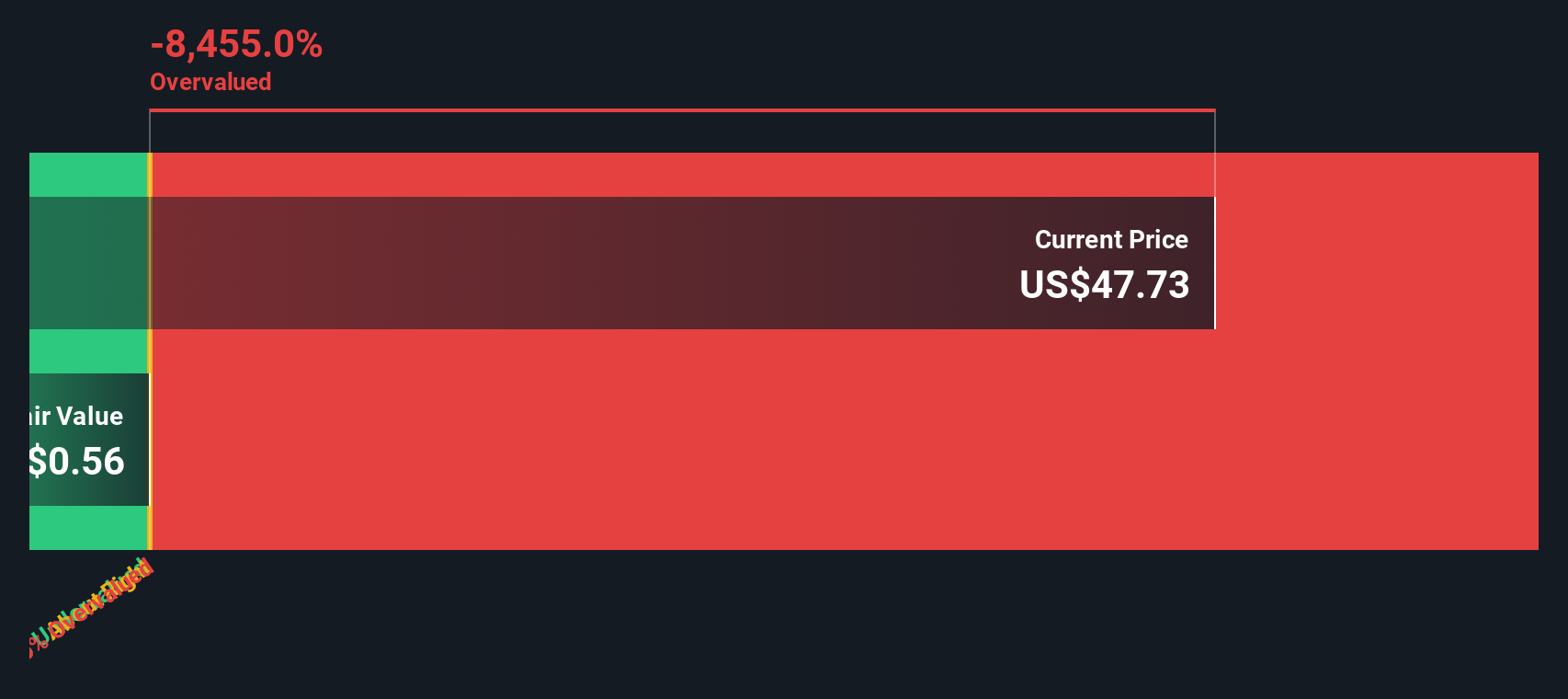

Another View: Discounted Cash Flow Model Poses Further Questions

Taking a different angle, our SWS DCF model suggests Bitmine Immersion Technologies is trading far above its estimated fair value. Shares are at $40.23, while the DCF fair value stands at just $0.35. This significant difference raises fresh doubts about whether the company’s rapid growth alone is sufficient to support its lofty valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you see the story differently or want to explore the details yourself, you can build your own view from the ground up in just a few minutes. Why not Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop here when you can give your portfolio an edge? Take a few minutes today and seize unique opportunities that could shape your financial future.

- Benefit from rapid tech advancements by tapping into these 25 AI penny stocks, which are making their mark on artificial intelligence and automation.

- Strengthen your income strategy with these 16 dividend stocks with yields > 3%, offering solid yields for consistent cash flow and potential long-term growth.

- Uncover tomorrow’s industry leaders by checking out these 28 quantum computing stocks, which are pushing boundaries in computing innovation and next-level processing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BMNR

Bitmine Immersion Technologies

Operates as a blockchain technology company primarily in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

SAP's Intrinsic and Historical Valuation

Nike: A Market Leader with Resilience and Long-Term Growth Potential

The Real Power Behind Alphabet’s Growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale