- United States

- /

- Software

- /

- NYSE:ZETA

Three Companies That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

In the midst of a challenging period for U.S. markets, with the Nasdaq experiencing its worst week since 'Liberation Day' and ongoing concerns about tech stock valuations, investors are keenly observing opportunities that may arise from these fluctuations. Identifying undervalued stocks can be crucial in such volatile times, as they may offer potential value when broader market sentiment is cautious or uncertain.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (ONB) | $20.99 | $41.08 | 48.9% |

| Nicolet Bankshares (NIC) | $123.53 | $242.17 | 49% |

| MoneyHero (MNY) | $1.23 | $2.42 | 49.2% |

| Huntington Bancshares (HBAN) | $15.69 | $31.03 | 49.4% |

| First Busey (BUSE) | $22.99 | $45.34 | 49.3% |

| Firefly Aerospace (FLY) | $19.74 | $39.11 | 49.5% |

| Fifth Third Bancorp (FITB) | $42.87 | $83.26 | 48.5% |

| Crocs (CROX) | $78.85 | $157.44 | 49.9% |

| Corpay (CPAY) | $276.53 | $552.52 | 50% |

| CNB Financial (CCNE) | $24.77 | $49.42 | 49.9% |

Here's a peek at a few of the choices from the screener.

Seacoast Banking Corporation of Florida (SBCF)

Overview: Seacoast Banking Corporation of Florida is the bank holding company for Seacoast National Bank, offering integrated financial services to retail and commercial customers in Florida, with a market cap of approximately $2.99 billion.

Operations: The company generates revenue of $556.54 million from offering comprehensive financial services to both retail and commercial clients in Florida.

Estimated Discount To Fair Value: 19.1%

Seacoast Banking Corporation of Florida is trading at US$30.91, approximately 19.1% below its estimated fair value of US$38.21, indicating potential undervaluation based on cash flows. The company reported strong net interest income growth for Q3 2025, reaching US$133.47 million compared to the previous year's US$106.67 million, alongside rising earnings per share and an increased dividend payout. However, recent charge-offs highlight some risk factors to consider in valuation assessments.

- In light of our recent growth report, it seems possible that Seacoast Banking Corporation of Florida's financial performance will exceed current levels.

- Dive into the specifics of Seacoast Banking Corporation of Florida here with our thorough financial health report.

Chewy (CHWY)

Overview: Chewy, Inc. operates as an e-commerce company in the United States, focusing on pet-related products and services, with a market cap of approximately $13.98 billion.

Operations: Chewy's revenue primarily comes from the sale of pet products and services, totaling $12.35 billion.

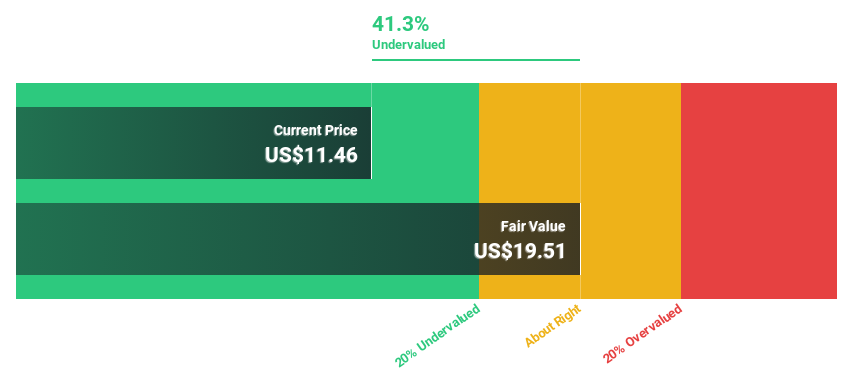

Estimated Discount To Fair Value: 44.4%

Chewy is trading at US$33.7, significantly below its estimated fair value of US$60.58, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins and net income compared to last year, Chewy's earnings are forecast to grow significantly at 29.2% annually, faster than the broader market. Recent strategic initiatives like launching Get RealTM fresh dog food and expanding premium pet apparel partnerships could bolster revenue streams amidst slower revenue growth projections relative to the market.

- Our comprehensive growth report raises the possibility that Chewy is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Chewy's balance sheet health report.

Zeta Global Holdings (ZETA)

Overview: Zeta Global Holdings Corp. operates an omnichannel data-driven cloud platform offering consumer intelligence and marketing automation software to enterprises globally, with a market cap of approximately $4.69 billion.

Operations: The company generates revenue of $1.22 billion from its Internet Software & Services segment.

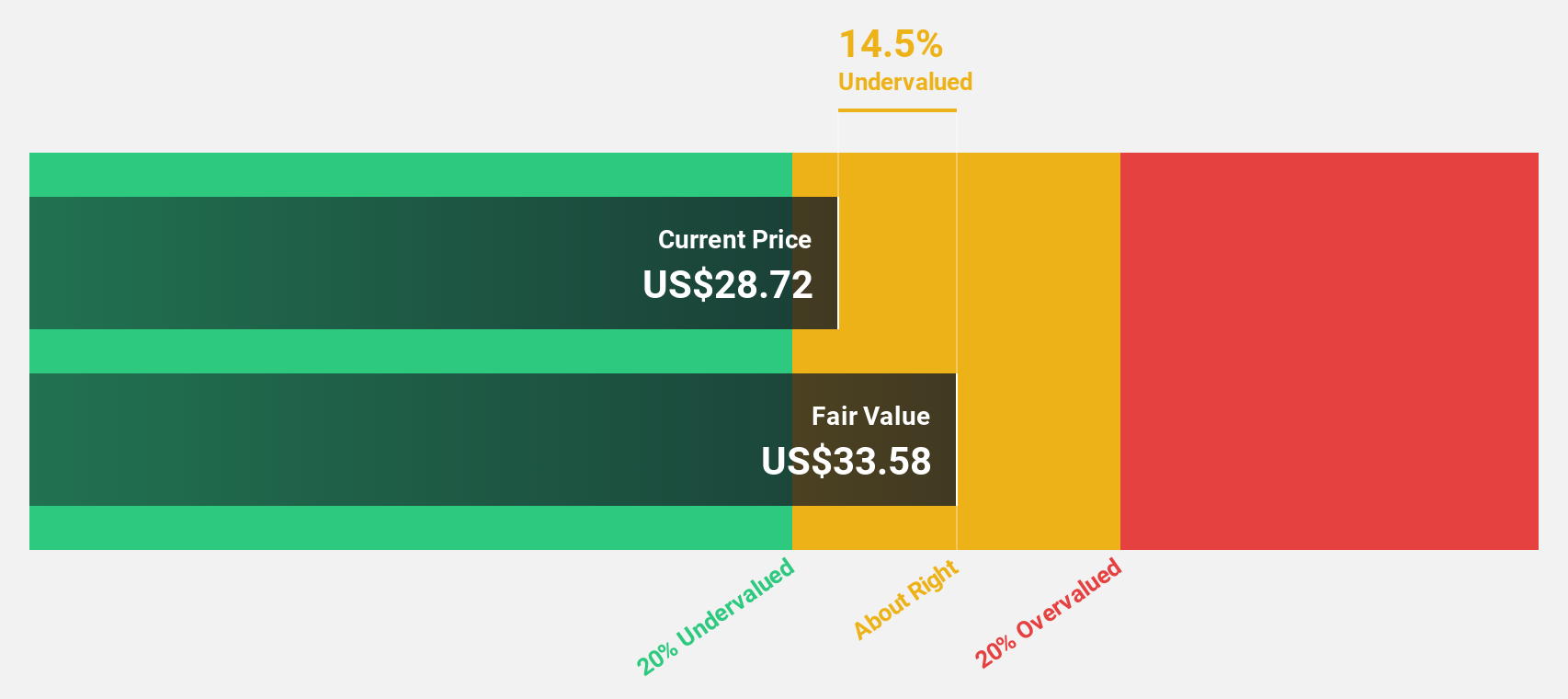

Estimated Discount To Fair Value: 27.9%

Zeta Global Holdings, trading at US$19.51, is undervalued relative to its estimated fair value of US$27.07, supported by robust cash flows. The company anticipates becoming profitable within three years and forecasts a 200.44% annual earnings growth rate. Recent revenue guidance revisions highlight strong performance with expected 2026 revenue reaching US$1.54 billion, up 21% from 2025 estimates. Innovative products like Athena by Zeta™ aim to enhance AI-driven marketing capabilities and optimize ROI for marketers.

- According our earnings growth report, there's an indication that Zeta Global Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Zeta Global Holdings stock in this financial health report.

Where To Now?

- Click here to access our complete index of 187 Undervalued US Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives