- United States

- /

- Software

- /

- NYSE:ZETA

Does Zeta Global Still Offer Growth After Shares Fall 5.8% This Week?

Reviewed by Bailey Pemberton

Thinking about whether Zeta Global Holdings is a buy, a hold, or a sell? You are not alone. Investors are debating what to do, especially after the stock’s ups and downs over the past year. If you are looking for growth stories with just the right amount of risk, Zeta has likely caught your eye. Over the last seven days, the stock dipped by 5.8%. If you zoom out, the 30-day chart shows a mild 2.3% uptick, while year-to-date it is up 3.1%. That may not sound wild, but the long view is eye-popping: in the past three years, Zeta’s shares have soared an astonishing 174.6%. Of course, it is not all smooth sailing. Zeta has faced a tough twelve months, down 37.7%, with recent volatility partly reflecting shifting investor appetite around technology and advertising stocks as the marketing landscape reacts to evolving privacy norms and digital ad spend trends.

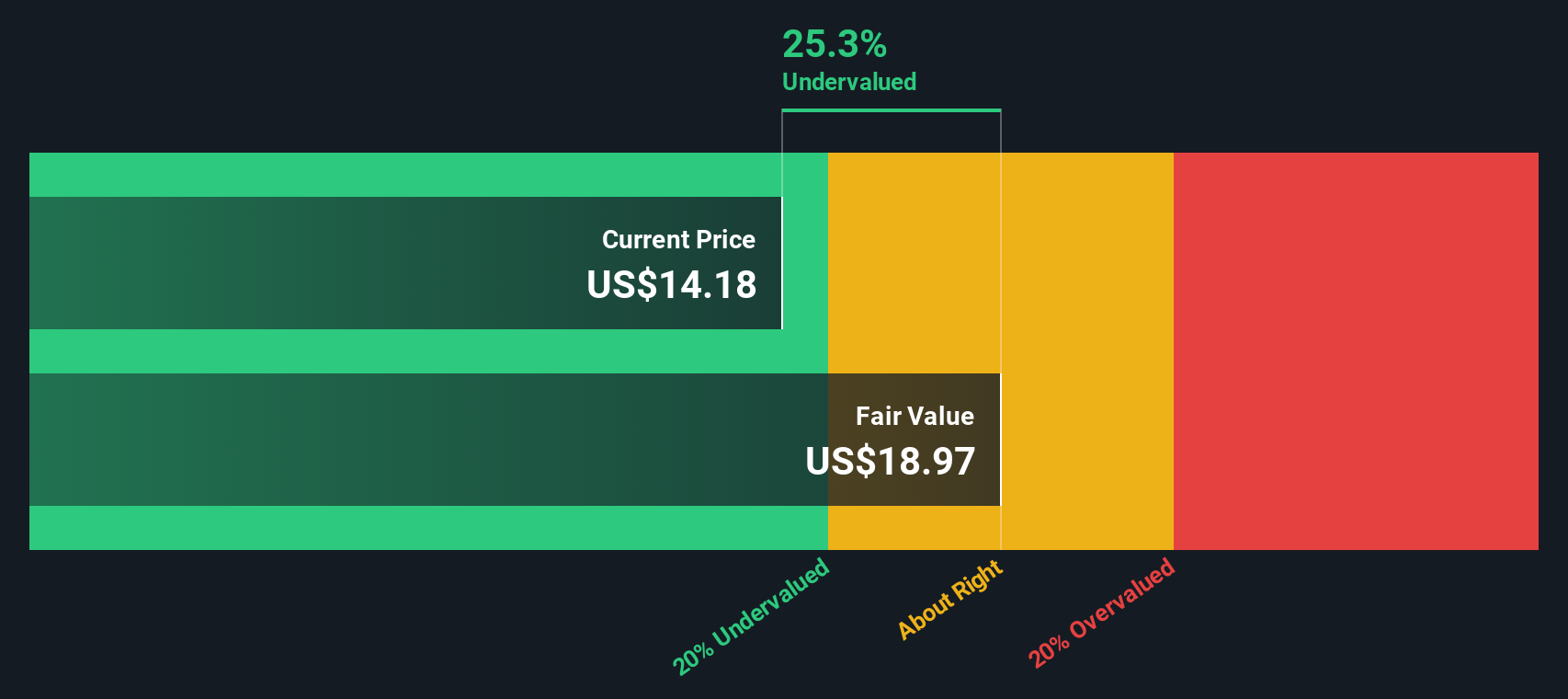

So, how undervalued is Zeta? The company’s value score stands at 5 out of a possible 6, meaning it passes the undervaluation check on almost every major measure analysts typically watch. But what exactly goes into that score? Are traditional valuation methods telling the whole story? Let’s take a closer look at each of the ways investors approach valuation before landing on an even smarter way to size up whether Zeta offers a real bargain or not.

Why Zeta Global Holdings is lagging behind its peers

Approach 1: Zeta Global Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to the present using an appropriate rate. This approach helps investors gauge what the business is fundamentally worth today based on its capacity to generate cash in the years ahead.

Zeta Global Holdings currently generates Free Cash Flow (FCF) of $105.8 Million. Analyst forecasts suggest this figure will grow steadily, with projections reaching $316.8 Million by 2028. Simply Wall St then extrapolates these trends, projecting FCF could surpass $583 Million by 2035. These ten-year projections reflect consensus estimates for the next five years, while longer-term figures are based on anticipated rates of growth in the software industry.

Using this 2 Stage Free Cash Flow to Equity DCF model, Zeta’s estimated intrinsic value comes to $30.80 per share. Compared to its current share price, the DCF analysis implies the stock is trading at a substantial 37.2% discount. This makes it look notably undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zeta Global Holdings is undervalued by 37.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

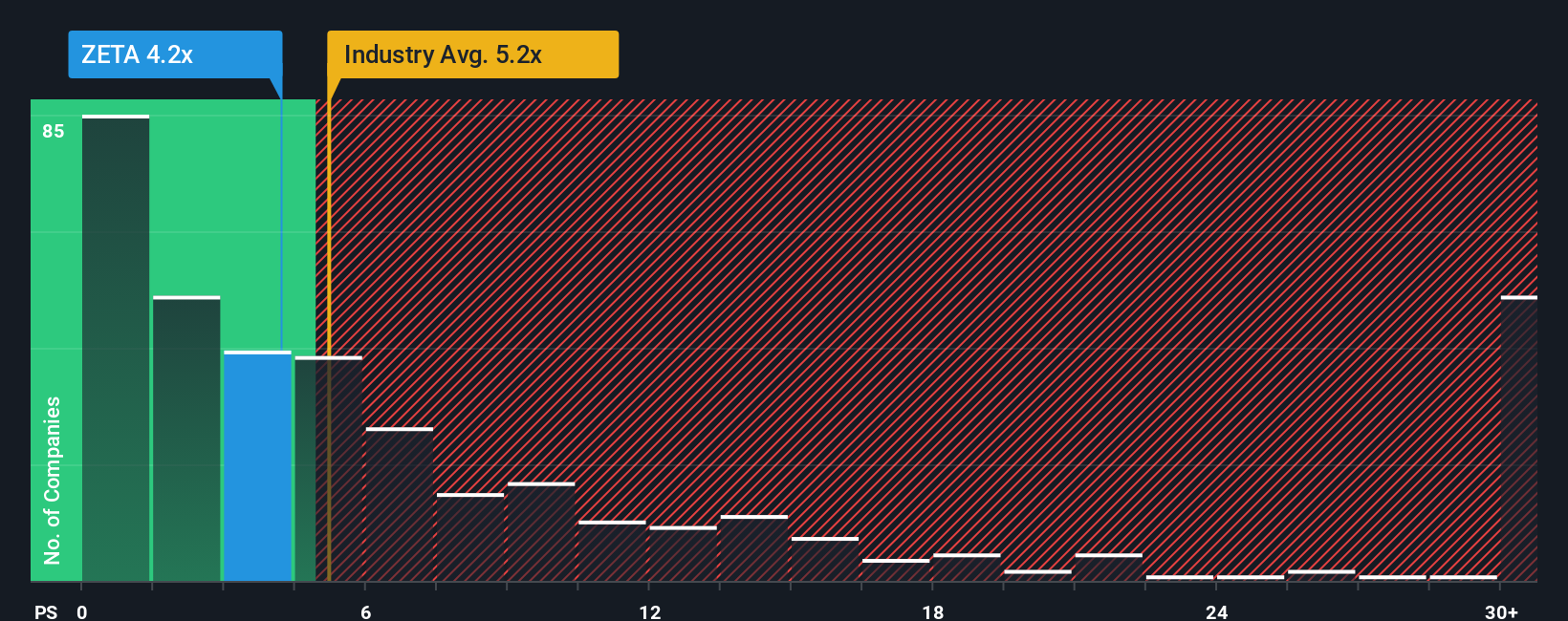

Approach 2: Zeta Global Holdings Price vs Sales

For companies like Zeta Global Holdings, which are still working toward consistent profitability, the Price-to-Sales (P/S) ratio is often a preferred valuation tool. The P/S ratio is especially useful in the software sector because it allows investors to compare how the market is valuing each dollar of the company’s revenue, even if net earnings are volatile or negative. Growth expectations and risk both play a big part in determining what a ‘normal’ P/S ratio should be for a stock. Faster-growing, lower-risk firms can command higher multiples, while slower-growing or riskier names usually trade lower.

Zeta’s current P/S ratio is 3.98x, which is below both the software industry average of 5.29x and the average of its direct peers at 12.53x. On the surface, this might suggest that the stock is relatively cheap compared to similar companies, but context is key. That is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric calculates what would be a reasonable multiple for Zeta based on a blend of its revenue growth, industry environment, profit margins, company size, and specific business risks. Because it tailors the benchmark specifically to Zeta, the Fair Ratio of 6.01x arguably offers a more accurate perspective than broad industry or peer comparisons.

Since Zeta’s P/S of 3.98x is well below the Fair Ratio, this suggests the market is undervaluing the company on a sales basis, especially after considering its growth outlook and risk profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

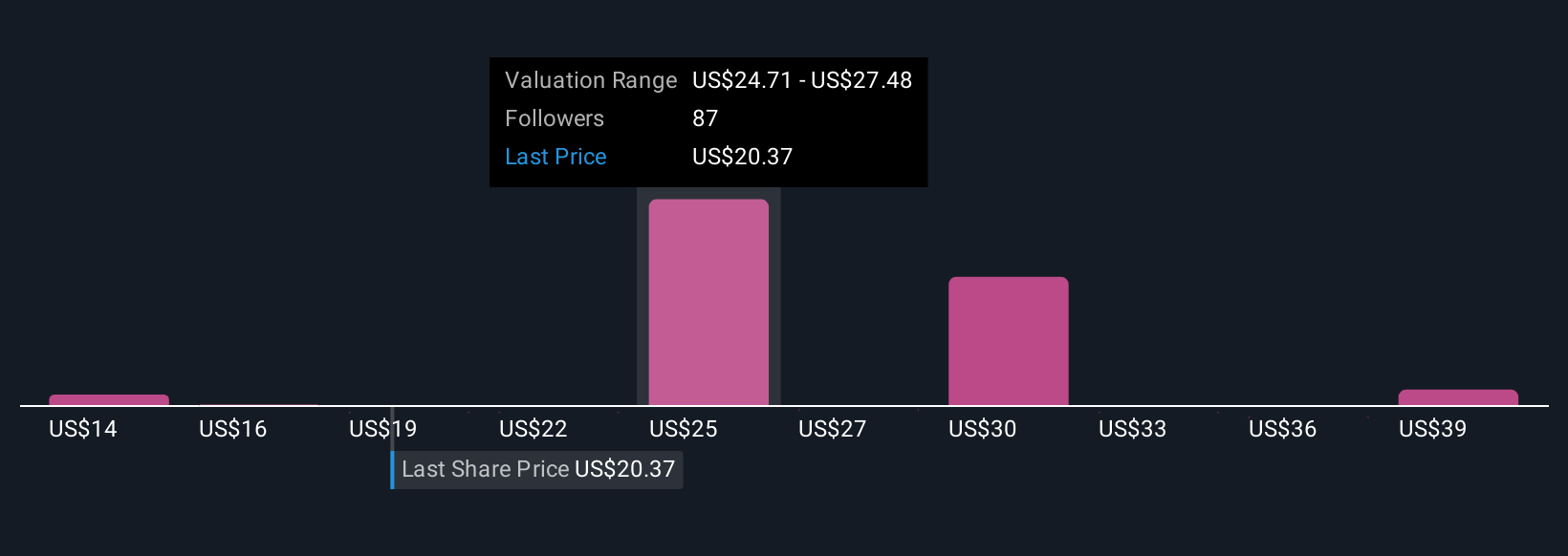

Upgrade Your Decision Making: Choose your Zeta Global Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just numbers. It’s an investment story that connects your perspective on Zeta Global Holdings with your own assumptions about its future revenue, margins, and fair value, all simplified into a single, easy-to-compare forecast.

Instead of only relying on ratios or analyst targets, Narratives let you anchor your investment decision in the business’s real story and outlook. You can state your revenue and margin estimates and see how that would translate to a fair value, then instantly compare that to the current price to decide if Zeta looks compelling to buy, hold, or sell.

Available on Simply Wall St’s Community page, this tool is easy for anyone to use, whether you’re new to investing or a seasoned pro, and automatically updates as new data and news come in, giving you the latest picture every time you log in.

For Zeta Global Holdings, for example, some investors are bullish, seeing AI-driven marketing automation and new agency clients fueling rapid growth (supporting a fair value as high as $44), while others see competitive risk and industry headwinds capping upside (with fair value as low as $18), so you can quickly understand the full spectrum of viewpoints and pick the Narrative that fits you best.

Do you think there's more to the story for Zeta Global Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives