- United States

- /

- Software

- /

- NYSE:ZETA

Does the Recent Slide in Zeta Global Signal a Long-Term Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Zeta Global Holdings stock right now? You are not alone. Investors have been weighing their options as Zeta’s share price tells a tale of both strong growth and recent turbulence. The company’s latest close was $19.44, up 1.2% in just the past week, but still sitting around 9.5% lower over the past 30 days. Longer-term holders will remember the downturn over the last year with a 26.4% decline. However, if you step back three years, Zeta still boasts a massive 143.3% gain.

What is behind these swings? Recent shifts in digital marketing demand and a string of new client signings have kept Zeta in the spotlight, shifting investor risk perceptions almost month by month. The digital advertising sector is undergoing a transformation, and Zeta’s focus on omnichannel marketing solutions appears to be catching attention from both enterprises and Wall Street. These moves have created plenty of conversation on whether the current valuation truly captures Zeta’s underlying potential or the risks on the horizon.

When we dig into the numbers, Zeta boasts a value score of 5 out of 6. That means the company checks the box for being undervalued in five of six key areas, which is a strong signal for bargain hunters. But as you will see, understanding exactly how these valuation measures work can make all the difference when making your next move, and there may be an even more insightful way to look at Zeta’s long-term worth coming up later in the article.

Why Zeta Global Holdings is lagging behind its peers

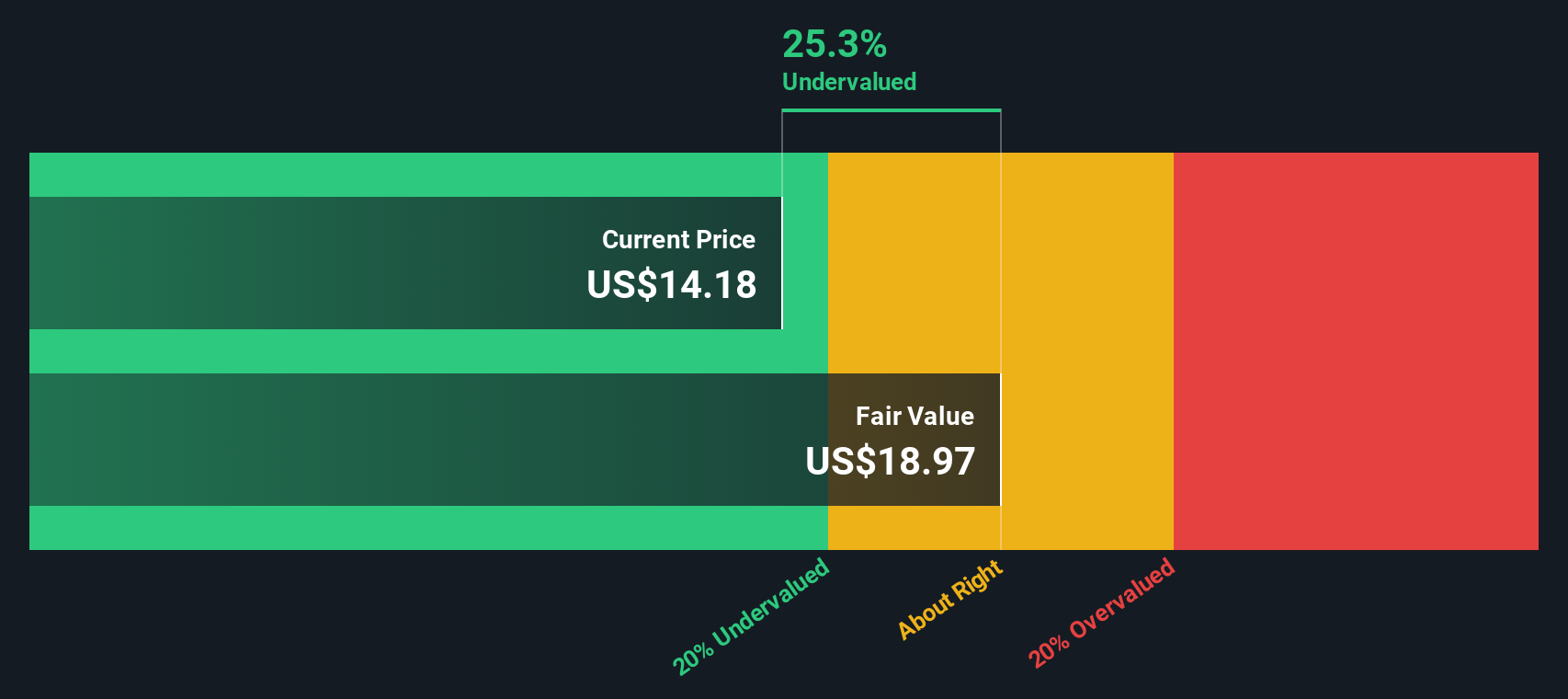

Approach 1: Zeta Global Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method helps investors gauge what a stock is truly worth, independent of current market sentiment.

For Zeta Global Holdings, the current Free Cash Flow (FCF) stands at $105.8 million. Analysts forecast FCF growth, with projections reaching $316.8 million by the end of 2028. Further out, using systematic extrapolations, Simply Wall St extends these estimates up to 2035 and reflects a steady rise each year. These projections, all calculated in US dollars, underscore a business generating more and more cash as time goes on.

After discounting these future cash flows to present value, the DCF valuation analysis sets the intrinsic share price at $30.92. With Zeta’s latest share price closing at $19.44, this suggests the stock is trading at a 37.1% discount to its estimated fair value. In other words, the DCF points to Zeta Global Holdings being significantly undervalued at its current price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zeta Global Holdings is undervalued by 37.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

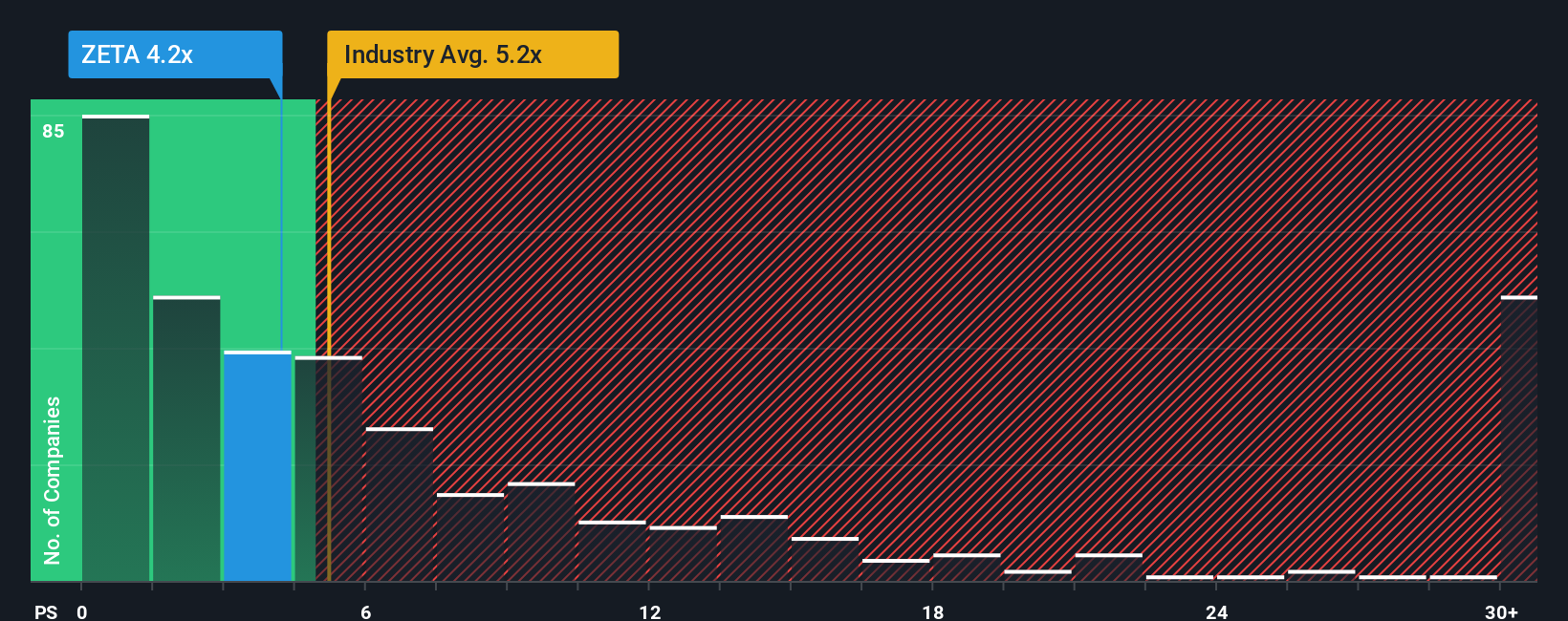

Approach 2: Zeta Global Holdings Price vs Sales

The Price-to-Sales (P/S) ratio is a valuable metric for understanding how the market values a company’s total revenue, especially for businesses like Zeta Global Holdings that are still ramping up profitability. Because Zeta is focused on scaling its top line and reinvesting in growth, looking at the P/S multiple helps investors judge value without being misled by volatile or negative earnings.

Generally, companies with strong growth prospects and lower perceived risk can justify higher multiples, while those facing hurdles might trade at a discount. Zeta’s current P/S ratio is 4.00x, which is below both the Software industry average of 5.26x and the peer average of 12.47x. This suggests the market is valuing Zeta’s sales more conservatively compared to its competitors and the wider sector.

Simply Wall St’s proprietary Fair Ratio for Zeta stands at 5.90x. Unlike simple peer or industry comparisons, the Fair Ratio factors in Zeta’s future growth, profit margins, market cap, and business risks. This makes it a more well-rounded benchmark. With Zeta's actual P/S ratio trading well below this fair value measure, the stock appears to offer attractive value on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zeta Global Holdings Narrative

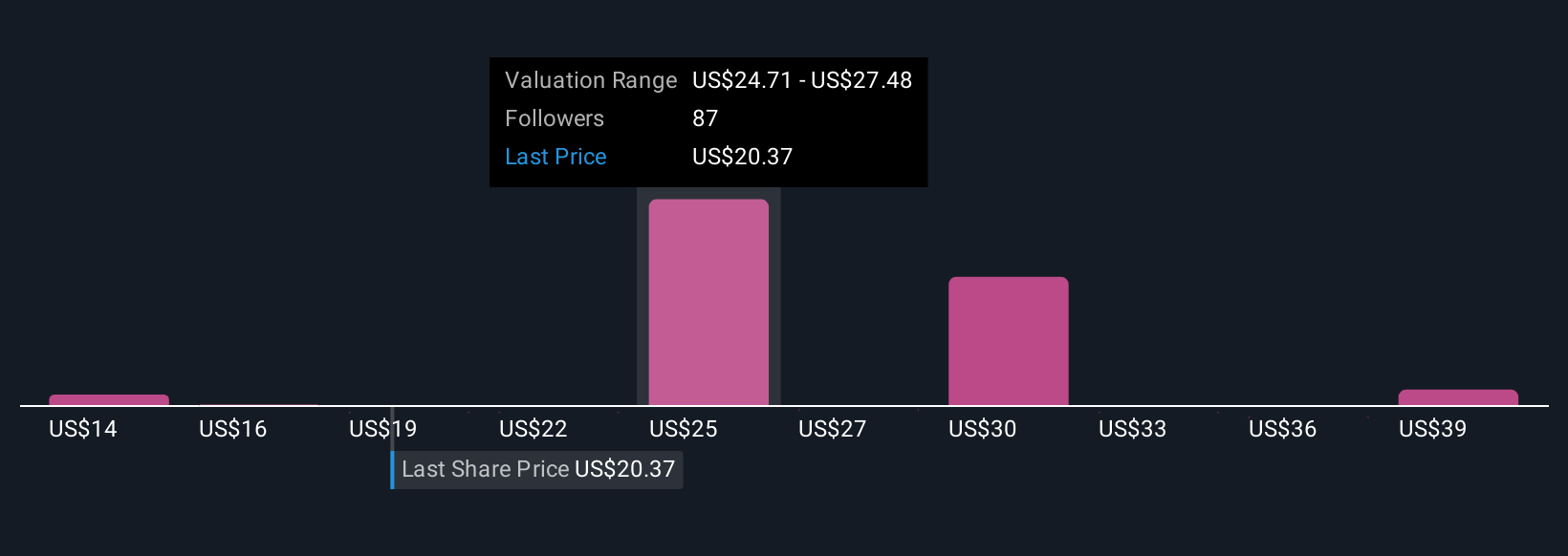

Earlier, we mentioned that there is an even more powerful way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story or perspective that connects your personal view of a company—why it might succeed or struggle—with a financial forecast and an estimated fair value. Instead of relying solely on traditional metrics, Narratives help you organize your reasoning: you explain what you expect for Zeta’s future revenue, earnings, and margins, and see what fair value follows from your assumptions.

Narratives are easy to use and fully accessible on the Simply Wall St Community page, where millions of investors actively share and update their perspectives. They make decisions clearer by joining the dots between Zeta’s story, your forecast, and a calculated fair value. This allows you to confidently compare that value to the current price and decide when to buy or sell. Additionally, each Narrative automatically updates as new company developments, earnings, or news emerge, making your decision-making more dynamic and responsive.

For example, some investors believe Zeta could be worth as much as $44 per share if its AI innovations accelerate growth, while others see more downside risk and value it closer to $18. Each Narrative is unique to the assumptions behind it, empowering you to shape your own actionable investment thesis.

Do you think there's more to the story for Zeta Global Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zeta Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZETA

Zeta Global Holdings

Operates an omnichannel data-driven cloud platform that provides enterprises with consumer intelligence and marketing automation software in the United States and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives