- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (NYSE:YOU) Partners With Greenhouse And T-Mobile For Enhanced Identity Verification

Reviewed by Simply Wall St

Clear Secure (NYSE:YOU) has seen a 4% increase in its share price over the past month. This uptick coincides with recent strategic partnerships, namely with Greenhouse and T-Mobile, enhancing its CLEAR1 identity platform for more secure hiring and employee verification processes. These developments align with broader market trends as the S&P 500 and Nasdaq both edged higher during recent trading sessions. The collaborations are expected to bolster the company’s offerings against the backdrop of a tech-forward security emphasis, mirroring the positive momentum observed in technology stocks and suggesting a supportive market environment for Clear's expanding solutions.

Find companies with promising cash flow potential yet trading below their fair value.

The recent partnerships with Greenhouse and T-Mobile are poised to significantly enhance Clear Secure's market position. By integrating with these platforms, Clear's CLEAR1 identity solution gains broader acceptance in employee verification, potentially driving new revenue streams and supporting long-term earnings growth. The expansion aligns with the company's focus on automation and biometric security solutions, designed to increase operational efficiency and user satisfaction. However, new leadership changes may introduce execution risks, which could influence financial stability and operational consistency.

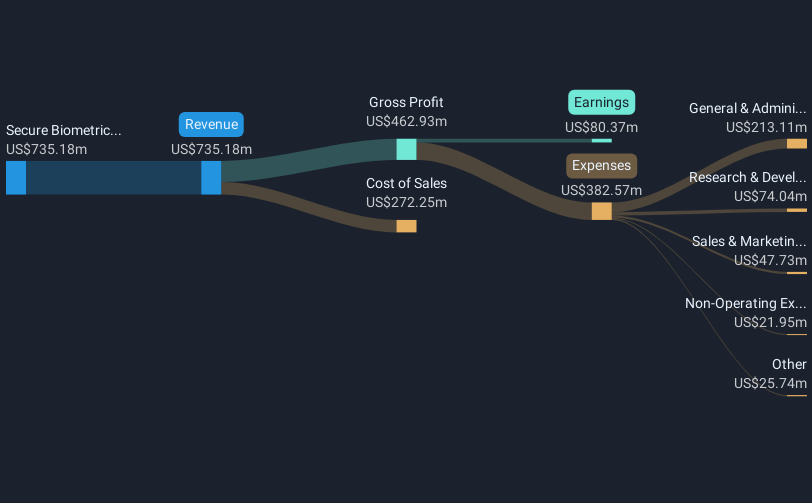

Over the past year, Clear Secure's total return, including dividends, reached 46.36%. This substantial growth suggests that the market has reacted positively to Clear's initiatives and strategic movements, even as analysts forecast a 4.4% annual decline in earnings. When comparing to the broader US software industry, Clear has outperformed with a return exceeding the industry's 18.5% over the last year. Such performance highlights investors' confidence in Clear's trajectory and potential future growth.

The recent price movement reflects the company's ongoing developments, yet it is essential to view the current share price in the context of analyst expectations. With the shares currently at US$26.17, there's a 10.1% gap to the analyst consensus price target of US$29.12. This gap suggests potential upside if Clear Secure manages to execute its strategies effectively. Analysts anticipate a revenue increase to nearly US$1 billion by 2028, though earnings are projected to decrease, indicating a mixed outlook. Investors should weigh market conditions and Clear's ability to navigate its strategic shifts against these expectations.

Jump into the full analysis health report here for a deeper understanding of Clear Secure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives