Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Yext (NYSE:YEXT) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Yext

Does Yext Have A Long Cash Runway?

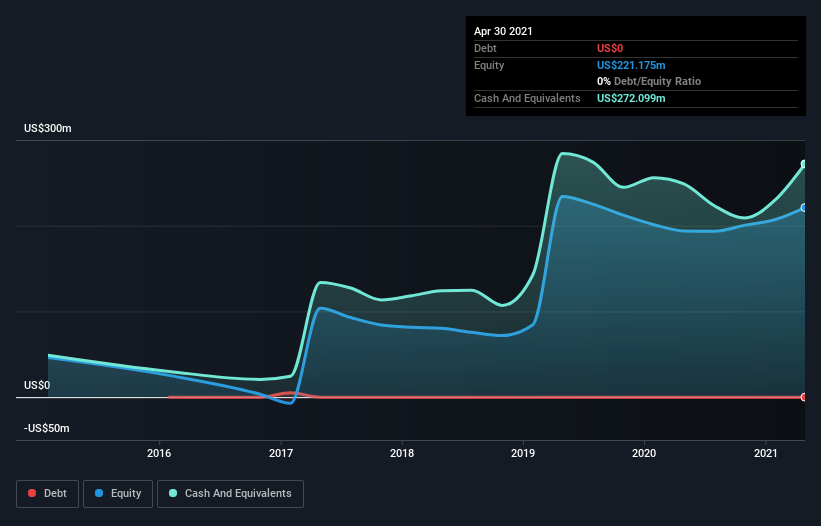

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at April 2021, Yext had cash of US$272m and no debt. Importantly, its cash burn was US$14m over the trailing twelve months. That means it had a cash runway of very many years as of April 2021. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Yext Growing?

Yext managed to reduce its cash burn by 78% over the last twelve months, which suggests it's on the right flight path. And while hardly exciting, it was still good to see revenue growth of 15% during that time. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Yext To Raise More Cash For Growth?

While Yext seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Yext has a market capitalisation of US$1.7b and burnt through US$14m last year, which is 0.9% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Yext's Cash Burn Situation?

It may already be apparent to you that we're relatively comfortable with the way Yext is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 3 warning signs for Yext that investors should know when investing in the stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Yext or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives