- United States

- /

- Software

- /

- NYSE:YEXT

How Yext's (YEXT) Return to Profit and Share Buybacks Have Changed Its Investment Story

Reviewed by Simply Wall St

- Yext, Inc. recently announced its second quarter and six-month earnings for the period ended July 31, 2025, reporting sales of US$113.09 million in the quarter versus US$97.89 million the prior year, and achieving net income of US$26.75 million compared to a net loss a year ago.

- The company also completed a significant tranche of its share buyback program, repurchasing over 2.36 million shares between May and September 2025, which management has suggested signals ongoing confidence in Yext’s business outlook.

- We’ll examine how Yext turning profitable and completing major share buybacks could shift analyst expectations around its long-term earnings potential.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Yext Investment Narrative Recap

For Yext shareholders, conviction rests on the company’s ability to capture demand for AI-driven digital presence management while fending off pricing pressure and customer churn from market commoditization. The recent turnaround to profitability and substantial share buybacks are encouraging but do not materially shift the most important short term catalyst, wider customer adoption of new products, and the main risk, which remains execution amid aggressive competition and potential revenue softness in renewals.

Among recent announcements, the ongoing share buyback stands out, with Yext having now repurchased over 20% of its outstanding shares. This move supports near-term earnings per share but ultimately ties back to the company’s broader challenge: driving recurring revenue through new solutions like Yext Scout and maintaining high customer retention as business needs evolve.

However, investors should also be aware that amid these positive signals, there remain unresolved concerns about whether early adoption of new products will...

Read the full narrative on Yext (it's free!)

Yext's outlook projects $517.1 million in revenue and $62.1 million in earnings by 2028. This requires 6.0% yearly revenue growth and an $85.5 million increase in earnings from the current level of -$23.4 million.

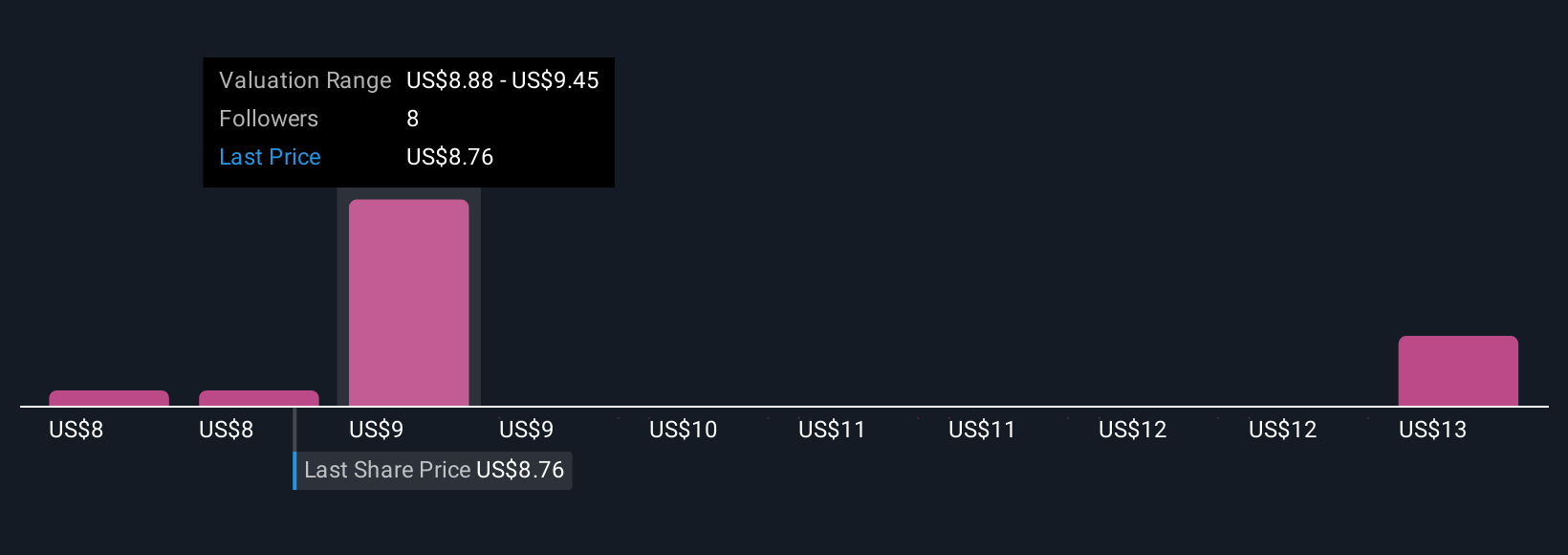

Uncover how Yext's forecasts yield a $9.44 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four Simply Wall St Community members provided fair value estimates ranging from US$7.75 to US$13.36 per share. While some anticipate upside as Yext expands into AI-enhanced products, others remain cautious given competitive and retention challenges ahead, check out diverse viewpoints to see how your outlook compares.

Explore 4 other fair value estimates on Yext - why the stock might be worth 12% less than the current price!

Build Your Own Yext Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yext research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yext research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yext's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YEXT

Yext

Provides a platform that offers answers to consumer questions in North America and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives