- United States

- /

- Software

- /

- NYSE:WK

How Investors May Respond To Workiva (WK) Facing Activist Push From Irenic for Strategic Changes

Reviewed by Sasha Jovanovic

- Earlier this week, activist investor Irenic disclosed a nearly 2% stake in Workiva and publicly shared several recommendations for the company’s direction.

- This type of activist involvement often signals to the market potential changes in leadership priorities, capital allocation, or operational focus, which can alter both internal decision-making and external investor expectations.

- We'll examine how Irenic's new engagement could influence Workiva’s approach to growth, partnerships, and operational efficiency in the coming period.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Workiva Investment Narrative Recap

To be a shareholder in Workiva, you need confidence in its ability to grow through larger, multi-solution deals and capitalize on regulatory-driven demand for sustainability reporting. The recent involvement of Irenic Capital, while sparking discussion on governance and capital allocation, does not materially change the primary short-term catalyst of expanding revenue from sustainability and regulatory solutions, nor does it immediately resolve the central risk of execution delays from European regulatory uncertainty. The core narrative remains largely intact as Workiva's strategic direction faces renewed scrutiny.

Relevant to this news, Workiva has advanced its AI capabilities, evidenced by the recent launch of Agentic AI and data automation features in September, aiming to streamline workflows for finance teams. These enhancements are directly connected to its growth catalyst: scaling adoption among large enterprises and strengthening its positioning within the regulatory compliance market, a critical area under activist investor focus as well.

However, investors should be aware that if partner-led deployments do not consistently deliver top-tier service quality...

Read the full narrative on Workiva (it's free!)

Workiva's narrative projects $1.4 billion revenue and $37.9 million earnings by 2028. This requires 20.6% yearly revenue growth and a $104.5 million increase in earnings from the current -$66.6 million.

Uncover how Workiva's forecasts yield a $97.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

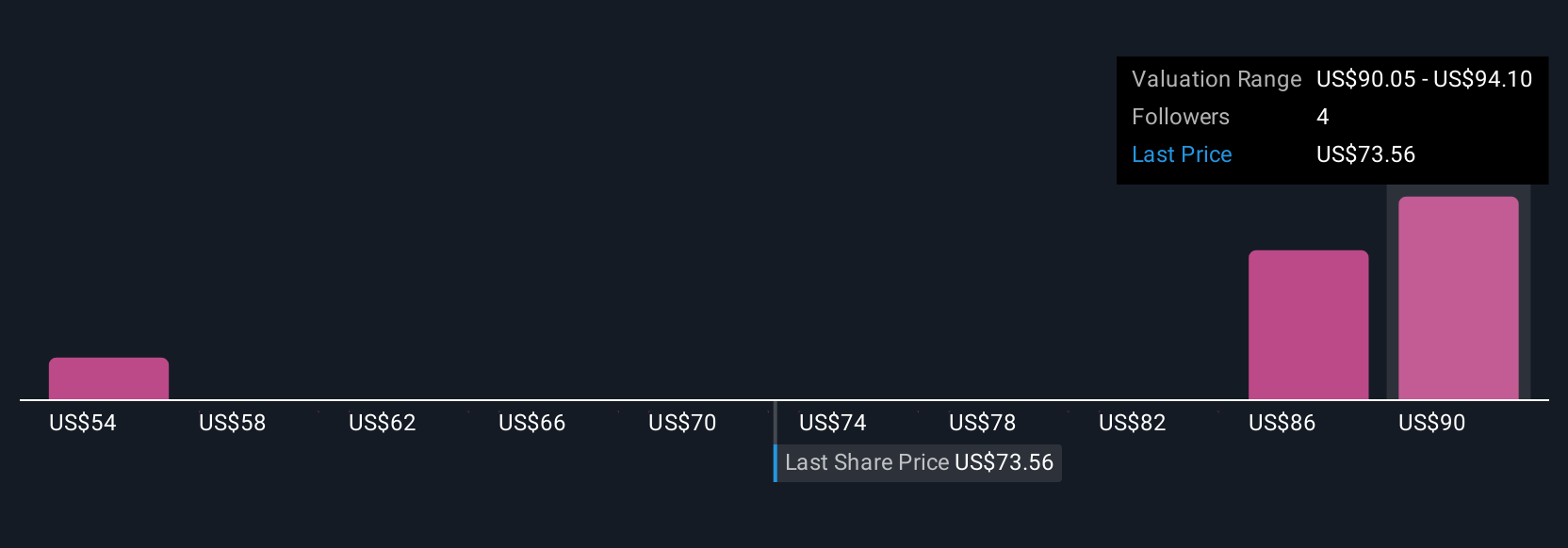

Three unique fair value estimates from the Simply Wall St Community place Workiva’s worth between US$53.57 and US$106.63 per share. Opinions differ widely, while the company’s future growth depends on successfully expanding its enterprise contracts and meeting the evolving needs of regulatory-driven clients.

Explore 3 other fair value estimates on Workiva - why the stock might be worth as much as 20% more than the current price!

Build Your Own Workiva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Workiva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workiva's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives