- United States

- /

- Software

- /

- NYSE:WK

Did Workiva’s (WK) Profit Return and Guidance Raise Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Workiva Inc. reported third quarter 2025 results with revenue of US$224.17 million, returning to profitability after a year-ago loss, and raised its full-year revenue guidance to US$880 million–US$882 million.

- The company also made leadership changes, appointing a new Chief Revenue Officer while expanding its share repurchase program, highlighting both a focus on growth and returning value to shareholders.

- As Workiva raises its full-year guidance, we're examining what this increased confidence means for the company's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Workiva Investment Narrative Recap

Owning shares in Workiva requires conviction in its ability to expand enterprise software revenue through both regulatory-driven sustainability solutions and ongoing international growth, all while managing execution risks tied to dependence on external partners and global policy change. The recent earnings beat and improved profit, accompanied by boosted full-year revenue guidance, appear to strengthen the company’s short-term outlook, though the most important catalyst, demand acceleration for sustainability solutions, remains heavily dependent on regulatory clarity in Europe. No material impact is noted on the key risk around shifting macroeconomic conditions affecting customer budgets for digital transformation projects.

Among the recent developments, the leadership transition with the appointment of a new Chief Revenue Officer is most relevant, as it aligns with Workiva’s focus on expanding global sales and strengthening partnerships, which directly supports the highlighted growth catalysts. This move underscores how management changes can play a role in executing the company’s growth ambitions, particularly in capturing new regulatory-driven market opportunities.

However, investors should also be aware that if there are delays or changes to Europe’s CSRD and CSDDD regulations, it could mean...

Read the full narrative on Workiva (it's free!)

Workiva's narrative projects $1.4 billion revenue and $37.9 million earnings by 2028. This requires 20.6% yearly revenue growth and a $104.5 million increase in earnings from the current -$66.6 million.

Uncover how Workiva's forecasts yield a $97.60 fair value, a 7% upside to its current price.

Exploring Other Perspectives

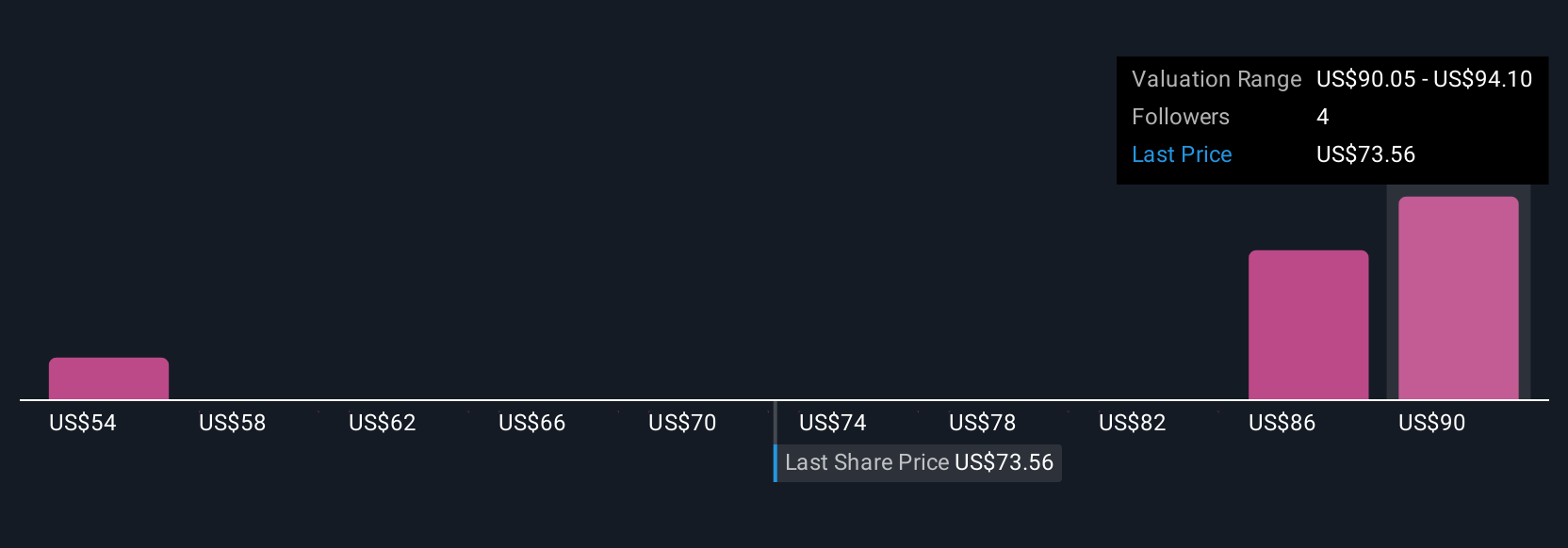

Across three estimates from the Simply Wall St Community, fair value ranges from US$53.57 to US$144.19. Take these varied views into account, as regulatory uncertainty in Europe could have significant implications for Workiva’s expected revenue growth.

Explore 3 other fair value estimates on Workiva - why the stock might be worth as much as 58% more than the current price!

Build Your Own Workiva Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Workiva research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Workiva research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Workiva's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WK

Workiva

Provides cloud-based reporting solutions in the Americas and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives