This article is written for those who want to get better at using price to earnings ratios (P/E ratios). We'll look at VMware, Inc.'s (NYSE:VMW) P/E ratio and reflect on what it tells us about the company's share price. VMware has a price to earnings ratio of 31.15, based on the last twelve months. That means that at current prices, buyers pay $31.15 for every $1 in trailing yearly profits.

See our latest analysis for VMware

How Do You Calculate VMware's P/E Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for VMware:

P/E of 31.15 = $185.05 ÷ $5.94 (Based on the year to February 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each $1 the company has earned over the last year. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. Then, a lower P/E should attract more buyers, pushing the share price up.

Notably, VMware grew EPS by a whopping 268% in the last year. And it has bolstered its earnings per share by 15% per year over the last five years. So we'd generally expect it to have a relatively high P/E ratio.

How Does VMware's P/E Ratio Compare To Its Peers?

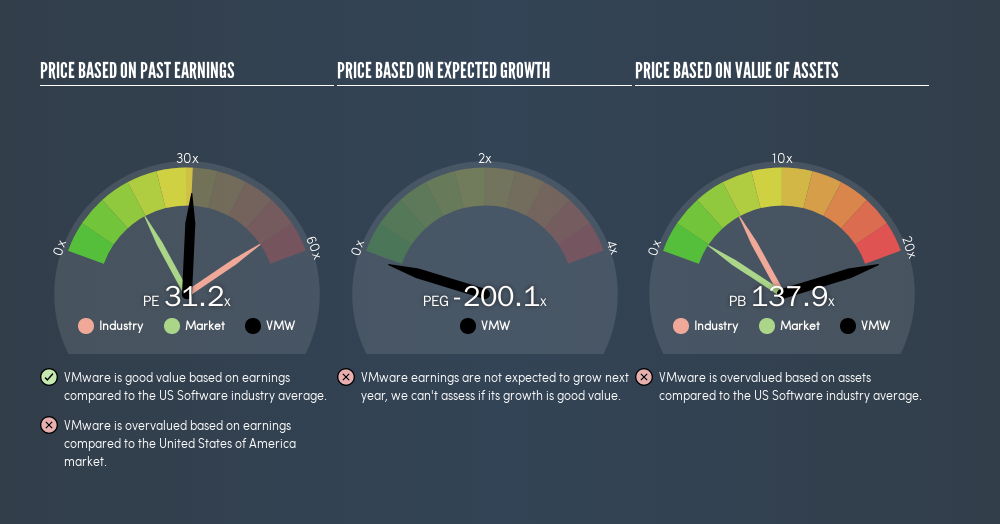

We can get an indication of market expectations by looking at the P/E ratio. We can see in the image below that the average P/E (54.1) for companies in the software industry is higher than VMware's P/E.

VMware's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting VMware's P/E?

VMware's net debt is 1.8% of its market cap. So it doesn't have as many options as it would with net cash, but its debt would not have much of an impact on its P/E ratio.

The Verdict On VMware's P/E Ratio

VMware's P/E is 31.2 which is above average (17.7) in the US market. The company is not overly constrained by its modest debt levels, and it is growing earnings per share. So it is not surprising the market is probably extrapolating recent growth well into the future, reflected in the relatively high P/E ratio.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this freereport on the analyst consensus forecasts could help you make a master move on this stock.

Of course you might be able to find a better stock than VMware. So you may wish to see this freecollection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:VMW

VMware

VMware, Inc. provides software solutions in the areas of modern applications, cloud management and infrastructure, networking, security, and workspaces in the United States and internationally.

Fair value with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)