- United States

- /

- Software

- /

- NasdaqCM:VHC

We're Keeping An Eye On VirnetX Holding's (NYSE:VHC) Cash Burn Rate

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether VirnetX Holding (NYSE:VHC) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for VirnetX Holding

Does VirnetX Holding Have A Long Cash Runway?

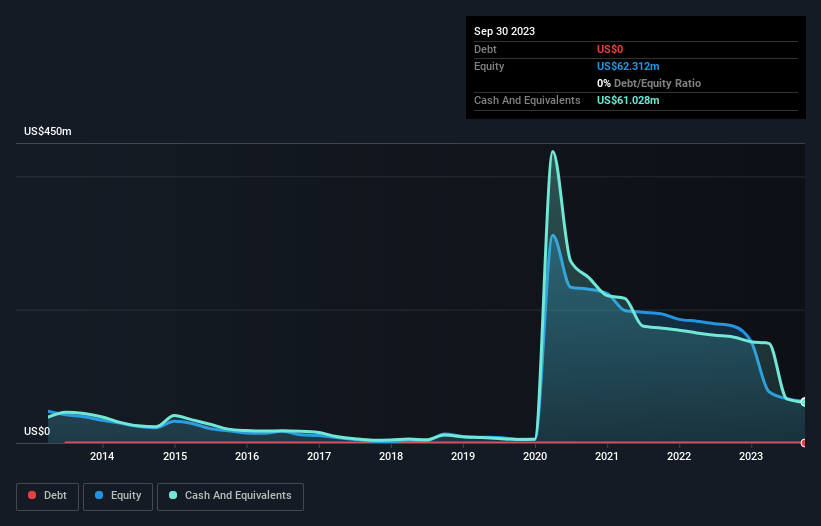

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at September 2023, VirnetX Holding had cash of US$61m and no debt. Looking at the last year, the company burnt through US$25m. Therefore, from September 2023 it had 2.5 years of cash runway. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is VirnetX Holding's Cash Burn Changing Over Time?

In our view, VirnetX Holding doesn't yet produce significant amounts of operating revenue, since it reported just US$12k in the last twelve months. Therefore, for the purposes of this analysis we'll focus on how the cash burn is tracking. During the last twelve months, its cash burn actually ramped up 91%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. Admittedly, we're a bit cautious of VirnetX Holding due to its lack of significant operating revenues. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For VirnetX Holding To Raise More Cash For Growth?

Given its cash burn trajectory, VirnetX Holding shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

In the last year, VirnetX Holding burned through US$25m, which is just about equal to its US$24m market cap. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

How Risky Is VirnetX Holding's Cash Burn Situation?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought VirnetX Holding's cash runway was relatively promising. Summing up, we think the VirnetX Holding's cash burn is a risk, based on the factors we mentioned in this article. On another note, VirnetX Holding has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:VHC

VirnetX Holding

Through its subsidiary VirnetX, Inc., operates as an Internet security software and technology company primarily in the United States.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.